Bank of America Merchant Services Review

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

This article is out-of-date. Bank of America has dissolved their merchant services joint venture, which the following review discusses. As the company is currently in the process of transitioning to a new merchant services offering, NerdWallet will be updating relevant information as it becomes available. More information is expected in 2022.

If you’re looking for merchant services for your business, you might start your search with a big name company, like Bank of America. But ultimately, it’s hard to recommend Bank of America Merchant Services to business owners who aren’t already Bank of America customers. Even if you are a Bank of America customer, you might prefer merchant service providers on the market who offer transparent pricing and aren’t reselling products from another provider. Here's what to know.

What is Bank of America Merchant Services?

Although Bank of America Merchant Services bears the name of the national bank, BoA Merchant Services is actually a separate company, a subsidiary of the actual bank, Bank of America, and First Data (now Fiserv).

As such, Bank of America Merchant Services is not a direct processor — instead, First Data provides the behind-the-scenes processing and Bank of America packages and prices its products, as opposed to creating and selling its own.

It’s fairly common for large merchant service providers like First Data (Fiserv) to sell their products through subsidiaries; however, with resellers like Bank of America Merchant Services, you’re more likely to see long-term contracts, hidden fees and unclear agreements.

NerdWallet rating 5.0 /5 | NerdWallet rating 5.0 /5 | NerdWallet rating 5.0 /5 |

Payment processing fees 0.40% + 8¢ plus interchange, in-person; 0.50% + 25¢ plus interchange, online. | Payment processing fees 2.6% + 10¢ in-person; 2.9% + 30¢ online. | Payment processing fees 2.7% + 5¢ in-person; 2.9% + 30¢ online. |

Monthly fee $0 | Monthly fee $0 Starts at $0/month for unlimited devices and locations. | Monthly fee $0 |

Fees

As you’re comparing your options for merchant services, cost will be a key factor in finding the right solution for you.

Unfortunately, since Bank of America Merchant Services is a First Data reseller, it doesn’t provide a lot of transparent pricing information.

The Bank of America Merchant Services fees you face will depend on the solutions you need; however, it’s very difficult to estimate what these costs will look like without going through the process of working with a BoA Merchant Services sales representative.

Overall, it’s safe to say that Bank of America Merchant Services prices its solutions on a quote basis, meaning it customizes the pricing based on your business and your unique needs.

Estimating the cost of Bank of America Merchant Services

Although it’s impossible to estimate exact numbers, you can expect to pay fees for software, hardware and credit card processing — depending, of course, on the specific solution you choose.

If you need online credit card processing from Bank of America Merchant Services, for example, you may be subject to monthly fees, payment gateway fees and, as with any service, the credit card processing fees associated with each transaction you accept online.

On the other hand, if you’re looking to process in-person transactions through a point of sale system, your fees will likely look a little different. If you already have a POS system and simply need processing, you’ll likely only have to pay monthly fees, credit card processing fees and any additional fees charged by BoA Merchant Services.

If you want to purchase your POS system directly from BoA Merchant Services, you’ll incur more fees for the software and hardware associated with this system. In fact, this is the one place where you can gain some insight into Bank of America Merchant Services fees on its website.

As a Clover POS reseller, Bank of America Merchant Services breaks down the cost of these software and hardware products:

POS software

Payments Plus: $4.95 per month, per device.

Register Lite: $9.95 per month, per device.

Register: $39.95 per month, per device; $9.95 per month for each additional device (per location).

Counter Service Restaurant: $39.95 per month, per device; $9.95 per month for each additional device (per location).

Table Service Restaurant: $69.95 per month, per device; $9.95 per month for each additional device (per location).

POS hardware

FD150 Terminal: $634.00.

Clover Go: $89.99.

Clover Flex: $564.00.

Clover Mini: $739.00.

Clover Station: $1,369.00.

Clover Station Pro: $1,649.00.

