Form W-2 vs. Form W-4: What’s the Difference & How to File

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

The difference between a W-2 and W-4 is that the W-4 tells employers how much tax to withhold from an employee’s paycheck; the W-2 reports how much an employer paid an employee and how much tax it withheld during the year. Both are required IRS tax forms.

This guide compares the W-2 and W-4 forms, explaining not only the core differences between the two, but also how to fill each one out correctly for your business.

FEATURED

H&R Block

$0

W-2 vs. W-4: The basics

You can find both the W-2 and W-4 online at IRS.gov. The W-2 and W-4 must be filled out for each one of your employees and they are part of the HR, accounting and payroll processes in your business.

What is a W-4 used for?

The W-4, also known as the employee’s withholding allowance certificate, tells employers how much income tax to withhold from an employee’s pay.

Each employee should correctly complete a W-4 as part of their new-hire paperwork on their first day of employment (or, at the very least, before their first paycheck) and update it if their personal or financial situation changes. Once your employee has completed a W-4, you use the information to calculate the correct federal tax to withhold each time you run payroll.

What is a W-2 used for?

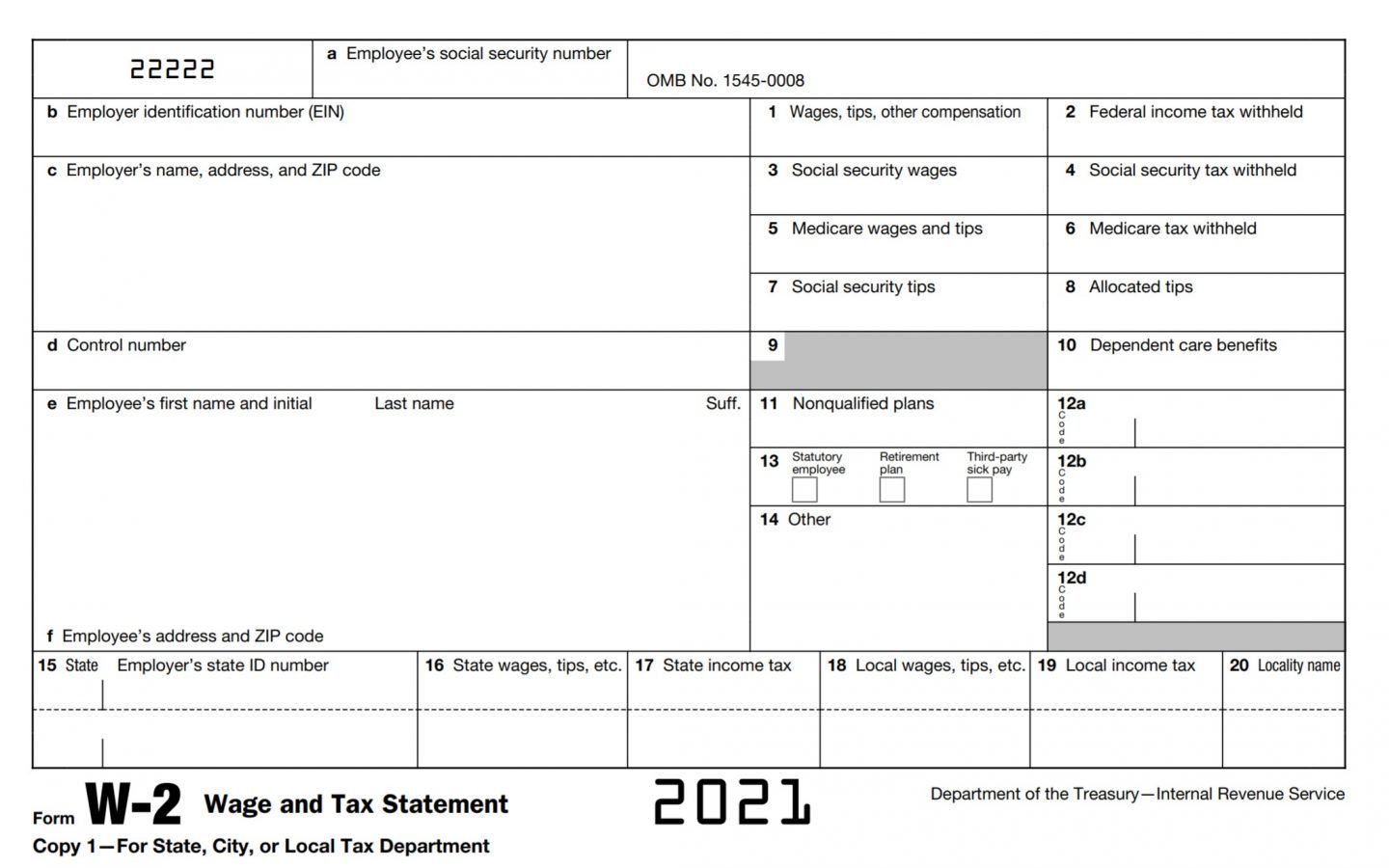

The W-2 form is as a wage and tax report that employers create annually for each of their employees. The W-2 shows the employee’s gross earnings, as well as their deductions for income, Social Security or Medicare taxes, certain child care account contributions and contributions to certain retirement accounts.

Employees need their W-2 forms to file their personal tax returns. You can file W-2 forms electronically or complete them manually and then mail them to the Social Security Administration (SSA), state and local governments, and your employees. Many payroll or accounting software platforms assist with W-2 filings.

W-2 vs. W-4 form differences

W-4 form: The W-4 form tells you, the employer, how much tax to withhold from your employee’s paycheck.

W-2 form: The W-2 form is a report you generate that tells the employee (as well as the IRS) their gross pay and tax withholding for the year.

Who completes the forms?

