Small-Business Tax Credits: The Complete Guide

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Small-business tax credits can be powerful because they can directly reduce your tax bill. This guide explains how tax credits work, the best small-business tax credits and what forms you need to file for each one.

FEATURED

H&R Block

$0

Small-business tax credits vs. tax deductions

People often confuse tax credits with tax deductions, but they are not the same thing.

Tax deductions decrease your taxable income, which can put in you in a lower tax bracket if you report business income on your personal tax return.

For example, if your business records $100,000 in revenue and takes $20,000 in tax deductions, your taxable income is $80,000 instead of the full $100,000. If you're in the 12% tax bracket, a $1 tax deduction could save you $0.12 in taxes; if you're in the 24% tax bracket, a $1 tax deduction could save you $0.24 in taxes.

Companies can claim tax deductions for most ordinary and necessary business expenses. There are also special deductions, such as for home-based businesses.

» MORE: Learn about the Qualified Business Income Deduction (QBI) and other tax deductions for small businesses

Tax credits reduce your tax bill on a dollar-for-dollar basis.

For example, if your small business owes $20,000 in taxes, a $5,000 tax credit means you can subtract $5,000 from your tax bill.

$10,000 tax deduction | $10,000 tax credit | |

Your AGI | $100,000 | $100,000 |

Tax deduction | –$10,000 | |

Taxable income | $90,000 | $100,000 |

Tax rate* | 25% | 25% |

Calculated tax | $22,500 | $25,000 |

Tax credit | –$10,000 | |

Your tax bill | $22,500 | $15,000 |

* Example rate. The U.S. has a progressive tax system. | ||

How much do you need?

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

How to claim small-business tax credits

If you’re eligible for more than one small-business tax credit, you must submit IRS Form 3800 along with your tax return. This form lists each and every small-business tax credit that your company might be eligible for. Adding up those credits, you can calculate your General Business Tax Credit.

As you might expect, there’s a limit on the amount of small-business tax credits you can claim each year. This formula will help you determine your business’s limit:

Add your net income tax and alternative minimum tax.

From that sum, subtract the greater of either your tentative minimum tax for the tax year or 25% of the amount of your regular tax liability that’s greater than $25,000.

Each individual tax credit requires its own form, noted below. On Form 3800, you’ll add up each of the individual tax credits to calculate the total value of your tax credits. If you’re only eligible for one small-business tax credit, there’s no need to submit Form 3800. You only need to submit the form that accompanies that specific tax credit.

If you’re eligible for a small-business tax credit but fail to claim it this tax year, you might be eligible to carry forward the credit to a future tax year. Just remember that whenever you do claim a tax credit, you typically can’t claim a deduction for the same expense.

10 Small-business tax credits you should know about

Here are the most important small-business tax credits that are available now:

1. Credit for Small-Business Health Insurance Premiums (Form 8941)

This popular small-business tax credit comes out of the Affordable Care Act, better known as Obamacare. This credit is for companies that provide small-business health insurance to their employees.

The small-business health care tax credit via Form 8941 is available to businesses that:

Have fewer than 25 full-time or equivalent employees.

Pay an average wage of less than $55,000 a year per full-time employee (this number used to be lower).

Pay at least half of their employees’ health insurance premiums.

Purchased a qualified health plan from the Small-Business Health Options Program (SHOP) Marketplace.

If you qualify, this credit is equal to 50% of employer-paid health insurance premiums. However, you can only claim the credit for two consecutive years after 2014. That means that if you’ve already claimed the credit for two years in a row, you’re no longer eligible to claim this credit.

