Forming an LLC in Ohio: A Step-by-Step Guide

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

When starting a small business, there are several legal requirements that you’ll need to meet, such as which type of business entity is best for your company.

If you’re looking to set up an LLC in Ohio, it’s important to know the state’s rules and requirements.

Bizee: Easily form your new businessShop Now on Bizee's website |

FEATURED

Forming an LLC in Ohio

Anyone who wants to form an LLC in Ohio must register their business with the Ohio Secretary of State before the company can operate. The Ohio Secretary of State sets the rules for LLC formation and establishes fees that business owners have to pay to operate in Ohio.

Step 1: Choose a name for your LLC

The first step you need to take when forming an LLC in Ohio is to choose a business name. Under Ohio law, the names of new businesses must be distinguishable from the names of other businesses that have registered with the Ohio Secretary of State. The purpose of this requirement is to prevent confusion among the public. For example, you can’t select the name “Hometown Bakeries, LLC” if there’s already a “Hometown Bakers, LLC” registered to operate in Ohio.

There are other naming requirements as well. The name of your Ohio LLC must end with one of the following: Limited Liability Company, LLC, L.L.C., Ltd., Ltd or Limited. Don’t use the words “bank” or “trust” unless you have special permission from the state. You can only use the words “cooperative” or “insurance” if you are a co-op or insurance agency that’s qualified to do business in Ohio. Similarly, the use of titles like “attorney” or “doctor” in your business name requires you or another owner to hold a professional license.

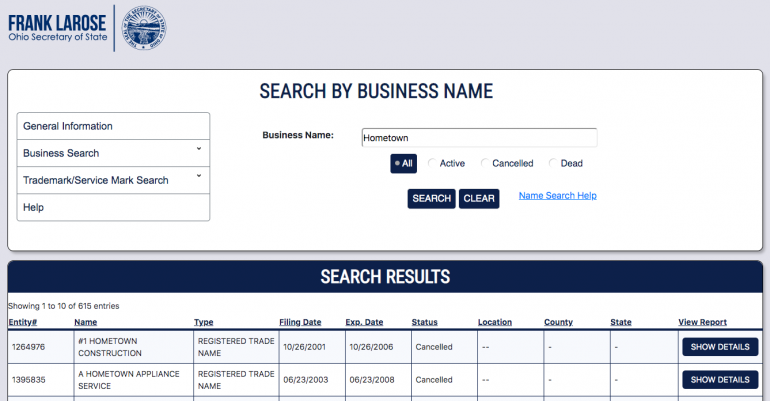

Before registering your business, you should check if the name you want for your business is available. You can check which business names are already taken on the Secretary of State’s Business Search tool. You can also check name availability by calling or emailing the Secretary of State.

If a business name is available, you have the option to reserve the name for up to 180 days. To reserve a name, you can submit a Name Reservation Form (Form 534B) online or by mail, along with a $39 processing fee. This grants you the right to use the name if you file your articles of organization within 180 days. You can provide up to three alternative names on the form, in order of preference, but only your top available choice will be reserved.

If the business name you want isn’t available, you can request consent to use the name from the business that currently owns the rights to the name. You’d need to file Form 590 to do so.

Even if the Secretary of State lets you reserve a business name, this isn’t a guarantee that the name complies with trademark laws. At the end of the day, it’s up to you and your business attorney to understand all naming requirements and choose a suitable name for your LLC.

Source: Ohio.gov

Step 2: Appoint a statutory agent

Every LLC that’s registered to do business in Ohio must have a statutory agent. A statutory agent, also known as a registered agent, is an individual or company that accepts legal and official documents on your business’s behalf. They are responsible for forwarding those documents to you, so you should carefully choose your statutory agent.

An individual can serve as a statutory agent if they are at least 18 years old, are an Ohio resident and available to accept documents during normal business hours. A company can act as your statutory agent as long as the company has a business address in Ohio. Initially, you’ll provide your statutory agent’s information on the articles of organization (see Step 4). After that, if you want to change your statutory agent, file Form 521 with the Secretary of State.