POS processing fees

Bank of America Merchant Services advertises two different processing rates depending on how you accept payments. For swiped, dipped or tapped payments, the processing fee is 2.7% per transaction. For card-not-present payments (phone, mail, hand-keyed or internet), you’ll pay 3.5% plus 15 cents per transaction.

It’s extremely important to note that these advertised rates are not necessarily the ones you’ll actually receive if you use Bank of America Merchant Services.

In the fine print on its website, it writes: “The equipment and transaction pricing available through our online application may not be available through Bank of America Merchant Services sales channels, including but not limited to, the offerings that can be made by Bank of America Merchant Services business consultants. Not all prospective clients and merchant types are eligible to apply online.”

Therefore, although these prices can give you insight into your software and hardware costs for purchasing a full point of sale system through BoA Merchant Services, it’s still difficult to determine what your credit card processing fees will actually look like.

You also may be charged additional flat and incidental fees with Bank of America Merchant Services, such as setup fees, cancellation fees, account maintenance fees, PCI-compliance fees, chargeback fees and more.

Available products and services

Regardless of the specific solution you’re looking for, Bank of America Merchant Services will include a dedicated merchant account for your business — the bank account that allows you to accept credit card payments.

This being said, Bank of America Merchant Services breaks its offering down into three branches: e-commerce, check acceptance and point of sale systems.

E-commerce

If you’re looking for credit card processing services to accept online payments, you have two options with Bank of America Merchant Services.

First, you can choose its payment gateway service — which allows you to integrate the BoA solution with your existing website or mobile app or customize your existing payment gateway to process online payments. Additionally, with this payment gateway solution (which is actually backed by Authorize.Net technology), you can accept payments using a web portal, add a payment page to your website or build a unique online payment solution.

If you don’t have an existing e-commerce website and you need to create one, as well as access credit card processing services, you can work with Bank of America Merchant Services for the processing and its partner BigCommerce to create an online store.

BigCommerce is a full-service, web-based e-commerce software that gives you the ability to create, customize and launch your online store, list your products, manage your orders and more.

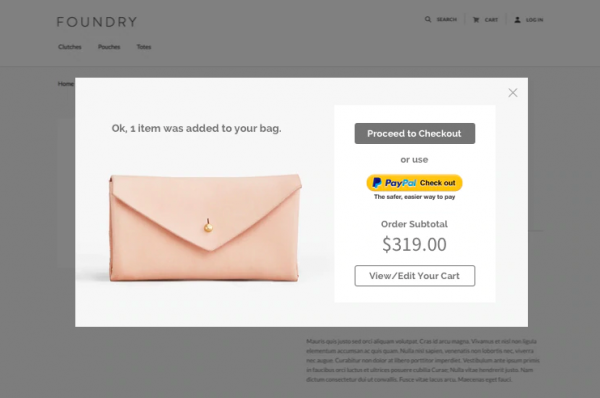

Example of a checkout pop-up through BigCommerce. Image source: BigCommerce

Check acceptance

Bank of America Merchant Services offers electronic check acceptance services through Clover POS (also a First Data-Fiserv product).

Through these electronic check acceptance services, your small business will be able to convert paper checks into electronic transactions.

Specifically, you’ll be able to utilize check acceptance in the following ways:

In-person: Paper checks are converted to electronic transactions at the point of sale.

Online: Customers can make online purchases using their checking accounts.

By mail: Paper checks are converted to electronic transactions in a back-office environment.

Recurring payment: You can set up recurring payments on a schedule from your customers’ checking accounts.

By phone: Customers can make check payments over the phone.

With this service, you’ll be able to offer customers another payment option — plus, you’ll typically be able to receive payment on the electronic checks in two business days.

You’ll also be able to choose between two service options for this Bank of America Merchant Services solution. First, there’s the Warranty option — in which you’ll receive an approved or denied response for every check — and TeleCheck, the company behind Clover’s check acceptance, absorbs the loss from returned checks.