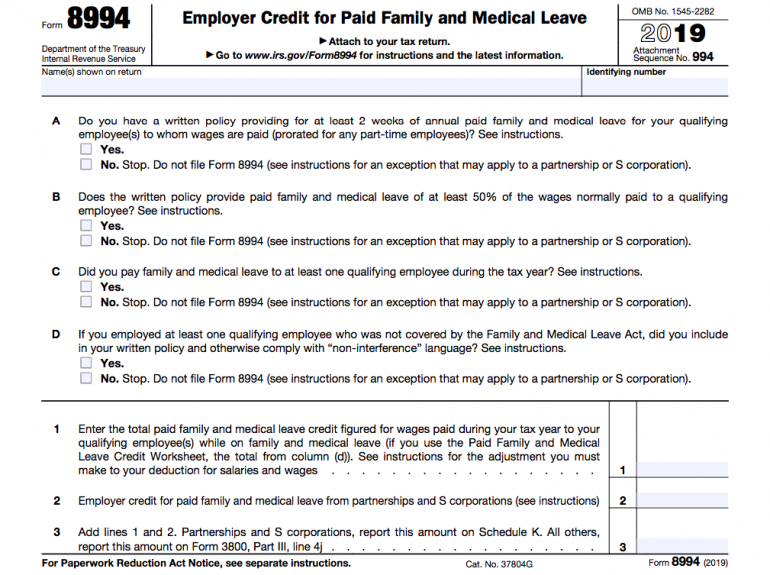

2. Employer Credit for Paid Family and Medical Leave (Form 8994)

Congress authorized this tax credit to encourage small-business owners to provide paid leave to employees. This credit is not meant to incentivize vacation time, but rather leave related to the birth of a child, health emergency in the family or another reason covered by the Family and Medical Leave Act (FMLA).

Employers are eligible for the Family Leave Act Tax Credit if they:

Have a written policy that provides full-time employees with at least two weeks of paid family and medical leave annually (prorated for part-time employees).

Pay employees at least 50% of their wages during leave.

The credit is equal to 12.5% of the wages that are paid to qualifying employees on family and medical leave during the tax year. The credit increases incrementally if you pay employees more than half of their wages during their leave. The maximum credit is 25% of wages for businesses that cover 100% of an employee’s salary during leave.

Keep in mind that if you claim the Family Leave Act Tax Credit, the amount of the credit will offset any deduction that you take for employee wages.

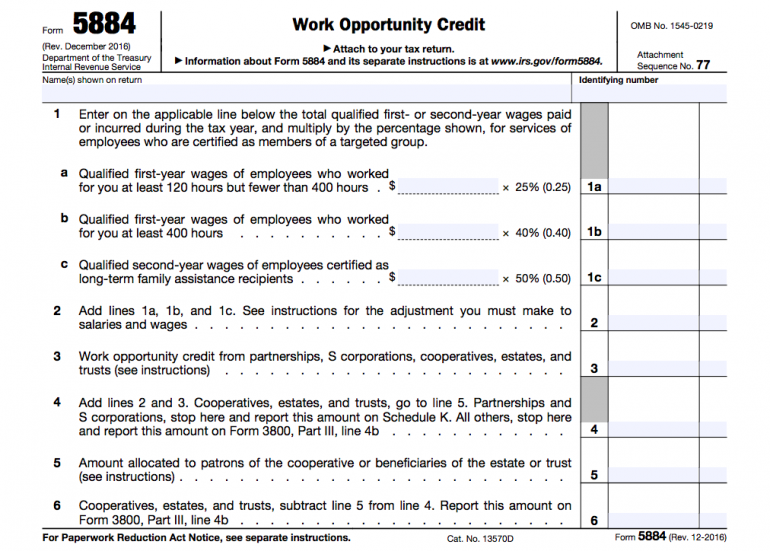

3. Work Opportunity Credit (Form 5884)

The Work Opportunity Credit incentivizes companies to hire employees from the following underserved populations:

Veterans.

Family assistance or food stamp recipients.

Ex-felons.

Individuals who have been unemployed long-term.

Individuals receiving Supplemental Security Income (SSI).

Designated community residents or summer youth employees living in federal empowerment zones.

