IRS Form SS-4 Instructions: What It Is and How to Find Yours

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

What is IRS Form SS-4?

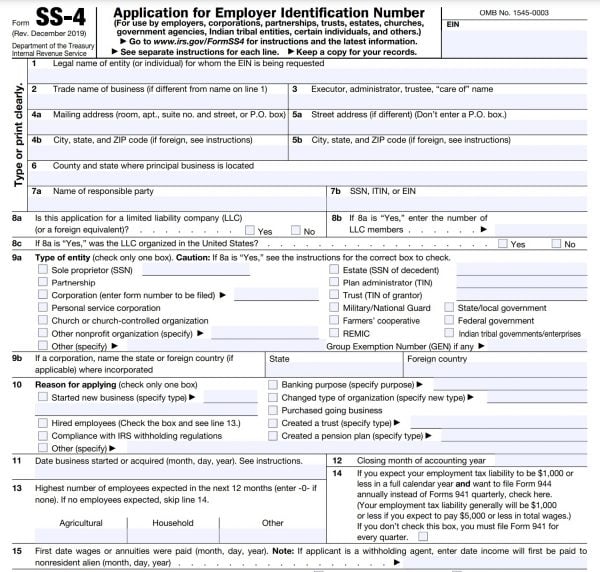

IRS Form SS-4, Application for Employer Identification Number, is an IRS form businesses use to apply for an employer identification number (EIN). Business lenders may require an IRS Form SS-4 notice to verify a business’s EIN when evaluating a loan application.

Applying for a small business loan can be overwhelming, but there are a few things you can do in advance to make applying for a business loan go smoothly. Along with filing your most recent year’s business income tax return (and any past due tax returns, too), you’ll also want to locate and make copies of the documents your lender is likely to request. Among these documents is your IRS Form SS-4. Lenders often ask for the IRS Form SS-4 notice you receive after filing the form, not the form itself.

Here’s everything you need to know about IRS Form SS-4, why it’s important to your lenders, and how to obtain yours.

What is IRS Form SS-4?

IRS Form SS-4, “Application for Employer Identification Number,” is the form businesses use to apply for an employer identification number (EIN). A business's EIN is its business tax ID number for use when filing small business taxes.

What is an EIN and why apply for it?

An employer identification number, aka an EIN, is a unique, nine-digit number that many types of businesses need for tax purposes.

If a business has employees, it needs an EIN to pay and file payroll taxes. And certain types of business entities need an EIN to file a business income tax return.

Sole proprietorships and single-person LLCs with no employees are the only types of business entities that are exempt from this requirement.

All U.S.-based businesses have the option of getting an EIN.

There are lots of benefits to having an EIN. For example, with an EIN, you can streamline your bookkeeping processes by separating your personal and business finances, open a business bank account, establish business credit, and even speed up your business loan application.

How to use IRS Form SS-4

You can get the IRS Form SS-4 on the IRS website. The form is only one page long.

Expect to provide information like:

Your business’s legal name and address

Name of applicant and their SSN, ITIN, or EIN

Type of entity

Reason for applying for an EIN

Date your business started

Highest number of expected employees in the next year

Principal business activity

Principal type of products or services sold or rendered

Also, note that business owners themselves don’t need to apply for their business’s EIN—you can delegate that task to any responsible party, which the IRS defines as the individual or entity that “controls, manages, or directs the applicant entity and the disposition of its funds and assets.” You can apply via mail, fax, or phone (phone for international applicants only).

Why lenders ask for a copy of the IRS Form SS-4

Lenders need to verify EINs, which is why they often request a business’s IRS Form SS-4. However, when a lender asks for your IRS Form SS-4, it's not asking for a copy of your EIN application; it wants the notice the IRS sends out once it assigns your EIN. (Because IRS Form SS-4 is referenced on this notice, the notice itself is often referred to as Form SS-4.)

Why you need IRS Form SS-4 to verify your EIN

Lenders can't just use a tax return to verify an EIN. Clerical errors and typos happen. It’s possible that your tax preparer entered your EIN incorrectly, and the IRS hasn’t notified you of the error yet. This is a common error for returns filed on paper rather than electronically. It can take the IRS months—sometimes even longer—to identify the error and notify you of it.

The SS-4 allows lenders to go straight to the source of the information, which can speed up the underwriting process.

What if you don’t have an SS-4 notice?

If you’re a sole proprietor or an LLC with no employees, you might not have an EIN (these are the only two types of business entities that aren’t required to get an EIN for tax purposes). In that case, the loan will be in your name, and your lender will use your social security number in lieu of an EIN.

But for all other kinds of business entities, the business is a separate and distinct legal entity from the individual. Even if you provide a personal guarantee for a loan, you’ll still need to complete the loan application in the corporation's name, using the corporation’s EIN instead of your Social Security number. That requires an SS-4.

How much do you need?

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How to get an IRS Form SS-4 notice: Instructions

Look on your hard drive or cloud-based filing system. If you applied for your EIN online, you received an IRS Form SS-4 notice — along with your EIN — immediately as a PDF.

U.S.-based banks require a copy of the IRS Form SS-4 notice in order to open a business bank account. Your banker may be able to get you a copy.

Your accountant might have completed your EIN application form for you and may have a copy.

Call the IRS Business and Specialty Tax Line at (800) 829-4933. After providing your EIN and identifying information about your business, the IRS sends a copy of your EIN assignment letter by mail or by fax. For security purposes, the letter will be sent to the address or fax number the IRS has on file for your business.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.