QuickBooks POS Review for 2024: Cost, Pros, Cons

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

» This page is out of date

QuickBooks is no longer selling its Desktop POS. QuickBooks has partnered with Shopify to create QuickBooks Desktop Connector, an app to help businesses transition from QuickBooks Desktop POS to Shopify POS.

QuickBooks POS | |

|---|---|

| 3.5 NerdWallet rating |

QuickBooks Point of Sale system is a great option for small business owners who use QuickBooks Desktop for accounting and prefer locally installed software to cloud-based software. Beyond that, the POS solution could be limiting for entrepreneurs who want greater flexibility.

QuickBooks markets its POS system to small retail businesses, clothing stores, jewelry stores, sporting goods or bike shops, furniture stores and home improvement-related businesses. The POS system is not a good fit for restaurants and cafes. Because it charges extra monthly fees for its e-commerce integration, shops that do most of their business online should explore alternatives. NerdWallet’s roundup of POS systems for small business lays out some of the best options.

Features overview

Software cost |

|

Hardware cost |

|

Payment processing cost |

For QuickBooks Online users

For QuickBooks Desktop users Pay as you go plan (no monthly fee):

Pay monthly plan ($20 monthly fee):

|

Contract length | None for QuickBooks Payments, but the POS software is a one-time purchase. |

Live support | Free chat support 6 a.m to 6 p.m. PT Monday through Friday; expert support plans available for $79 per month. |

NerdWallet rating 5.0 /5 | NerdWallet rating 5.0 /5 | NerdWallet rating 5.0 /5 |

Payment processing fees 0.40% + 8¢ plus interchange, in-person; 0.50% + 25¢ plus interchange, online. | Payment processing fees 2.6% + 10¢ in-person; 2.9% + 30¢ online. | Payment processing fees 2.7% + 5¢ in-person; 2.9% + 30¢ online. |

Monthly fee $0 | Monthly fee $0 Starts at $0/month for unlimited devices and locations. | Monthly fee $0 |

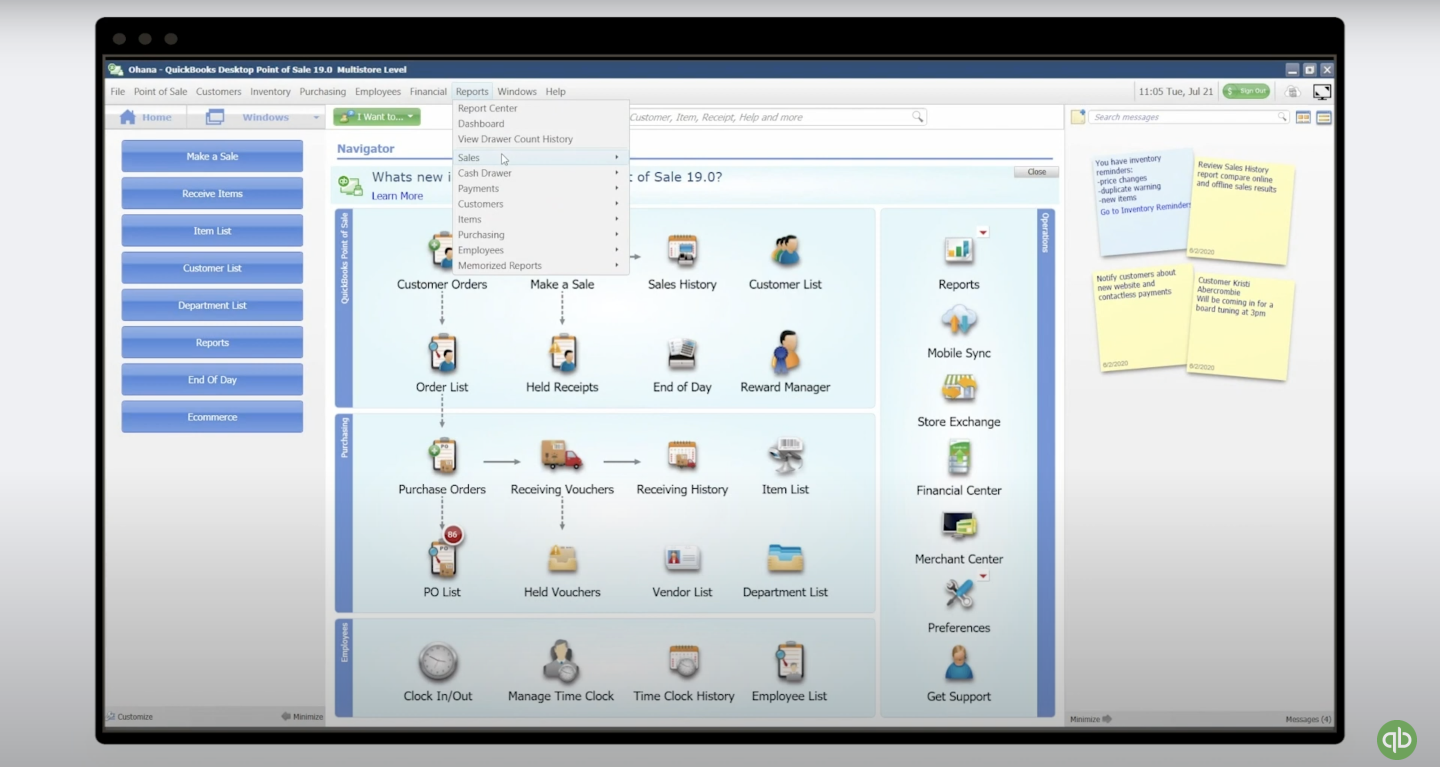

How does QuickBooks POS work?

