B2B Payments: The 8 Best Payment Solutions for Your Business

Best B2B Payments Solutions for Small Business

- Fundbox Pay

- PayPal

- Square

- QuickBooks

- Plastiq

- Due

- Transpay

- TradeGecko

A few years ago, when you dined out or took a cab ride with friends, you had to settle the payment with cash. Today, you might opt for Venmo, Zelle, Square Cash, or another payment app. Person-to-person (P2P) payment apps are becoming more popular and are expected to account for $240 billion worth of transactions by 2021.[1]

Business-to-business (B2B) payments represent an even larger opportunity, but payments solutions are lagging behind. A survey from the Association for Financial Professionals showed that more than half of all B2B payments—51%—are still made by paper check.[2] Paper checks are not the most secure form of payment, and they are also not the most convenient. For these reasons, a majority of businesses are planning to switch over to digital payment options.

Digital B2B payment products make it easier to make, receive, and process payments. They can also make your cash flow more predictable, which is something that every small business owner strives for. Find out more how about B2B payments work, and which are the best B2B payment products for your small business.

An Overview of B2B Payments

B2B payments are payments made between two merchants for goods or services. Paper checks are still the most common way for businesses to pay each other. Digital B2B payments solutions make it faster to issue, receive, and process payments, all of which can improve a business’s cash flow.

In terms of innovation, B2B payments lag behind consumer payments. That’s because B2B payments—payments between two businesses—are impacted by a variety of factors that don’t affect consumer payments.

These include:

- Volume: Payments between merchants tend to be higher than payments between consumers. As a whole, the B2B payments industry is worth $18.5 trillion, which dwarfs the $709 billion P2P payments industry.

- Frequency: Merchants often have contracts that allow for regular, recurring transactions. For example, a retailer might receive a monthly recurring shipment from their supplier.

- Industry: Certain industries have specific payment needs. For example, healthcare providers often use custom B2B payment products because of HIPAA and privacy regulations.

- People involved: There are multiple people involved with each B2B transaction, including accounts receivable, accounts payable, billing, and procurement teams.

- Payment delay: When you pay a friend or family member for something, it’s often right on-site (e.g. at the restaurant if you’re splitting a bill) or just a few hours after the event. In contrast, B2B payment cycles often last 30 to 90 days.

In light of the complexity of B2B payments, more and more businesses are opting for trackable, digital payment options. Fifty-one percent of organizations still pay by check, declining from 81% in 2004.[2] And 44% of businesses still receive payment by check, declining from 75% in 2004.[2]

B2B Payment Processing: 5 Ways to Send and Receive Money

There are five main ways to send and receive B2B payments:

- Checks – This category includes traditional paper checks and electronic checks issued by a buyer to a seller. When the check is deposited, the seller’s bank will request payment from the buyer’s bank.

- Wire transfers – These are funds transfers between banks that are routed through a financial network like SWIFT. Wire transfers usually deliver money within hours.

- Electronic bank transfers – These are payments between banks that are routed through the Automated Clearing House (ACH). This is one of the safest and reliable payment systems, but bank transfers take a few days longer than wire transfers.

- Credit cards (including one-time use virtual credit cards) – Credit cards allow the seller to receive payment quickly, but the buyer can defer payment for one or more billing cycles.

- Payment gateway – A payment gateway is an online payment platform that allows the buyer to pay for goods or services online during the checkout process.

Each option differs in ease of use for the sender and recipient, cost, and security. That said, most businesses are shifting away from paper checks and moving toward electronic and digital payments. Below, we’ll introduce you to some B2B payment products that cover the range of different payment processing options.

Benefits of Using a B2B Payment Solution

If your business is reluctant to move away from check payment, there are several reasons to do so. Billing and invoicing software and payment apps make B2B payments easier and faster and can help improve your cash flow.

Improve Cash Flow

Starting a small business is a risky venture, with business failure rates hovering around 50% after five years in business. Cash flow problems are the biggest reason for business failure.[3] By automating more of your B2B payments, instead of relying paper checks to make or receive payments, you can see more easily see patterns in your incoming and outgoing cash flow.

Payments software and apps have reports that give you an overview of your accounts receivable and accounts payable. For example, if there a few merchants that regularly pay you late, you can either enforce stricter deadlines or stop working with them. B2B payment solutions also make it easier for your customers to pay you, helping you receive payment faster. For example, invoicing apps let your customer pay you with a single click, instead of having to draw up a check and mail it to you. This gets the money in your bank account sooner, shoring up your cash flow.

Simplify Bookkeeping and Taxes

B2B payment solutions are also a good way to simplify your accounts receivable and accounts payable. Handling a bunch of checks coming from or going to different parties can be confusing. It’s easy to lose checks in the shuffle or make recording errors when transcribing check amounts into your books.

