The Complete Guide to Forming an LLC in Delaware

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

Table of Contents

If you’re thinking about starting an LLC in Delaware, you can follow the steps below to learn how to successfully get everything set up. Plus, we’ll break down the benefits of starting an LLC in Delaware and why so many businesses choose to do so.

Bizee: Easily form your new businessShop Now on Bizee's website |

FEATURED

Starting an LLC in Delaware

If you’re looking to form an LLC in Delaware, you’ll need to register your business with the Delaware Division of Corporations. Even though the word “corporations” is in the name, this agency handles business formations of all types. The Division of Corporations defines the rules for entrepreneurs who want to start an LLC in Delaware or operate an out-of-state LLC in Delaware.

Step 1: Choose a name for your LLC.

The first step to starting an LLC in Delaware is choosing a name.

As in most states, Delaware law requires you to select a unique name for your LLC. In other words, it has to be different from the names of other businesses that have filed with the Division of Corporations, so the public won’t get confused.

Names for Delaware LLCs must end with “Limited Liability Company,” “LLC,” or “L.L.C.” You cannot use the word “bank” or any variation of it, but most other words are allowed in your business’s name, including: “company,” “association,” “club,” “foundation,” “fund,” “institute,” “society,” “union,” “syndicate,” “limited” and “trust.”

Additionally, your business name can contain the name of a manager or member of your LLC as well.

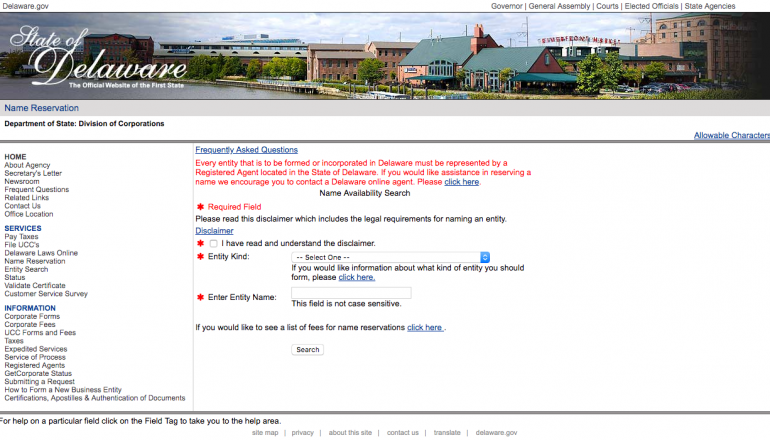

In order to ensure that the business name you’ve chosen isn’t already in use in Delaware, you can use the Division of Corporation’s name availability search tool (shown below).

Source: Delaware Division of Corporations

If your name is available, you have the option to reserve the name online for up to 120 days. You also can fax or mail a name reservation form to the Division of Corporations. Reserving a name, however, has a $75 filing fee, which is on the high side compared to other states.

This being said, you’ll want to keep in mind that a name reservation isn’t required to form your LLC, but it does guarantee that your name will be available for 120 days.

Furthermore, it’s important to note that just because a name is available through the Division of Corporations doesn’t necessarily mean that it complies with federal and state trademark laws. You’ll want to perform additional research and perhaps even consult with a business attorney to determine if your LLC’s name complies with state and federal requirements.

Using a DBA in Delaware

If you want to operate your LLC under a fictitious business name, in other words, a name that is different from your company’s legal name, you can do so. However, to use a DBA, or “doing business as,” you’ll have to register the name within the Delaware county with which you do business.

To do so, you’ll complete the Registration of Trade, Business & Fictitious Name Certificate form, and file it with each county Superior Court where you conduct business. There is a $25 filing fee for this form and it must be notarized. You can mail the form to the applicable Superior Court or deliver the form in person.

Step 2: Select a registered agent.

After you’ve chosen an appropriate business name, the next step to starting an LLC in Delaware is designating a registered agent.

A registered agent is a person or company that accepts legal and official mail on your business’s behalf. This individual will be the first to notify you if your business is sued or receives a legal or tax notice from the government.

In Delaware, your registered agent must be a resident of the state. However, unlike many other states, Delaware doesn’t impose too many other restrictions on who can serve as a registered agent for your LLC.