The size of the tax credit depends on which category your employee falls into and how many hours they worked for your company during the tax year. In general, with Form 5884 you can claim a tax credit of 40% of the first $6,000 of the employee’s first-year wages, which equals $2,400. Higher credits are available for companies that employ veterans and long-term family assistance recipients.

4. Credit for Increasing Research Activities (Form 6765)

There are several research and development (R&D) tax credits for small businesses. Although science, medical and technology businesses are most often eligible for these tax credits, many types of companies engage in R&D activities.

Any of the following types of activities might help you qualify for an R&D tax credit:

Developing new prototypes or models.

Developing proprietary products and seeking patents for those products.

Developing a new manufacturing process or business process.

Improving product efficiency or existing business processes.

Improving quality control processes.

Environmental or certification testing.

If you qualify for this small-business tax credit, you can subtract up to 10% of your R&D costs from your tax bill. Some small businesses can use the tax credit to offset their alternative minimum tax. To qualify, the business must be a non-publicly traded corporation, partnership or sole proprietorship with an average of $50 million or less in gross receipts over the last three years. Just be sure to carefully document your R&D activities with project notes, process diagrams, lab results, etc.

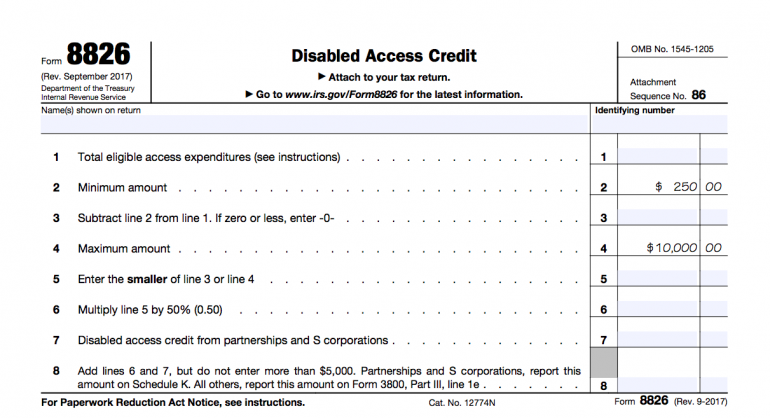

5. Disabled Access Credit (Form 8826)

The Disabled Access Credit encourages companies to make their business locations accessible to customers with disabilities. Not only can you remove barriers to access and invite more customers into your business, but you can also be financially rewarded for your efforts.

The Americans with Disabilities Act (ADA), enacted in 1990, requires businesses with 15 or more employees to provide reasonable accommodations to employees with disabilities. Other provisions of the ADA regulate public access to certain types of businesses, such as shopping malls and restaurants.

Making your place of business accessible to people with disabilities might require expensive upgrades, such as building a ramp, placing appropriate spacing between shelves or providing text in formats like braille. To lower the financial impact of such changes, the government offers this tax credit.

The credit is available to businesses that have total revenues of $1 million or less, or 30 or fewer full-time employees. With this credit, you can cover up to 50% of disabled access expenditures, ranging from $250 to $10,000. This means you can claim a maximum Disabled Access Tax Credit of $5,000 in one year.