With B2B payment solutions, payments are automatically recorded and stored by the software tool or app. Many also integrate with your accounting or bookkeeping software to make bookkeeping and tax filing easier.

Save Time and Resources

By adopting a B2B payments solution, you save time for yourself, your team, and your customers. You customer doesn’t need to write and mail a check to you. And you don’t need to deposit and reconcile the check.

When you account for personnel costs, processing a hard-copy check costs about $2 per check.[4] Although this might not seem like a big deal, it can add up to hundreds, even thousands, of dollars over time. Your team could be spending more of their time on core products and services.

Increase Security

In cities across the country, mail theft is on the rise.[5] This is another reason to switch over to B2B payment solutions. Although digital solutions aren’t immune to hackers and security breaches, most payment providers have a team of data experts and engineers working to keep your information safe (and your payers’ information). There’s also a clearer payment trail when you use pay digitally.

Best B2B Payment Solutions and Providers in 2020

The B2B payments space is pretty crowded. Several banks, fintech firms, and industry specialists offer B2B payments platforms, and new companies are entering the space frequently.

We checked out the options, and here are some of the best B2B payment solutions:

Fundbox Pay

Best for: B2B businesses who buy or sell on net terms.

Fundbox is a small business lender who specializes in invoice financing and business lines of credit.

Fundbox’s newest product, Fundbox Pay, provides a marketplace for B2B payments.

Fundbox Pay allows sellers to receive payment on an invoice right away, but gives buyers up to 60 days to pay for the good or service. Sellers can invite their customers to Fundbox Pay, and if the buyer is approved, the seller can send them a payment request. Once the buyer accepts the request, Fundbox will immediately send payment to the seller, minus a 2.9% processing fee (similar to what PayPal and Square charge for credit card payments). The buyer has 60 days to pay Fundbox, interest free. After 60 days, the buyer can extend terms for up to one year, for a flat weekly fee.

There’s also checkout functionality with Fundbox Pay. If you have a B2B ecommerce or wholesale website, buyers can check out with Fundbox Pay. Credit decisions can be made within minutes. If the buyer qualifies, they can complete check out, the seller will get paid right away, and the buyer will receive credit terms. This all happens at the moment of credit need, similar to consumer online checkout experiences allowing you to pay with a credit card. You don’t need to spend time on emails or back-and-forth faxes to arrange payment terms.

Fundbox Pay’s B2B solutions essentially shift the risk of the buyer not paying away from the seller. This is similar to the use of credit cards in the consumer space. When someone goes to a restaurant or buys a movie ticket with a credit card, the merchant gets paid right away, and the consumer defers payment for a billing cycle. Fundbox Pay brings the same idea to B2B payments.

Photo credit: Fundbox

Photo credit: Fundbox

PayPal

Best for: B2B businesses that use invoices to bill their customers or pay their vendors.

PayPal is a heavyweight in the B2B payments industry. When using PayPal for these payments, you can send a custom invoice via email to another business. All they have to do is click the “pay” button, and they can pay with their PayPal balance, a linked bank account, or a credit or debit card. It’s easy to manage all your invoices from your PayPal account, and you can schedule invoices in advance. It’s also possible to accept installment payments.

When a buyer pays with a credit or debit card, the seller’s fee is 2.9% plus $0.30 per transaction. There’s no fee when the buyer pays with a PayPal balance or a linked bank account. You can also send and receive payments via mobile, which can be helpful for someone like a truck driver who wants to charge a business upon delivery.

If you want even more advanced B2B payment features, there’s a monthly $30 fee on top of transaction fees. This upgraded plan, called PayPal Payments Pro, lets you accept phone, mail, and fax payments. You can also design and host an online checkout experience for wholesale buyers.

Photo credit: PayPal

Photo credit: PayPal

Square

Best for: B2B businesses who want to offer an online payment page for customers.

Square is another popular company in the B2B payments space. If you’ve sent or received payment from a friend or family member, you’ve probably heard of the Square Cash app. Square Cash is also available for B2B payments. Merchants can visit Cash.app to set up a unique Square Cash username for their business, called a cash tag. This automatically sets up a payment page for you, which will prompt visitors to pay with a debit card or credit card. Square Cash for business costs 2.75% per transaction.

Like PayPal, Square also has an invoice offering. Square Invoices allows you to send custom invoices to your business customers via email. They can pay with a credit card or debit card. Unlike PayPal, customers can’t pay with a linked bank account on Square. You can easily track invoices, seeing which have been viewed and paid, and who might need a reminder. You can also send automatic reminders if an invoice hasn’t been paid by a specific date. The cost for digital invoicing is the same as PayPal—2.9% plus $0.30 per payment. Fees are slightly higher for phone payments or for using a stored credit card. You also have the option to use Square Invoices Plus for additional features—but this will cost $20 per month on top of processing fees.