W-4 form: Employees fill out the W-4. Each employee provides personal information and withholding allowances on the W-4. As an employer, you only need to fill out part of the W-4 if you’re using the document to fulfill state new-hire reporting requirements.

W-2 form: The employer fills out the W-2 using payroll data for the year. You complete a W-2 for each employee.

When are they completed?

W-4 form: Employees should fill out a W-4 form as part of their onboarding paperwork. Because the W-4 determines how much tax to withhold from an employee’s paycheck, the employee should complete a W-4 before their first payday. Employees can fill out a new W-4 if their personal or financial situation changes and they want to adjust their withholding allowances as a result.

W-2 form: You must file a W-2 for every employee, every year, no later than Jan. 31. The W-2 reflects data from the previous year. A W-2 filed in January 2022, therefore, will reflect payroll and tax information from 2021.

Bookkeeping and accounting software | |

|---|---|

QuickBooks Online $30 per month and up. Read Review. | |

FreshBooks Accounting $17 per month and up. Read Review. | |

Xero $13 per month and up. | |

Zoho Books $0 per month and up. | |

Sage 50 Accounting $48.17 per month (when paid annually) and up. | |

Wave Financial Free (add-ons available). | |

What do you do with them?

W-4 form: When your employee fills out a W-4, you should file it (either electronically or physically), but you do not need to send it to the IRS or Social Security Administration. You only need to file a W-4 form if you’re using it to meet state new-hire reporting requirements.

W-2 form: You must submit all W-2 forms to the Social Security Administration, either by mail or electronically. Additionally, you must also distribute completed W-2 forms to all of your employees each year, no later than Jan. 31. You may also have to file a copy with your state or local tax department.

W-2 vs. W-4 forms: how to file

To ensure you meet the W-2 and W-4 requirements for your business, let’s go through how to find and fill out each form, as well as some tips to help simplify the process.

W-4 form: Employee’s Withholding Certificate

Employees ideally fill out a W-4 on their first day of employment — and definitely before their first paycheck. The W-4 tells employers how much tax to withhold from employees’ paychecks when you run payroll. You can find blank W-4 forms on the IRS website.

