How to Write Off an Invoice in QuickBooks

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Uncollectible invoices are an unfortunate reality for many businesses. Although most customers enter into a business relationship intending to pay in full and on time, sometimes they are unable to make their payments as promised. And sometimes they cannot make a payment at all.

When this happens, it becomes necessary to write off the uncollectible invoice. There are a number of ways to remove uncollectible invoice amounts from your accounting books. In this article, we’ll look at the best ways to write off an invoice in QuickBooks' software for small business.

FEATURED

Reasons to write off an invoice

There are a couple of reasons why you might want to write off an invoice in QuickBooks:

Bad debt. Sometimes, a customer is unable to pay an invoice due to financial circumstances beyond their control. Less frequently, a customer chooses not to pay for other reasons. In either case, if a customer defaults on a payment, it’s important to recognize this default properly in your books by writing off the invoice.

Underpayment. Maybe your customer has made a payment on your invoice, but there is still a balance due on it. This is usually due to a clerical error on the customer’s end. In cases of underpayment, the amount is often too small — sometimes only pennies — to warrant reaching out to the customer for the remainder of the payment.

Mistakes to avoid

You may think the easiest way to write off an invoice in QuickBooks is to simply delete the invoice. Do not do this. Deleting the invoice rather than properly writing it off can have the following impacts on your business’s bookkeeping:

You lose valuable information. If you write off an invoice for a customer due to bad debt, you will want to retain this information so you don’t sell to that customer on credit again. If you delete the invoice, you will lose this information. Similarly, you need to be able to tell what percentage of your invoices you write off. This is a valuable business metric that will help you manage your business more effectively and profitably.

You could overpay your sales tax obligations. If you simply delete an invoice in QuickBooks, you run the risk of skewing your sales tax payable liability account. This could result in you remitting sales taxes you never actually collected.

Items on the deleted invoice will be marked unbilled. Deleting an invoice in QuickBooks will make all the items on that invoice show up as not billed. If you continue to do business with the customer whose invoice you wrote off, these items will show up each time you attempt to invoice the customer, causing confusion and clutter in your books.

If you’re a cash basis taxpayer

If you’re a cash basis taxpayer, you don’t technically have accounts receivable from a tax perspective. However, if you invoice customers you still need to maintain accounts receivable. This is called modified cash basis accounting.

Some accountants and bookkeepers will advise you to simply delete bad debt invoices if you are a cash basis taxpayer. Others will recommend you issue a credit memo using the same items you used on the original invoice instead of using a bad debt expense item, which has the impact of reducing your total sales for those items. Both of these methods can cause the same issues mentioned in the previous section.

Even if you’re a cash basis taxpayer, you should properly write off your invoices in order to keep your QuickBooks file in good order.

How to write off a bad debt invoice in QuickBooks

The best way to write off an invoice in QuickBooks — whether you are using QuickBooks Desktop or QuickBooks Online — is to use the credit memo feature. Using a credit memo with a bad debt expense item will keep your sales tax liability account pristine, meaning you never have to worry about overpaying your sales tax obligation.

1. Open the invoice you are writing off. You will want to refer to the invoice as you proceed through the following steps. To find the invoice:

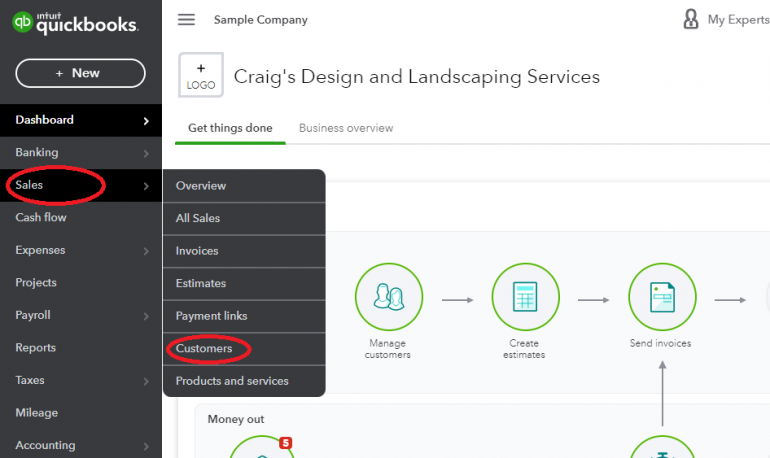

Click on Sales.

Click on Customers.

Enter the customer’s name and click on the invoice from the list to open the invoice.

2. Create a new credit memo.

Duplicate the browser tab by right-clicking on it. This lets you view your original invoice and the credit memo side by side.

