Business Loan Agreement: What You Need to Know Before Signing

Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money.

Business loan agreements allow lenders to document and enforce the specifics of their lending transactions. Therefore, it’s essential that you understand the terms and conditions of any loan contract before signing. If you’re not satisfied with the arrangement, you’re not required to move forward.

Here’s everything you need to know about business loan agreements.

How much do you need?

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

What is a business loan agreement?

A business loan agreement is a legal contract between a borrower and lender that defines the terms and conditions of their loan arrangement. This document typically includes the loan amount, repayment terms and schedule, interest rates and collateral, among other terms.

How does a business loan agreement work?

After you’ve applied and been approved for a small-business loan, your lender — whether a bank, credit union or online company — will provide you with a unique business loan agreement. If you’re getting a private loan from an individual, on the other hand, you may need to draft your own loan agreement and/or work with that person to create a contract that’s agreeable to both parties.

In this case, you may choose to refer to business loan agreement templates or samples online. It may also be helpful to work with a business attorney to get professional advice and guidance through this process.

Note that you’ll want to consider developing a business loan contract even if you’re borrowing money from friends and family. Although it may seem like a formality, laying out the details of your arrangement can help prevent strain on your personal relationships.

Sections of a business loan agreement

Most business loan agreements will contain the same general sections. Your lender will customize these sections based on its lending practices and the details of your transaction.

Although some loan contracts may vary slightly in terms of structure or language, you can typically expect to see the following:

Effective date

This is the date that the loan contract becomes legally binding. In many cases, this is the day that your small-business lender disperses your funds.

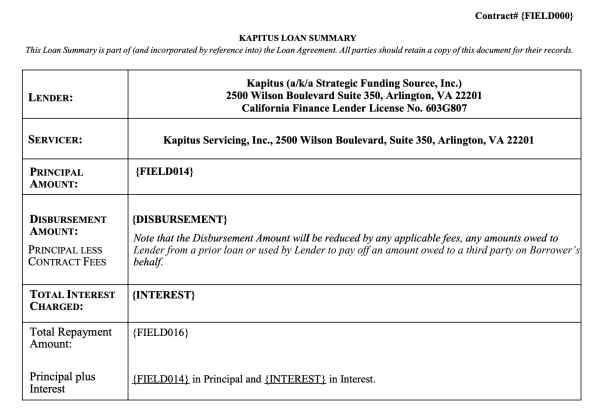

Parties and loan amount

In this section, you’ll find basic information about you and your lender — e.g., names, addresses, phone numbers — as well as the amount of money that you’re borrowing.

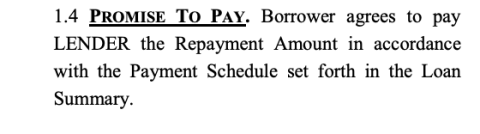

Promissory note

The promissory note is your promise to repay the loan according to the terms laid out in the agreement.

Collateral

If you’ve secured your loan with collateral, it will be described here. Collateral may include real estate, equipment, inventory or other business assets. Traditional lenders, like banks and credit unions, are more likely to require collateral than online lenders.

Terms and conditions

This section includes the key details about your business loan and how you’ll repay it, such as your loan amount, loan term, repayment schedule, interest rate and fees.

You’ll also find information about your lender’s prepayment policy. Some lenders allow you to prepay your loan without a fee (or even offer a discount), whereas others charge a penalty for paying early.

Penalties for nonpayment

This part of the loan contract outlines what happens if you miss a payment. Your lender may charge a late fee or offer a grace period where you can make a late payment without penalty.

Defaults and acceleration clause

This section explains what happens if you can’t repay your loan and default. It may include information regarding fees, remedies and acceleration. An acceleration clause generally states that in the case of default, the lender can require immediate payment of the unpaid loan balance.

Jurisdiction and governing law

Because laws vary from state to state, this section defines which laws in which state are responsible for governing the agreement. This part of the contract may also identify the jurisdiction that will hear any disputes that are brought to court as a result of the loan agreement.

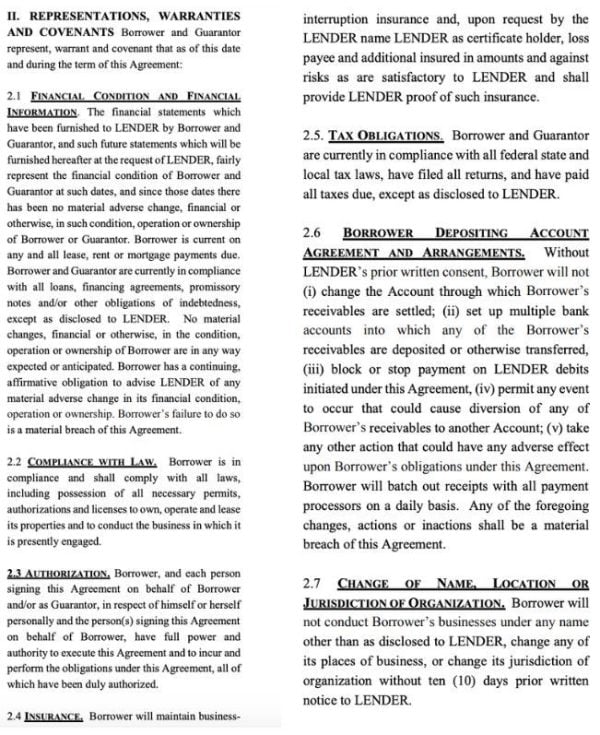

Borrower representations

Through this section, you — the borrower — attest to certain pieces of information for the lender. You typically confirm your legal right to operate in the state, your authority to sign the business loan agreement and the accuracy of your financial statements.