Photo credit: Square

Photo credit: Square

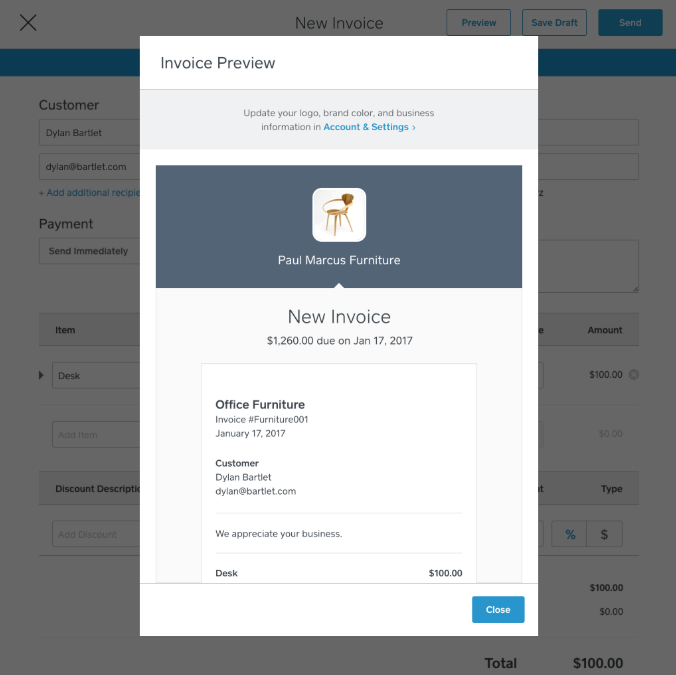

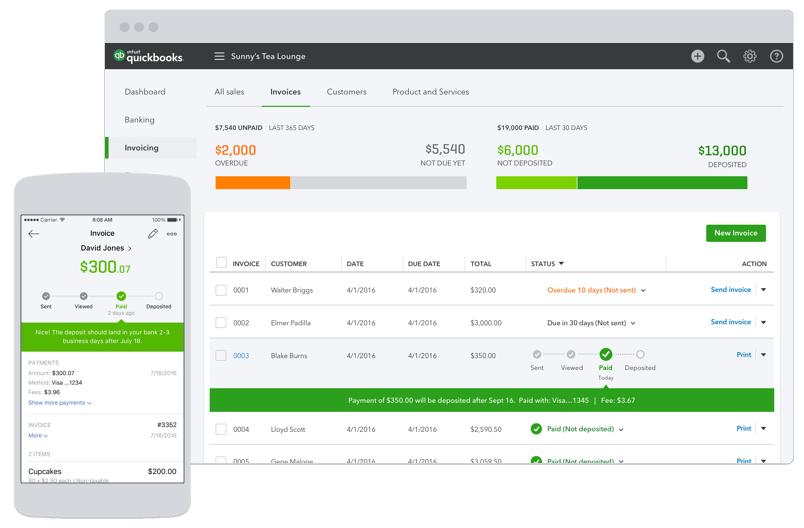

QuickBooks

Best for: B2B businesses that already use QuickBooks for accounting.

QuickBooks is one of the biggest names in small business, best known for their accounting software. However, QuickBooks also provides a B2B payment solution that works similarly to Square and PayPal. You can email invoices to customers, with instant notifications when the customer views and pays the invoice. You can also use progress invoicing, which allows customers to pay for a product or service in installments.

For QuickBooks customers, ingoing and outgoing payments automatically sync with your accounting statements. This makes bookkeeping and taxes much easier later.

When customers pay the invoice by bank transfer (ACH), there’s no fee. When they pay by credit card, the fee is 2.9% plus 25 cents per transaction, slightly lower than PayPal and Square. Businesses that pay a $20 monthly fee or that accept over $7,500 per month in B2B payments can get discounts off these rates.

Photo credit: QuickBooks

Photo credit: QuickBooks

Plastiq

Best for: B2B buyers that want to centralize payments with a credit card.

A unique entrant in the B2B payments space is Plastiq. One reason that managing B2B payments is difficult is that different vendors prefer different payment methods. One vendor might request ACH transfer, while another asks for wire transfer. Using Plastiq, you can centralize all payments to your sellers with a credit card.

Plastiq will send payment to your sellers right away according to their preference—check, wire transfer, or ACH transfer. Then, they’ll charge your credit card for the amount, along with a 2.5% transaction fee. The charge will show on your credit card statement, just like any other charge. This gives you an extra billing cycle to pay, plus you can earn credit card rewards and cash back. You can use Plastiq to pay almost any merchant, such as your lawyer, accountant, and suppliers.

Photo credit: Plastiq

Photo credit: Plastiq

Due

Best for: B2B businesses that want a payments and time tracking solution in one platform.