QuickBooks POS system accepts credit cards, debit cards and contactless payments. While businesses can use third-party apps to connect with QuickBooks Online, the integration won’t be as seamless as it is with QuickBooks Desktop. The system is compatible with tablets running on a Windows 10 operating system. It offers a wide array of hardware, including cash drawers, barcode scanners, receipt printers, PIN pads and tablet stands.

Unlike some of its competitors, QuickBooks POS doesn’t charge a monthly fee to use its software. Instead, business owners pay a steep lump sum to install it locally. If a business opts to use the company’s POS system, QuickBooks Payments would be the most convenient payment processing solution. It integrates with QuickBooks POS and offers both monthly and pay-as-you-go plans.

» MORE: QuickBooks Online vs. Desktop

Pricing

On the upside, QuickBooks POS clients don’t have to worry about monthly software payments. On the other hand, the system’s upfront price is costly. At the time of writing, QuickBooks offered clients a promotional discount on software products. The prices below do not reflect this promotion.

Software

Software plan | One-time fee | Features |

|---|---|---|

POS Basic | $1,200. |

|

POS Pro | $1,700. | Basic plan features plus:

|

POS Multi-Store | $1,900. | Pro plan features plus:

|

Hardware

$39 for QuickBooks charging stand.

$49 for QuickBooks card reader.

$79 for QuickBooks card reader with charging stand.

Payment processing

Note that if you are using QuickBooks’ PIN pad or the GoPayment app, you must use QuickBooks Payments as your processor. There are no setup or termination fees, but clients must have a QuickBooks Desktop or QuickBooks Online account to use the service. The company offers two payment processing plans for in-store transactions and one for mobile transactions processed in the GoPayment app. PCI compliance service costs $9.95 per month.

Pay as you go: 2.7% for in-person transactions; 3.5% per keyed transaction.

Pay monthly: $20 per month; 2.3% plus 25 cents for in-person transaction; 3.2% plus 25 cents per keyed transaction.

1% for ACH transactions.

For QuickBooks Online users

2.5% for in-person payments.

2.99% for online and invoiced payments.

3.5% for manually keyed payments.

1% for ACH transactions.

For QuickBooks Desktop users

Pay as you go plan (no monthly fee):

2.4% plus 30 cents per swiped transaction.

3.5% plus 30 cents per keyed-in or invoiced transaction.

$3 per ACH transfer.

Pay monthly plan ($20 monthly fee):

1.6% plus 30 cents per swiped transaction.

3.3% plus 30 cents per keyed-in or invoiced transaction.

$3 per ACH transfer.

PCI compliance service costs $9.95 per month.

Pros

QuickBooks integrations

QuickBooks POS is a natural choice for businesses dedicated to the company’s suite of accounting and payroll products. Clients with QuickBooks Desktop can sync POS data with their chart of accounts, so data doesn’t have to be input manually.

Strong inventory management

On top of giving you real-time inventory updates, the system can sync inventory across multiple locations. As a result, you can track what sells best and when, and then use that information to determine your employee scheduling needs.

Cons

Only integrates directly with QuickBooks Desktop

QuickBooks POS is locally installed as opposed to cloud-based. This could be a plus for some businesses hesitant to move to a cloud-based system, but it also comes with its limitations. Though cloud-based accounting software is becoming more popular, the POS system only integrates directly with QuickBooks Desktop, not QuickBooks Online.

Quickbooks Online |

Expensive

Even if you opt for the most basic setup, it’s still going to cost your business a considerable sum — and that’s before you purchase hardware. And if your store has multiple locations, you’ll have to pay for a separate software license for each. This can be a serious deal-breaker for small businesses, especially when companies such as Square and Toast offer free POS software.

Expert customer service isn’t free

Clients can chat with customer service representatives, but expert technical support costs more. The POS support plan is $79 per month and gives clients unlimited access to POS experts. The annual plan, which is $589 per year, comes with data recovery services.

NerdWallet’s ratings for point-of-sale system providers reward companies whose products and services are priced well and work in a variety of payment scenarios, among other criteria. Ratings are based on weighted averages of scores in several categories, including cost, system capabilities, contract requirements, customer service and integrations and add-ons. Learn more about how we rate point-of-sale systems providers.

These ratings are a guide, but services, hardware and pricing can vary widely from business to business and provider to provider. We encourage you to shop around and compare several providers.

NerdWallet does not receive compensation for any reviews. Read our editorial guidelines.

| Product | Payment processing fees | Monthly fee | Learn more |

|---|---|---|---|

Helcim NerdWallet Rating Learn more on Helcim's website | 0.40% + 8¢ plus interchange, in-person; 0.50% + 25¢ plus interchange, online. | $0 | Learn more on Helcim's website |

Square NerdWallet Rating Learn more on Square's website | 2.6% + 10¢ in-person; 2.9% + 30¢ online. | $0 Starts at $0/month for unlimited devices and locations. | Learn more on Square's website |

Stripe Payments NerdWallet Rating Learn more on Stripe's website | 2.7% + 5¢ in-person; 2.9% + 30¢ online. | $0 | Learn more on Stripe's website |

Shopify POS NerdWallet Rating Learn more on Shopify's website | 2.70% in-person; 2.9% + 30¢ online (Basic plan). | $39 and up for e-commerce plans with POS Lite; Can upgrade to POS Pro for an extra $89. | Learn more on Shopify's website |