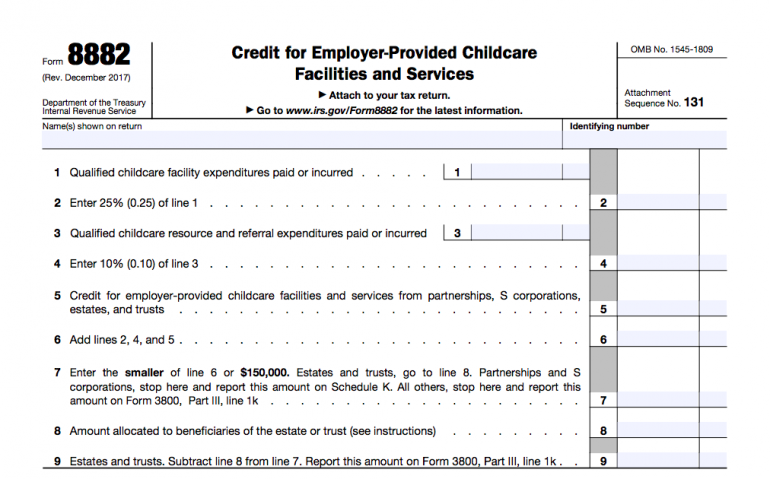

6. Credit for Employer-Provided Childcare Facilities and Services (Form 8882)

This tax credit targets businesses that pay for their employees’ child care expenses or help their employees obtain child care.

The following expenses are covered by the Employer-Provided Child Care Tax Credit:

Expenses used to construct, remodel or expand a child care facility.

Expenses used to operate an existing child care facility, such as caregiver salaries.

Expenses used to provide child care to employees’ children, through a contract with a qualified child care facility.

Expenses used to provide child care resources and referrals through a contract with a child care provider.

Businesses that qualify for this tax credit can claim 25% of their expenditures on child care, plus 10% of child care resource and referral expenditures. The credit is limited to $150,000 per tax year. All facilities must be qualified child care facilities, meaning that they must comply with the licensing requirements of the state or locality in which they are located.

7. Alternative motor vehicle, electric vehicle and alternative fuel credits

The IRS offers several tax credits related to alternative energy use. If you produce or use alternative fuels in business, use an electric vehicle or use a vehicle that runs on alternative fuel, then you might be able to claim one of these small-business tax credits:

The amount of these tax credits varies based on which credit you claim. For example, the qualified electric vehicle credit is worth between $2,500 to $7,500 based on the vehicle’s battery capacity. Check out the Department of Energy’s website for more details on these tax credits.

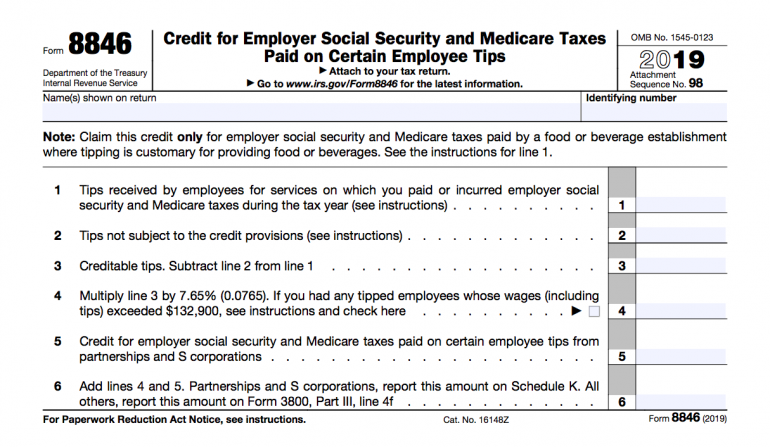

8. Credit for Employer Social Security and Medicare Taxes Paid on Certain Employee Tips (Form 8846)

Individuals who work in the food and beverage industries rely heavily on tips. If employees in your food or beverage establishment receive tips, you can claim a tax credit for the social security and Medicare payroll taxes that you’ve paid on those tips.

In most cases, this small-business tax credit equals the amount of employer social security and Medicare taxes that you paid for tips received by the employee. However, the amount of the credit is reduced for businesses that don’t pay their employees at least the federal minimum wage that was in effect on January 1, 2007 ($5.15 per hour). The federal minimum wage is higher today, but for purposes of calculating this credit, you must reference the 2007 minimum wage.