If your business is physically located in the state, it can act as its own registered agent (which is not allowed in most states). Additionally, a member or manager of your LLC could serve as the registered agent, as can any other individual resident or business entity authorized to do business in Delaware. Again, the only restriction is that your registered agent must have a physical street address in Delaware.

This being said, the Division of Corporations provides a list of registered agents on its website, but you might instead opt to use a third-party registered agent service, such as Bizee. If you do form your LLC on Bizee, one year of free registered agent service will be included.

Step 3: Obtain a Delaware business license.

Once you’ve selected a registered agent, you’ll want to continue the process of starting an LLC in Delaware by getting a business license.

Whereas many other states don’t require a general operating license, Delaware has strict requirements for business licenses. Every business that’s organized in or operates in Delaware must obtain a state business license from the Delaware Department of Revenue.

To get a Delaware business license, you can create a “One Stop” account and complete the entire process online. The filing fee you’ll have to pay for your license will vary based on the type of business you run, ranging from $50 up to $450.

When you use the “One Stop” process, you’ll receive a temporary license that’s valid for 60 days. Permanent licenses are typically sent within 10 days.

Moreover, on top of the state business license, some Delaware cities and counties require you to get a license. You can contact your local government agency to find out if you need additional licenses to operate your LLC.

This being said, at the state level, members of certain regulated professions must also obtain a license from the Delaware Division of Professional Regulations. Here’s a list of professions that are regulated by this agency. Businesses comprised of licensed professionals may choose to form a professional corporation or a regular LLC. Unlike other states, Delaware does not recognize professional LLCs.

Step 4: File your certificate of formation.

Next, in order to officially form your LLC with the state of Delaware, you’ll need to file your certificate of formation — typically referred to as your articles of organization — with the Division of Corporations.

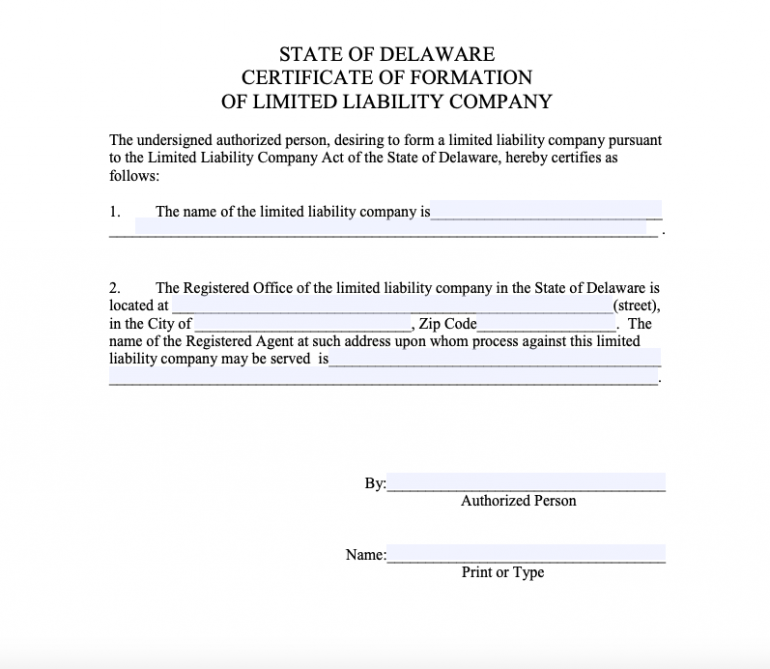

The Delaware certificate of formation (shown below) doesn’t require a lot of information. All you have to include is:

The LLC’s name.

Registered agent’s name.

Registered agent’s address.

Name and signature of the organizer who is filling out the form (should be someone affiliated with the business).

Cover page.

Source: Delaware Division of Corporations

To complete this form, you can access a fillable PDF on the Division of Corporations website. The LLC certificate of formation can be faxed or mailed to the Division of Corporations — you also can use the online Document Upload service to submit the completed form electronically.

Regardless of how you submit the form, however, you’ll have to pay a $90 filing fee.

This being said, the state of Delaware is accustomed to handling a large volume of corporate and LLC filings, so it generally only takes a maximum of three to four business days to process your certificate of formation.

After approving your filing, the state will send you a stamped copy of your certificate of formation. You should also receive a business identification number that you will use on other state paperwork to identify your LLC.