Some HR or payroll software allows employees to fill out W-4s electronically.

You cannot tell your employees what to put on their W-4s, but you can offer resources to help them determine their correct withholding.

Once an employee completes a W-4, they’ll return it to you; keep the form on file for reference. Input the information into your payroll system to ensure you withhold the correct amount of tax from each paycheck.

Employees can change their W-4s any time. You should update your filing system with the new W-4 information and adjust your payroll data accordingly.

Depending on the state, your employees may also have to file state withholding tax forms. State withholding forms specify state income tax withholding and follow the same procedure as the W-4. You can refer to the revenue and taxation department website in your state to confirm state tax withholding form requirements.

FEATURED

H&R Block

$0

W-2 form: Wage and Tax Statement

As an employer, you are solely responsible for completing and filing W-2 forms for each of your employees annually and filing those forms with the SSA. The SSA recommends filing W-2s electronically, but you can physically file as well.

You must complete, distribute and file your W-2s no later than Jan. 31 for the previous year. You can access blank W-2 forms on the IRS website. In many cases, your accountant or payroll administrator can help you with W-2 filings. Additionally, many payroll software platforms allow you to file W-2s through their system as well.

To complete the W-2 form for each of your employees, you will have to fill out:

The employee’s Social Security number.

Your employer identification number (EIN).

Your name, address and ZIP code.

The employee’s name, address and ZIP code.

The employee’s wages and tax withholdings.

2021 Form W-2

What you put on a W-2 depends on your business and individual employees. Dependent care benefits and retirement plans, for example, might not apply to every employee — and therefore might not apply to every W-2 you complete. Again, the IRS provides detailed instructions on how to complete each box within the W-2.

Once you complete your W-2 forms for your business, file them with the SSA and distribute them to your employees.

File and provide a W-2 for every employee that worked for you during that tax year, even if they don't work for you anymore.

You complete W-2s only for employees, not for contractors. For 1099 contractors, on the other hand, you file the 1099-NEC form (previously the 1099-MISC for tax years 2019 and earlier). The 1099-NEC form (and, previously, 1099-MISC) is similar to a W-2 in that it reports what you paid the contractor and how much tax you withheld for that individual. Like W-2s, 1099-NEC and MISC forms, file them before Jan. 31 and distribute them to the independent contractors that worked for you during the tax year.

Tips for small businesses filing W-2 and W-4 forms

These tips will help you streamline your W-2 and W-4 processes so you complete the forms correctly and efficiently.

Be proactive. Don't wait until the last minute to complete these forms. That can lead to errors or missed deadlines, which for W-2s can trigger a late penalty from the IRS. It’s best to have your employees fill out their W-4s on or before their first day of employment and input the relevant information into your payroll system as soon as possible. For W-2s, start working on them first thing in the new year to meet the Jan. 31 deadline.

Consult a professional. Although the IRS website includes detailed instructions for both forms, they still can be confusing. It’s helpful to consult a business accountant or tax advisor who has experience with IRS tax forms and can answer questions or help you fill things out.

File electronically, if possible. When it comes to the W-2, the IRS recommends that you file electronically. That saves paper and is quicker and easier. Additionally, it may be easier to have employees fill out their W-4s electronically. Storing W-4s electronically will help you stay organized and able to access them quickly if necessary.

Use payroll or HR software. Using payroll or HR software that has W-4 and W-2 capabilities is perhaps the easiest way to streamline your tax-form processes. Not only can you complete and possibly file forms on the platform (depending on the system you choose), but also your employees can fill out their forms and access them later as needed.

Take caution. As you do with all of your business tasks, use extra caution when completing W-2s and helping your employees complete their W-4s. Errors on these forms can hurt your business and your employees — especially in an audit — so spending a little extra time now can save you time (and money) in the long run.

A version of this article was first published on Fundera, a subsidiary of NerdWallet