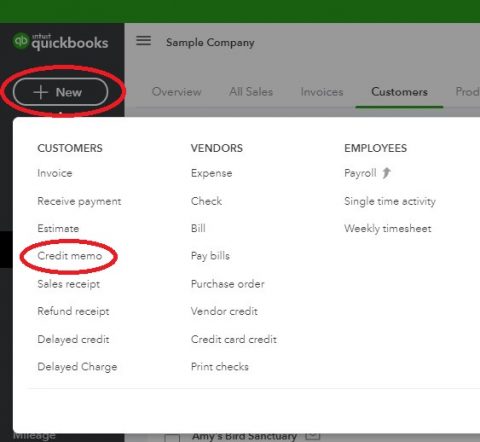

Click on the “+ New” button in the new tab to create a new transaction.

Select Credit Memo from the menu that appears.

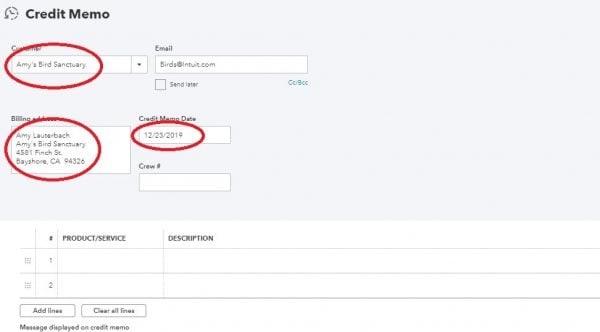

3. Enter identifying information for the credit memo. Enter your customer’s name and the date you are writing off the bad debt. You will notice QuickBooks automatically enters a credit memo number. We recommend not changing this, as it could lead to later problems with your invoice and credit memo numbering.

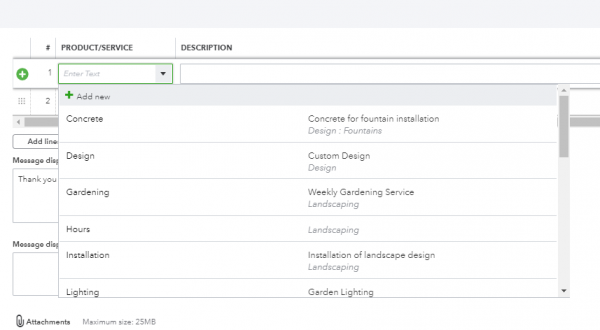

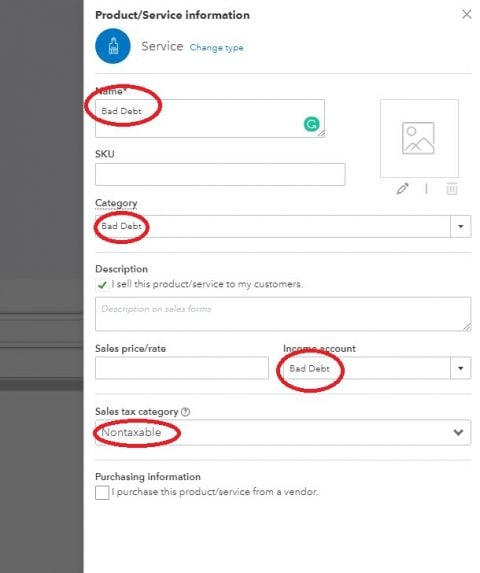

4. Create the bad debt expense item. In both QuickBooks Desktop and QuickBooks Online, you can enter Items on the fly. If you don’t already have a “bad debt” expense item in your item drop-down list, you will want to create one.

Click into the Product/Service field and then click Add new.

Choose the Service product type.

Name the item Bad Debt.

Choose your bad debt expense account for the income account type.

Change the sales tax category to Nontaxable. You can adjust this on each individual credit memo.

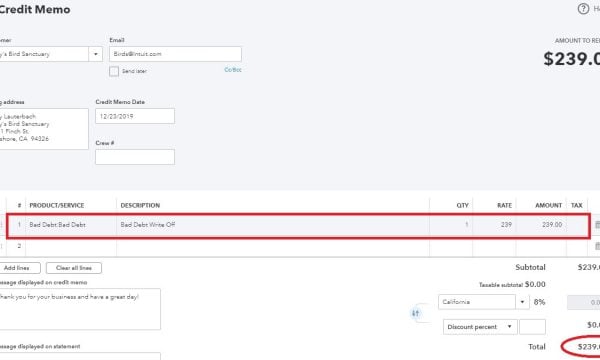

5. Fill out the credit memo. In this step, you’re basically going to duplicate the invoice you are writing off in the credit memo screen. But instead of using the original product/service or item you used in the invoice, you’ll use the “bad debt” item you created in the previous step.