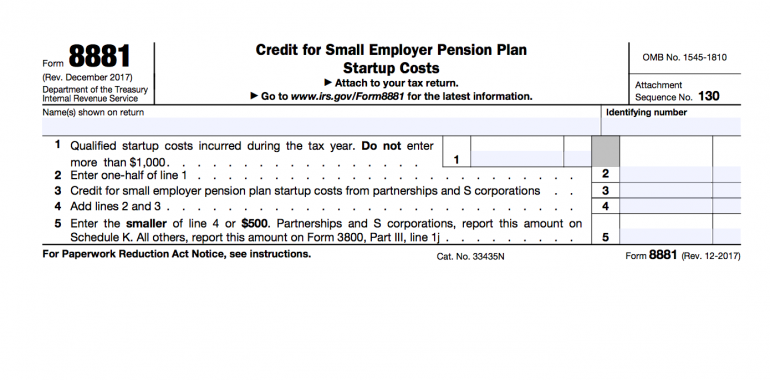

9. Tax Credit for Small Employer Pension Plan Startup Costs and Auto-Enrollment (Form 8881)

This tax credit helps to lower the cost of setting up a retirement plan for your team. Businesses are eligible for the tax credit if:

They had 100 or fewer employees during the tax year, all of whom received at least $5,000 in wages.

They have not previously had a retirement plan in place over the last three years for the same group of employees.

Most common retirement plans, including 401(k) plans, SEP IRA plans and SIMPLE IRA plans, qualify under this tax credit. The credit is worth $500, to be claimed for administrative costs and money spent to inform employees about their benefits and options under the plan.

People who contribute to a retirement plan, including self-employed individuals, can take advantage of a retirement savings contribution tax credit if they fall into a lower income bracket.

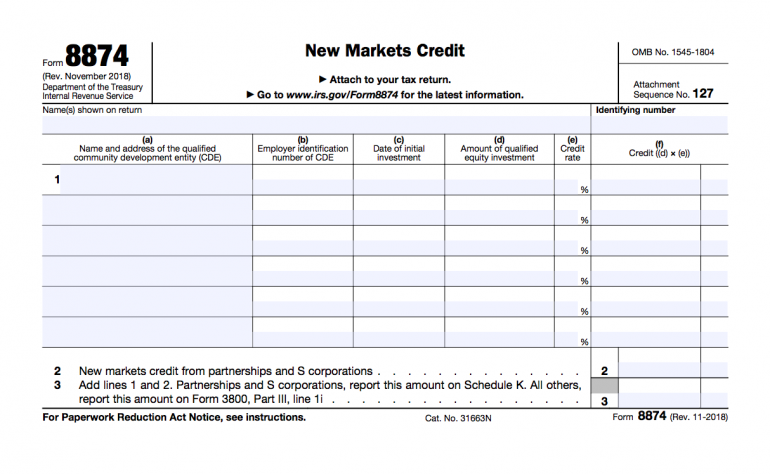

10. New Markets Credit (Form 8874)

The last tax credit on our list is the New Markets Credit. This tax credit supports businesses that invest in Community Development Enterprises (CDEs) and Community Development Financial Institutions (CDFIs), which are organizations that aid low-income communities.

Projects that qualify for the credit typically involve the acquisition, renovation or construction of real estate in low-income areas, or the expansion of existing businesses in those areas. Example projects include:

Construction or rehabilitation of educational facilities or community centers

Fix and flip businesses that renovate residential property.

Construction or rehabilitation of hospitals and other health facilities.

Construction or rehabilitation of industrial facilitates that create jobs.

Construction or rehabilitation of facilities that provide services to women, minorities or other underserved communities.

In order to be eligible for the New Markets Tax Credit, a project must be located within a census tract that has a poverty rate of at least 20% or with median family incomes that do not exceed 80% of the area median income. The Department of the Treasury has a tool to find CDEs and CDFIs near you if you’re interested in getting involved.

FEATURED

Ask your tax professional about small-business tax credits

Be sure to ask your tax professional which small-business tax credits your business is eligible for. There are additional federal small-business tax credits — and state and local governments often offer tax incentives of their own. Tax credits often expire in a few years, however, so you need to act quickly to take advantage of them.

A version of this article was first published on Fundera, a subsidiary of NerdWallet