Some small-business owners designate themselves or another owner of the LLC to serve as a statutory agent. However, you could land in trouble with the Secretary of State if you’re out sick or go on vacation and are unavailable to accept official mail. It’s for this reason that many businesses choose a registered agent service. An online legal services company like Bizee can provide these registered agent services.

Step 3: Check if you need an Ohio business license

Several types of companies need a business license to operate in Ohio. The Ohio Secretary of State maintains a checklist of licensing requirements for different industries. Your county or city government can also give you detailed licensing information for your business.

Anyone who sells tangible personal items or taxable services must obtain a vendor’s license from the Ohio Department of Taxation. You’re responsible for collecting the appropriate amount of sales tax and forwarding it to the state with monthly sales tax returns.

If you’re doing business under a trade name that’s different from your LLC’s legal name, then you’ll need to register your trade name or file a fictitious business name, using Form 534A. The filing fee is $39. Under Ohio law, trade names must be distinguishable from other business names on file with the Secretary of State. Fictitious business names need not be distinguishable from other Ohio business names.

Step 4: File articles of organization

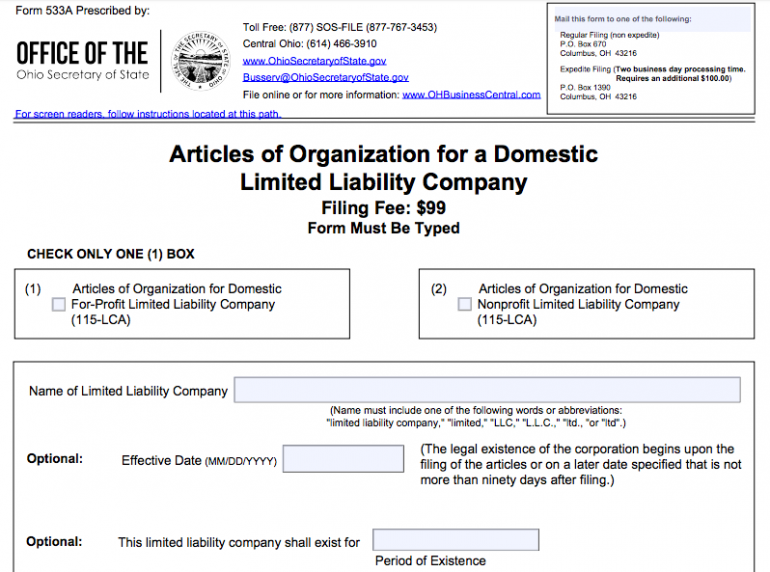

The next step to forming an LLC in Ohio is to file articles of organization with the Ohio Secretary of State. The correct form is Form 533A for domestic LLCs (LLCs that are based in Ohio and organizing under state law) and Form 533B for foreign LLCs (LLCs that are organized under the laws of another state but want to operate in Ohio). We suggest filing online for fastest processing, but you can also mail the form. The filing fee is $99.

In Ohio, the LLC articles of organization must include the following:

LLC name.

(Optional) Effective date of the LLC (can’t be more than 90 days after filing articles; if not completed, the LLC is effective as soon as the articles are accepted).

(Optional) LLC’s period of existence (if not completed, the state will assume that the LLC exists forever).

(Optional) Purpose of the LLC.

Name, contact information and signature of the statutory agent.

Name and signature of the member, manager or company representative who is filling out the articles.

(For foreign LLCs) State and date of original filing.

Once you submit your articles of organization, the state will process and file the articles in three to seven business days. For an additional fee, you can request expedited filing. After filing your articles, the state will send you a stamped copy of your articles of organization. Keep this stamped copy with other important business records.

If you’ve reached this point, congratulations! You’re now authorized to do business in Ohio as an LLC. But there are still a few more steps you need to follow to ensure that your LLC remains in good standing with the state.

Source: Ohio Secretary of State

Step 5: Draft an LLC operating agreement

The state of Ohio doesn’t require members of an LLC to create an LLC operating agreement, but you should still consider this as an essential step to forming an LLC in Ohio. The operating agreement is a written contract that outlines the governing structure of the LLC, as well as each member’s rights, duties and share of the business profits and losses.