Make sure to mark items “taxable” as you go along. You will know you’ve done it right if your credit memo amount equals the amount remaining on the invoice you are writing off.

If the invoice you are writing off has all taxable or all nontaxable items, your credit memo only needs one line using the item “bad debt.” Enter the full, pretax amount of the invoice you are writing off on this line. Then, if the invoice was taxable, apply sales tax to the credit memo.

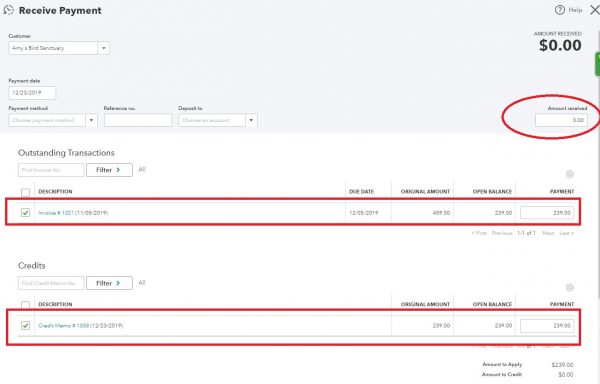

6. Apply the credit memo to the invoice. If you skip this step, your accounts receivable balance will still be correct, but the invoice you created the credit memo for will still appear on your Open Invoice report.

Click on the invoice you are writing off

Click on Receive Payment.

On the next screen, you’ll have the option to select the outstanding credit memo as part of your payment. The amount of the payment after the credit memo is applied should be $0. This will result in a $0 transaction in your check register, which you can clear the next time you reconcile the bank account.

The problem of overstated income

When you write off an invoice in the manner outlined above, the invoice will show as “paid” after the credit memo is applied to it. This means your income will increase by the amount of the invoice on your cash basis profit and loss statement. However, there will also be an offsetting amount in the “bad debt” expense account, which means the effect on your net income will be $0.

In most states, this is good enough to ensure you aren’t paying more income tax than necessary. However, if you live in a state with gross receipts tax, you will need to ensure your accountant deducts the bad debt expense amount from your total income prior to filing your tax return. Otherwise, you will pay taxes on money you never collected.

Small amount write-offs

If you are writing off the remaining balance on an invoice that has been mostly paid, you will follow the same method outlined above. You could choose to use an expense account other than bad debt expense for this, but doing so could clutter your chart of accounts and is unnecessary, since small amount write-offs are rare and typically do not amount to a large dollar amount over the course of the year.

Write-offs: The right way to record bad debt

There are a number of ways you can remove bad debt and other uncollectible amounts from your accounting records. Although it’s more cumbersome than simply deleting the invoice or issuing a credit memo that reverses the invoice, the method outlined above will help you keep your records intact and give you important managerial information. This means you can use your financial statements to effectively and profitably run your business, while still providing your tax professional with the information they need to file your tax return quickly and accurately.

QuickBooks Online resources

Read more about how QuickBooks Online works.

Bookkeeping and accounting software | |

|---|---|

QuickBooks Online $30 per month and up. Read Review. | |

FreshBooks Accounting $17 per month and up. Read Review. | |

Xero $13 per month and up. | |

Zoho Books $0 per month and up. | |

Sage 50 Accounting $48.17 per month (when paid annually) and up. | |

Wave Financial Free (add-ons available). | |

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

On a similar note...

| Product | Starting at | Promotion | Learn more |

|---|---|---|---|

QuickBooks Online NerdWallet Rating Learn more on QuickBooks' website | $30/month Additional pricing tiers (per month): $60, $90, $200. | 50% off for first three months or free 30-day trial. | Learn more on QuickBooks' website |

Xero NerdWallet Rating Learn more on Xero's website | $15/month Additional pricing tiers (per month): $42, $78. | 30-day free trial or monthly discount (terms vary). | Learn more on Xero's website |

Zoho Books NerdWallet Rating Learn more on Zoho Books' website | $0 Additional pricing tiers (per month): $20, $50, $70, $150, $275. | 14-day free trial of the Premium plan. | Learn more on Zoho Books' website |

FreshBooks NerdWallet Rating Learn more on FreshBooks' website | $19/month Additional pricing tiers (per month): $33, $60, custom. | 30-day free trial or monthly discount (terms vary). | Learn more on FreshBooks' website |