Foreign LLCs Operating in Delaware

It’s important to note that if you’re starting a foreign LLC in Delaware, the process of submitting your certificate of formation will be slightly different.

Whereas domestic LLCs, those that are organized under the laws of Delaware, must fill out the certificate of formation mentioned above, foreign LLCs — those that are formed under the laws of another state but want to do business in Delaware — must fill out a certificate of registration of a foreign limited liability company.

These businesses will also be able to file online, by mail, or by fax, but they’ll also need to provide a certificate of existence from their home state, as well as a filing fee of $200.

Step 5: Draft an LLC operating agreement.

Once you’ve received approval from the Division of Corporations, you’ve officially formed an LLC in Delaware. This being said, however, there are a few additional steps you’ll need to take.

First, you’ll need to create an LLC operating agreement. Delaware is, in fact, one of the five U.S. states that require members of an LLC to adopt an operating agreement. The law doesn’t specify, however, exactly when you have to enter into the agreement, but it’s a good idea to do so soon after filing your certificate of formation. Although a verbal agreement is allowed, it’s best to have a formal, written operating agreement.

At a minimum, you’ll want to include the following information in your operating agreement:

The LLC’s purpose, including products or services offered.

The names and addresses of the members (and the manager, if there is one).

Each member’s contributions of value to the LLC.

Each member’s ownership interest in the company, voting rights, and share of the profits and losses.

Procedure for admitting new members.

Procedure for electing a manager if the LLC is manager-managed.

Meeting schedule and voting procedures.

Dissolution process.

After you’ve created your agreement, it should be reviewed and signed by each member of the LLC.

Even though Delaware requires that you adopt an operating agreement, you're not required to file it with the state. Therefore, you’ll simply want to store it with other important business records.

Step 6: Comply with federal, state and local regulations.

Finally, the last step to starting an LLC in Delaware is abiding by the federal, state, and local regulations associated with the operation of your business. Although some of these regulations will vary based on your specific location and the nature of your business, there are a few things you’ll want to keep in mind:

Applying for an EIN: Although getting an EIN, also called a federal tax ID number, is not required for all LLCs, you will need one if you have employees, multiple owners, as well as if you elect to be taxed as a corporation. Generally, you’ll want to apply for an EIN — as you’ll use this number when filing your business taxes, as well as for a number of other financial purposes.

Taxes: Although Delaware does not have a sales tax, you’ll still have to fulfill various tax requirements as an LLC operating in the state. In addition to paying your federal taxes — including self-employment taxes and payroll taxes if you have employees — you’ll have to pay state taxes as well. First, all LLCs that are registered to do business in Delaware must pay an annual tax of $300, due on June 1 of each year. You will not, however, have to file an annual report. Moreover, you’ll need to pay gross receipts taxes (ranging from 0.0945% to 0.7468%) based on your business type. Last, each member of your LLC will pay state income taxes on their personal tax returns, unless you’ve elected to be taxed as a corporation.

Employer obligations: If your business has employees, you’ll need to meet specific employer requirements including reporting new hires, paying payroll and unemployment taxes, and purchasing workers’ compensation insurance. To this last point, unlike other states, Delaware employers must register with the Division of Workers Compensation and purchase workers’ compensation insurance after hiring their very first employee, even if the employee is just part-time.

All of this being said, if at any time you’re unsure whether or not you’re meeting Delaware’s requirements for an operating LLC, you can contact a business attorney or a representative at the Division of Corporations for assistance.

FAQs

As you can see, if you follow each of these steps, starting an LLC in Delaware is a fairly quick and straightforward process. If, however, you still have questions about LLC formation in this state, you might find the appropriate answers below:

How much does it cost to start an LLC in Delaware?

For all of the benefits of starting an LLC in Delaware, the formation and filing fees are typically higher than those you see in other states. This being said, at a minimum, it will cost you $140 to start an LLC in Delaware — $90 fee to file your articles of organization, plus $50, the lowest fee for a state business license.

Of course, depending on the type of business you run, your license fee may be higher, and you might require additional industry or local licenses as well.

Moreover, although these costs are not required, you might also face some of the following fees:

$75 filing fee to reserve your LLC business name for 120 days.