On the other hand, there’s the Verification option, in which you still receive an approved or denied response for every check, but you absorb the returned check costs.

POS systems

The third type of merchant services Bank of America offers — point of sale services — also comes from Clover.

Although Bank of America Merchant Services does give you the option to integrate its credit card processing with an existing point of sale system that you already own — if you want to purchase POS software or hardware from them, you’ll be choosing from Clover products.

Bank of America Merchant Services offers the following options for POS software and hardware:

Clover POS Software

Payments Plus: Includes cloud-based reporting, customer engagement tools, employee management, cash drawer integration and access to over 200 apps in the Clover App Market.

Register Lite: Includes everything offered with Payments Plus, as well as inventory and order management, discounts and tax calculations, offline payment processing, paperless receipts, refunds, basic reports and more.

Register: Includes everything offered with Register Lite, as well as weight scale integration, item variants and item cost tracking, refund and exchange for items, item-level sales tracking, robust inventory management and more.

Counter Service Restaurant: Includes everything offered with Register, as well as kitchen printers and display integration, menu management, customer-facing screen capabilities, separate order types (dine-in, to-go, etc.), bar tab pre-authorization and more.

Table Service Restaurant: Includes everything offered with Counter Service Restaurant, as well as bar tab and advanced table order management, automatic gratuity, table floor plan management, bill splitting, enhanced employee logins and more.

Clover POS Hardware

Clover Go: Bluetooth point of sale device that relies on a smartphone or tablet.

Clover Flex: Fully-functional handheld POS device.

Clover Mini: Small, portable point of sale device with user-friendly interface.

Clover Station: Table-top, comprehensive point of sale device.

Clover Station Pro: Table-top, comprehensive point of sale device with customer-facing display.

Clover POS software on the Clover Mini device. Image source: Bank of America Merchant Services

If you choose to integrate with an existing POS system that you own, and you simply need a credit card processing terminal from Bank of America Merchant Services, you can use the more traditional FD130 Terminal.

Additional Tools

On top of these three main branches of service, Bank of America Merchant Services also offers:

Security: Encryption, tokenization and overall data security tools through TransArmor Data Protection.

Reporting and analytics: Payments data, reporting and notifications through Business Track.

Gift cards: Customizable gift card program for your business.

Support: Receive 24/7 support via phone, live chat and email.

Pros of Bank of America Merchant Services

Here are a few advantages to this provider compared to others on the market:

Variety of solutions

As a traditional merchant service provider, Bank of America Merchant Services gives you a variety of options so that you can accept and process payments in the way that works best for your business.

If you only need Bank of America Merchant Services credit card processing, you can choose this option — or, if you need more, you can utilize a payment gateway, e-commerce platform, POS software and hardware or check acceptance.

Bank of America Merchant Services includes a dedicated merchant account for your business — which means more account stability than working with a payment aggregator — that stores all their customers’ funds in a single account and then distributes them from there.

Next-day deposits

One of the biggest benefits of Bank of America Merchant Services is its fast processing time. If you’re an existing Bank of America customer, you can receive your funds from card payments as fast as the next business day.

Most other merchant services providers will take 24 to 48 hours to process your credit card transactions — not including the time it takes for the funds to transfer to your bank account. Therefore, this is a huge cash flow advantage for current Bank of America business customers.

Plus, there is also the benefit of being able to manage your banking and merchant services in one place.

Preferred Rewards

Bank of America also offers Preferred Rewards for businesses that work with them.

This program is available to eligible business owners who bank with Bank of America and the perks include cash rewards for those who process transactions with Bank of America Merchant Services.

The more you process through them, the more you earn in cash rewards.

Cons of Bank of America Merchant Services

There are downsides associated with Bank of America Merchant Services as well.

First Data (Fiserv) reseller

It’s important to remember that most of the merchant services Bank of America Merchant Services offers don’t come directly from them, but from First Data in one way or another.