The LLC operating agreement should contain the following types of information:

The purpose of the LLC, including products or services offered.

Names and addresses of all the members (and the manager, if there is one).

Each member’s contributions of value to the business.

Each member’s ownership interest in the company, division of profits and losses and voting rights.

Process for admitting new members.

Process for electing a manager if the LLC is manager-managed.

Process for handling exits of existing members.

Meeting schedule and voting process.

Dissolution procedures.

All members of the LLC should carefully review and sign the operating agreement. You won’t file your operating agreement with the state, but you should store it with other important business records.

Step 6: Comply with employer obligations

Ohio businesses that have employees have to meet additional obligations when forming an LLC in Ohio.

Employee reporting: Report employee information to the Ohio New Hire Reporting Center within 20 days of hiring or rehiring an employee. This is mandatory under federal and state law.

Purchase workers’ compensation insurance: Ohio is one of just a few states where you have to purchase workers’ comp insurance from the state, instead of a private insurer. The Bureau of Workers’ Compensation (BWC) will set your rate, and you’ll pay premiums directly to the BWC. To get started, fill out Form U-3 with a filing fee of $120.

Pay unemployment taxes: Employers must establish an unemployment compensation tax account with the Ohio Department of Job and Family Services.

Businesses operating in Ohio that have employees should be sure to comply with these obligations to avoid paying penalties.

Step 7: Pay Ohio business taxes

LLCs in Ohio are treated as pass-through tax entities by default. This means the LLC itself does not pay income taxes. The business income and losses pass through to each owner’s personal tax return, and each owner pays federal and state taxes on their share of the profits. LLCs can elect to be taxed as corporations instead of pass-through entities.

Ohio also has a commercial activity tax that is based on the gross sales of your business. Both LLCs and corporations are responsible for paying this tax. You only have to pay the tax if your gross sales are over $150,000. The tax rates vary as follows:

LLCs with employees must withhold payroll taxes from their employees’ wages and pay the employer share of payroll taxes. Employer payroll taxes in Ohio are 2.7% for new employers.

Unlike most states, Ohio LLCs are not required to file an annual report or pay an annual fee.

Step 8: Comply with federal requirements

In addition to Ohio requirements for LLCs, you’ll also need to comply with federal requirements if you have an LLC.

For example, you’ll need to apply for a federal employer identification number (EIN) if you have employees, have multiple owners or if your LLC is taxed as a corporation.

LLC owners must also pay federal self-employment taxes to cover Social Security and Medicare obligations. Plus, if you have employees, you must withhold Social Security and Medicare taxes from your employees and pay the employer share of these taxes.

LLCs with employees must pay Ohio unemployment compensation tax, as mentioned above. The federal equivalent is called Federal Unemployment Tax Act (FUTA tax). The state taxes you pay can be credited against your federal obligations.

Benefits and drawbacks of forming an LLC in Ohio

Forming an LLC in Ohio has numerous advantages and disadvantages. On one hand, LLCs offer tax and operational flexibility and are easier to start and maintain than corporations. However, you also could end up paying more in taxes or face difficulty raising money.

Benefits

Members get limited personal liability for business debts and lawsuits.

LLCs have fewer reporting and recordkeeping requirements than corporations.

LLCs avoid double taxation of C-corporations.

LLCs can elect whether to be taxed as a pass-through entity or corporation.

LLCs don’t have to pay an annual report or pay an annual fee in Ohio.

Ohio LLC drawbacks

Ohio’s commercial activity tax applies to LLCs and corporations, but not to sole proprietorships and partnerships.

LLC owners often pay higher self-employment taxes than corporate shareholders.

It’s harder to raise money when you have an LLC because you can’t issue stock.

When evaluating the pros and cons, make sure you consider all types of business structures. A sole proprietorship and general partnership require the least effort and money to start, but they don’t offer limited liability protection. If you’re planning to raise money from investors, then you should consider starting a C-corporation or S-corporation, which allows you to issue stock to your investors.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.