$25 fee per county to operate as a DBA.

$200 filing fee (instead of the typical $90) for foreign LLCs registering to operate in Delaware.

$50 to receive a certified copy of your filed certificate of formation.

$50 to $100 for expedited services.

Finally, you’ll also want to remember that although you don’t need to file an annual report each year in Delaware, you will be required to pay a $300 annual tax to the state.

How long does it take to set up an LLC in Delaware?

The process to form an LLC in Delaware is relatively fast on the business’s end. This process can be completed in a matter of hours.

However, for your LLC setup to be official, you’ll have to wait for confirmation from the state. Typically, if you file your articles of organization online, you’ll see faster approval times. Overall, however, it takes the Division of Corporations an average of 10 to 15 business days to process these filings.

During certain times of the year — March, June and December — you might see a longer timeline (three to four weeks) due to the large amount of work received in the state office in these months.

It’s worth noting that the Division of Corporations does offer expedited service for LLC formation. To receive 24-hour service, you’ll simply have to pay a $50 fee and for same-day service, you’ll need to pay a $100 fee.

If you need particularly fast service, you can request priority one- or two-hour service. These services will require a fee of $1,000 per document and $500 per document, respectively.

Do Delaware LLCs pay taxes?

Yes, like all LLCs, Delaware LLCs pay business taxes. LLCs in Delaware do have a few unique tax requirements:

Alternative entity tax: LLCs formed in Delaware are required to pay a $300 tax to the state by June 1 every year.

Gross receipts tax: Again, even though Delaware does not have a sales tax, as a business that sells goods or has employees, you’ll need to register with the Delaware Division of Revenue and pay a gross receipts tax. The specific amount you’ll pay for this tax will vary based on your business type.

Federal and state income taxes: Your LLC will be required to pay both federal and state income taxes. The way you pay these taxes will vary based on whether or not you’ve elected to be taxed as a corporation. LLC members will also be required to pay self-employment taxes.

Payroll taxes: If you have employees, you’ll need to withhold and pay payroll taxes, as well as pay unemployment taxes.

Why is Delaware the best state to form an LLC?

Delaware is often considered one of the best states to form an LLC because it has limited fees and tax obligations. In fact, many businesses choose to form an LLC in Delaware even if they don’t intend on doing business in Delaware.

They do so because if you don’t intend on doing business in Delaware, Delaware does not require that you obtain a business license nor does it require that you pay income or gross receipt taxes. Additionally, Delaware does not tax intangible income and LLC formation is relatively low-maintenance in comparison to other states (with the exception of the $300 annual tax).

Moreover, Delaware is well-known for its established business codes and statutes. In fact, Delaware has a court especially for businesses, called the Court of Chancery. In this court, cases are argued in front of judges, not juries, and cases are typically resolved much more quickly than those in other states.

Benefits

No sales tax.

No state income tax or gross receipt taxes for LLCs who don’t actually do business in Delaware.

No tax on intangible income (like patent and trademark leases).

No annual report filing.

Business license not required for LLCs who don’t actually do business in Delaware.

Simple LLC formation document and filing process (which also limits exposure of personal information).

Limited LLC naming restrictions.

Limited registered agent restrictions; business can serve as its own registered agent.

Court of Chancery devoted exclusively to businesses cases.

Of course, there are also the traditional benefits of starting an LLC in Delaware, as opposed to starting another entity type. LLCs offer their members personal liability protection, they have very few reporting and record-keeping requirements, and they avoid the double taxation that C-corporations face. Plus, LLCs have the option to select how they’d like to be taxed.

Drawbacks

Filing fees, including those for name reservation and articles of organization filing, are more expensive than in other states.

Delaware requires, at a minimum, a state business license for all LLCs (with associated fees).

LLCs are required to adopt an operating agreement.

Delaware charges relatively high rates for state unemployment taxes.

LLC members must pay high self-employment taxes at the federal level.

$300 annual alternative entity tax required.

Gross receipts tax required even though you don’t collect sales taxes from customers.

Workers compensation insurance is required after you hire your first employee, even if they’re only part-time.

Plus, there are also some of the general disadvantages associated with LLC formation. Namely, compared to corporations, LLCs make it difficult to raise money from investors as they can’t issue and sell stock.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

On a similar note...