QuickBooks Questions: The 11 Most Common Questions, Answered

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Table of Contents

- 1. Can you add credit card accounts to your QuickBooks feed?

- 2. How do you perform transfers between accounts?

- 3. Can a customer pay the total balance due on multiple outstanding invoices?

- 4. How do you delete a connected bank account?

- 5. Can I upgrade QuickBooks Self-Employed?

- 6. Can you edit accountant firm users with QuickBooks Simple Start?

- 7. What happens if you cancel your QuickBooks account?

- 8. Why don't manual payroll taxes match up with QuickBooks liabilities?

- 9. Can specialized QuickBooks Desktop products convert to QuickBooks Online?

- 10. Can you create a budget sorted by customer and service item?

- 11. Can you do job costing on QuickBooks Online?

- More QuickBooks questions? Here’s where to go

Questions about QuickBooks' small-business products — and the answers to them — can open up some pretty amazing features in your accounting software. Through face-to-face conversation with QuickBooks users, we’ve compiled some common QuickBooks questions and answers.

FEATURED

QuickBooks Online resources

Read more about how QuickBooks Online works.

1. Can you add credit card accounts to your QuickBooks feed?

Most QuickBooks users are familiar with the concept of adding checking accounts to their QuickBooks bank feed. However, the prospect of adding credit card accounts to their QuickBooks bank feed often comes up in QuickBooks questions. Some users wonder if you can add credit card accounts at all, and others wonder how many credit card accounts you can add.

Although QuickBooks doesn’t specifically limit the number of bank or credit card accounts you can add, users should keep in mind that bank and credit card accounts count toward their subscription’s usage limits. QuickBooks Online, Simple Start, Essentials, and Plus all have a usage limit of 250 accounts.

2. How do you perform transfers between accounts?

Many users ask QuickBooks questions about the mechanics of performing account transfers. More specifically, there are questions about which labels you should place on each account within the transfer. Many get confused about what combination of “Transfer” and “Match” labels you should apply in QuickBooks. When doing transfers between accounts in QuickBooks, do you mark one account “Transfer” and the other account “Match”? Or do you click transfer for both? Or do you click match for both? An account transfer can get confusing.

The best way to attack an account transfer is to first create a transfer in QuickBooks, as the below media demonstrate. Then, when that transfer comes through your bank feed, you can match it to the corresponding account.

3. Can a customer pay the total balance due on multiple outstanding invoices?

When customers have multiple outstanding invoices, many business owners want to be able to send them a link through which they can pay their total balance, rather than just the amount of the most recent invoice. Unfortunately, there’s no automatic way to send a link to pay the total owed balance to a customer through QuickBooks. You will have to manually create a new invoice of their total outstanding balance, then void the previous invoices, to consolidate them.

4. How do you delete a connected bank account?

Many QuickBooks users want to delete bank and credit card accounts when they close them so as to keep their QuickBooks interface tidy. Doing so is pretty easy, as you’ll see with these steps:

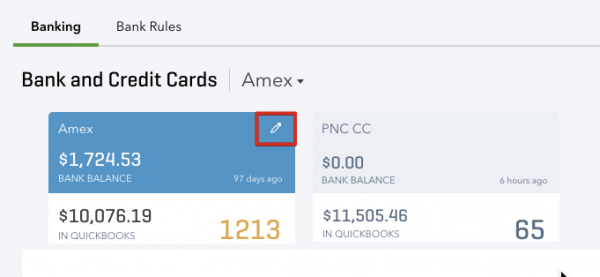

First, you want to make sure that you’ve matched and added all of the transactions that have been downloaded to the bank feed. While you’re in the bank feed screen, click the pencil icon for the account:

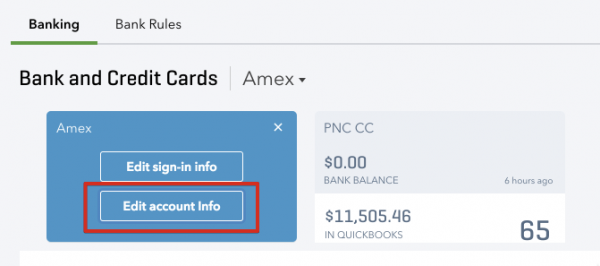

Then, you’ll click the button that reads “Edit account info”:

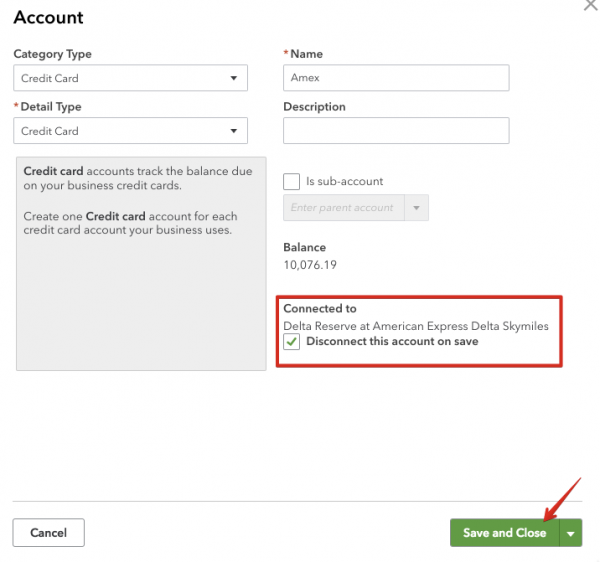

Now, check the box next to “Disconnect this account on save,” and last, click “Save and Close.”