Due is a full-scale payments dashboard for your small business that includes electronic invoicing, a digital wallet, mobile payments, project management, and time tracking. With electronic invoicing, you can send invoices via email or as a pdf. The invoicing tool has a bunch of features, such as recurring invoices and automatic reminders for your customers.

Unlimited time tracking is included, so you can track billable hours on your invoice. This makes Due a good choice for law firms, bookkeepers, and others who track time worked. Due’s rate is 2.8%, which is lower than Square and PayPal.

The company is also developing an eCash app that will allow businesses to request money from an app and send payment through the app. Similar to a PayPal account, you’ll be able to use the cash balance in your account or link your business bank account or credit card. You’ll also be able to easily split costs with business partners, a feature that isn’t readily available on Square and PayPal.

Photo credit: Due.com

Photo credit: Due.com

Transpay

Best for: B2B businesses that have international sellers or buyers.

If you do business internationally, then you should consider Transpay, a cross-border B2B payments solution. The company supports payments to and from 200 countries in 60 currencies. When doing wire or bank transfers overseas, small business owners often incur high currency conversion fees. Transpay eliminates these fees by developing direct relationships with banks worldwide.

Transpay’s Pay by Web service lets you send money directly from your U.S. bank account to your recipient’s local bank account in their local currency. Their fees are 90% lower than bank wire fees and usually range from $5 to $20 per transaction.[6] If you’re the seller, U.S.-based clients can also pay you via Transpay. You can send an email request for payment, and their payments get transferred right to your bank account without any transaction fees.

Photo credit: Transpay

Photo credit: Transpay

TradeGecko

Best for: B2B sellers that offer online checkout to wholesale buyers.

TradeGecko is an inventory and order management company, but also offers robust B2B payments solutions. There’s an e-invoicing product similar to Square and PayPal. However, they also offer a payment gateway for wholesale buyers. Essentially, this is similar to an online checkout experience for business customers.

Instead of invoicing your customers, the customer pays immediately upon placing an order for supplies. You can see your account balance, payments, and payment history from the dashboard.

TradeGecko charges a monthly fee plus a fee on each transaction. The monthly fee starts at $79 (when billed annually) and scales up based on number of users, number of orders, and functionality. Email invoicing is available with the $79 plan, but the payment gateway on checkout requires upgrade to the $199 monthly plan. The even costlier plans are primarily for businesses that also need inventory tracking and order management. On top of TradeGecko’s monthly fee, when your customers pay with a credit card, you’ll pay a 2.9% plus $0.30 per transaction fee.

Photo credit: TradeGecko

Photo credit: TradeGecko

B2B Payments: Follow Best Practices for Buyers and Sellers

There are dozens of B2B payment solutions to choose from, whether you’re on the paying end or receiving end. For most businesses, there is a much better option than physical checks. Digital B2B payment solutions simplify your finances, let you receive payment faster, protect your business’s security, and ultimately help your cash flow.

Whichever B2B payment solution you choose, most small business owners find themselves on the paying end and receiving end.

Here are some best practices when you’re the buyer:

- Clear your accounts payable balance by paying soon after the transaction.

- Use a credit card to pay if you need more time to reconcile the cost.

- Contact the vendor if you expect to miss a payment deadline.

- Use your positive payment history to negotiate favorable terms with new suppliers.

Here are some best practices when you’re the seller:

- Send an invoice or payment request right after the transaction.

- Follow up with friendly reminders as the payment deadline nears.

- Enforce due dates and late fees to ensure your customers pay on time.

- Offer early payment discounts to incentivize customers to pay early.

Following these best practices will help you stay on good terms with your vendors and buyers and help your business succeed in the long run.

Article Sources:

- USAToday.com. “Venmo, Zelle and Cash App Are Tops in Mobile Peer-to-Peer Payments: A Foolish Take“

- AFPOnline.org. “Survey: 57% of Organizations Intend to Use Same-Day ACH for Last Minute Bill Payments“

- PreferredCFO.com. “Cash Flow: The Reason 82% of Small Businesses Fail“

- DailyPay.com. “How Much Are Paper Checks Costing Your Business?“

- CNBC.com. “As Computers Get Harder to Crack, Thieves Are Pillaging Mailboxes“

- TransPay.com. “Transparent Fees & Rates“

Priyanka Prakash, JD

Priyanka Prakash is a senior contributing writer at Fundera.

Priyanka specializes in small business finance, credit, law, and insurance, helping businesses owners navigate complicated concepts and decisions. Since earning her law degree from the University of Washington, Priyanka has spent half a decade writing on small business financial and legal concerns. Prior to joining Fundera, Priyanka was managing editor at a small business resource site and in-house counsel at a Y Combinator tech startup.