Therefore, instead of having to go through the process of working with a reseller — you might instead go directly to the source and work with Clover, Authorize.Net or BigCommerce.

Resellers can be unclear about their specific offerings, pricing and long-term contracts with hidden fees. If you want to avoid the process of working with a Bank of America Merchant Services representative to sort through all of this, we’d recommend looking for a direct processor or a provider that offers its own solutions.

Lack of transparency

As the merchant services industry has evolved, providers have focused more and more on transparent pricing, access to information and avoiding the criticisms (like hidden fees) that are associated with traditional merchant service providers.

With Bank of America Merchant Services, however, this is not the case. Overall, it’s difficult to tell what the cost of Bank of America Merchant Services will look like and how exactly its payment processing services will work for your business.

Customer reviews

Reviewers write about unhelpful customer service, hidden fees, steep cancellation fees, unclear contract terms and more.

Although it’s worth taking into account that customers with a negative experience are more likely to write a review than those with a positive one, these extremely negatively skewed reviews are worth taking into account.

Top alternatives

If you’re not convinced that Bank of America Merchant Services is the right fit for your small business, then your next step will be to look into your alternatives.

Square Point of Sale

If you don’t already use Square POS for your small business, then odds are you’ve at least come across it as a consumer. Square offers a straightforward, affordable point of sale solutions to small businesses.

Square offers three versions of its POS software: A basic free version, Square for Restaurants and Square for Retail. In-person payments cost 2.6% plus 10 cents in most plans. You’ll also have access to Square’s marketplace of point-of-sale hardware:

Square Register - $799: Take customer orders on a large touchscreen. Customer-facing panel in front.

Square Stand - $149: A stand you can equip with an iPad to use as your POS terminal. It includes a built-in reader for mobile and contactless card payments.

The Square Reader for Contactless and Chip - $49: A portable card reader that must be attached to a smart device to run transactions. Accepts tapped and dipped cards.

The Square Magstripe Reader - free or $10: This comes free when you sign up for Square if you’re an eligible merchant, but it only accepts swiped cards. Subsequent devices cost $10. It attaches to a mobile device to process payments.

Intuit QuickBooks POS systems

If you — like many small-business owners out there — are keeping track of your business’s finances with QuickBooks accounting software, then consider QuickBooks POS as an alternative to Bank of America Merchant Services.

QuickBooks POS system will work hand in hand with your accounting software to make tracking each step of your business’s revenue remarkably easy.

QuickBooks POS provides three packages to choose from:

Basic plan: Starts at a one-off price of $1,200 and allows you to perform basic point of sale capabilities like ring sales, track inventory and perform reporting.

Pro plan: Starts at $1,700 and tacks on employee and payroll management, gift card programs, layaway capabilities and advanced reporting.

Multi-Store plan: The most capable of all the versions, starts at $1,900 but will also allow you to manage multiple stores, manage and transfer inventory and perform advanced inventory reporting.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

| Product | Payment processing fees | Monthly fee | Learn more |

|---|---|---|---|

Helcim NerdWallet Rating Learn more on Helcim's website | 0.40% + 8¢ plus interchange, in-person; 0.50% + 25¢ plus interchange, online. | $0 | Learn more on Helcim's website |

Square NerdWallet Rating Learn more on Square's website | 2.6% + 10¢ in-person; 2.9% + 30¢ online. | $0 Starts at $0/month for unlimited devices and locations. | Learn more on Square's website |

Stripe Payments NerdWallet Rating Learn more on Stripe's website | 2.7% + 5¢ in-person; 2.9% + 30¢ online. | $0 | Learn more on Stripe's website |

Shopify POS NerdWallet Rating Learn more on Shopify's website | 2.70% in-person; 2.9% + 30¢ online (Basic plan). | $39 and up for e-commerce plans with POS Lite; Can upgrade to POS Pro for an extra $89. | Learn more on Shopify's website |