5. Can I upgrade QuickBooks Self-Employed?

The answer is maybe. Some users now have access to an upgrade feature to transition to QuickBooks Online. If you don’t see an option to “Explore QuickBooks” in your QuickBooks Self-Employed account, you can manually import your QuickBooks Self-Employed data into QuickBooks Online.

6. Can you edit accountant firm users with QuickBooks Simple Start?

QuickBooks questions regarding accountant users usually have pretty simple answers: QuickBooks Simple Start, Essentials, and Plus only allow for two accountant firm users. QuickBooks Online Advanced allows for three accountant firm users. If you have two users on your QuickBooks Simple Start, Essentials or Plus account and want to add one, you’ll need to delete one of the accountant firm users before inviting another.

7. What happens if you cancel your QuickBooks account?

When a user cancels a QuickBooks Online subscription, Intuit keeps the data for one year. Prior to canceling, you should export and/or print any necessary reports. You could even consider converting the data to a QuickBooks Desktop version for further accessibility. If you reinstate your account within a year after canceling it, QuickBooks will still have your historical data.

8. Why don't manual payroll taxes match up with QuickBooks liabilities?

Some business owners choose to pay their payroll taxes manually outside of their QuickBooks account. It’s only natural to compare the liabilities that QuickBooks shows in your account to the ones you actually had when you reconciled payroll. And, as a result, many business owners wonder why these figures don’t match up. Overall, the difference between these figures is generally a rounding issue, and users can just make the adjustment in QuickBooks accordingly.

9. Can specialized QuickBooks Desktop products convert to QuickBooks Online?

Many specialty QuickBooks Desktop products, like QuickBooks Contractors edition, can be easily converted to QuickBooks Online. See Intuit guides to converting to QuickBooks Online from QuickBooks for Mac, Pro, any Premier Edition or Enterprise Solutions.

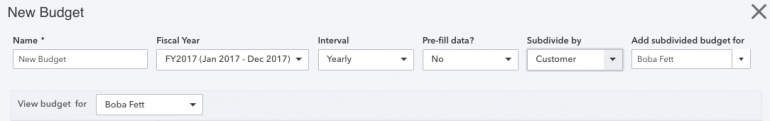

10. Can you create a budget sorted by customer and service item?

Many QuickBooks users want to know whether you can sort budgets by customer and by service item. In fact, many QuickBooks accounting experts want to be able to provide this kind of budget for their client. Nonetheless, you can only create a budget that’s sorted by customer, but you can’t sort it by item.

11. Can you do job costing on QuickBooks Online?

QuickBooks Online Plus and QuickBooks Online Advanced offer project profitability and job costing features, but users should be aware that job costing in QuickBooks Online works differently than what they might be used to in QuickBooks Desktop. Patience will be important as you learn the nuances of job costing in QuickBooks Online.

More QuickBooks questions? Here’s where to go

Didn’t get your QuickBooks questions answered in this article? Not to worry — there are tons of QuickBooks training resources out there that can help you get answers. Plus, many of the best places for your QuickBooks questions will answer them for free.

QuickBooks Community

QuickBooks Community is a forum on which accountants, QuickBooks users, and Intuit employees answer and discuss QuickBooks questions. Odds are that any QuickBooks question you have will already be answered ten times over on QuickBooks community, so it’s worth sifting through. And if you don’t find an answer to your QuickBooks question, you can create a new post to get answers that can help future QuickBooks users who have the same question as you.

QuickBooks ProAdvisor

If you have access to a QuickBooks ProAdvisor, then you should absolutely bring your QuickBooks questions to them. A QuickBooks ProAdvisor is a certified QuickBooks power user, so they should really be able to answer just about any QuickBooks question you can come up with whether concerning QuickBooks checks, profit and loss statements or general reporting. If you want expert QuickBooks advice, or even just a constant source of useful answers for your questions, then we suggest you look into finding a QuickBooks ProAdvisor.

A version of this article was first published on Fundera, a subsidiary of NerdWallet.

| Product | Starting at | Promotion | Learn more |

|---|---|---|---|

QuickBooks Online NerdWallet Rating Learn more on QuickBooks' website | $30/month Additional pricing tiers (per month): $60, $90, $200. | 50% off for first three months or free 30-day trial. | Learn more on QuickBooks' website |

Xero NerdWallet Rating Learn more on Xero's website | $15/month Additional pricing tiers (per month): $42, $78. | 30-day free trial or monthly discount (terms vary). | Learn more on Xero's website |

Zoho Books NerdWallet Rating Learn more on Zoho Books' website | $0 Additional pricing tiers (per month): $20, $50, $70, $150, $275. | 14-day free trial of the Premium plan. | Learn more on Zoho Books' website |

FreshBooks NerdWallet Rating Learn more on FreshBooks' website | $19/month Additional pricing tiers (per month): $33, $60, custom. | 30-day free trial or monthly discount (terms vary). | Learn more on FreshBooks' website |