Covenants

A covenant is a general agreement between two parties. In this case, the lender promises to provide you with a specific amount of funds, and you agree to repay them based on the terms of the loan contract. You may have to make other covenants as part of your business loan agreement, such as:

Maintaining certain types of business insurance.

Using the loan proceeds as set out in the agreement.

Not taking on additional debt.

Remaining up to date on tax payments.

Keeping financial records and providing them to the lender as necessary.

Not changing the name, location or ownership of the business.

Miscellaneous

At the end of your business loan agreement, there may be a miscellaneous section that contains additional details specific to your lender’s processes. This section may include how you’ll receive loan notices, the procedure for modifying or amending the contract, as well as a jury trial waiver clause, among other information.

Signatures

The last section of a business loan contract is where you sign the agreement. Here, you’ll typically find a signature space for you (the borrower), additional business owners or guarantors, and the lender.

The agreement will become effective on the date written in this section.

Business loan agreement: Terms to know

Business loan agreements can be long and complicated documents. It may be helpful to familiarize yourself with some of the most common terms and phrases used in these contracts, such as:

Amortization

Amortization refers to the way in which loan repayments are structured. If your loan amortizes, you’ll repay through equal, scheduled payments over the loan term — usually on a monthly basis.

Typically, each payment includes interest costs and a payment toward the loan principal.

Annual percentage rate, or APR

APRs are expressed as an annual percentage and represent the total cost of a business loan, which includes both interest and fees. Although not all lenders provide APRs, it can be helpful to calculate other types of interest rates into an APR to get a better understanding of how much a loan costs.

Automated Clearing House, or ACH

ACH is a type of money transfer that lenders often use for loan repayment. The lender can set up automatic ACH payments — whether daily, weekly or monthly — to be taken directly from your business’s bank account.

Balloon payment

A balloon payment is a large lump sum that you pay at the end of a loan term. Throughout the life of the loan, your regular payments may be all or almost all interest costs, with the balloon payment covering the principal.

You may find balloon payments in some short-term loans, as well as commercial real estate loans.

Blanket lien

A blanket lien gives the lender a right to seize all of a borrower’s business assets if they default on a loan. The lender can claim and sell any of these assets in order to recoup its losses.

Co-signer

A co-signer is an individual who agrees to take over payments if the business or first guarantor can’t. Getting a co-signer for your business loan may make your application more compelling to a lender — but it’s also a significant responsibility that you should think carefully about.

Curtailment

Curtailment essentially means paying more than your preplanned loan payment. If you perform a partial curtailment, you’re able to pay more toward your loan than you expected, but you don’t pay your loan off in full. A full curtailment, on the other hand, means you pay off your loan in full early.

Default

To default on a loan means you’ve failed to repay based on the loan agreement. When you default on a loan, the lender can take legal action against you to recover what it is owed.

Deferred payment loan

A deferred payment loan is when the borrower and the lender arrange an agreement that allows the borrower to begin payments at a specific time in the future rather than immediately.

Factor rate

A factor rate represents the cost of a business loan and is expressed as a decimal. Factor rates are often used to quote the price of merchant cash advances and short-term loans.

Factor rates are multiplied by your loan amount to calculate the total amount you’ll need to repay. For example, if your loan amount is $100,000 and your factor rate is 1.18, you’ll be repaying a total of $118,000.

You should always try to convert a factor rate into an APR to get a better sense of loan costs.

Interest-only payment loan

With an interest-only loan, you have scheduled payments that only cover interest costs (and not the principal) for a certain period of time. When this period ends, you may pay off the principal in full, refinance it with another loan or start to pay off the balance in monthly payments.

Loan-to-value ratio

The loan-to-value, or LTV, ratio denotes how much of the value of an asset a loan will cover. Calculating this ratio is particularly important for commercial real estate or equipment loans.

Say, for example, you have a storefront valued at $750,000 and a lender offers you a $600,000 loan to purchase the property. In this case, $600,000 / $750,000 = 0.8. You now know that only 80% of your purchase will be covered by this loan.

Loan underwriting

This refers to the process that a lender goes through to assess a borrower’s risk level. The underwriting process will determine if you qualify for a loan — as well as your prospective terms provided you do qualify.

Prepayment penalty

A prepayment penalty is the fee that some lenders charge if you repay your loan early. Lenders charge this penalty because when you repay early, they can’t collect as much interest from you as they expected. Prepayment penalties are intended to make up for these lost costs.

Principal

Principal refers to the amount of money you borrowed, not including interest or, in other words, your loan amount. If you borrowed $100,000 for your business, then your principal is $100,000.

Refinancing

When you refinance a business loan, you apply for a new loan to pay off your existing debt. Ideally, your new loan will have more desirable terms so that you can save money and improve your cash flow.

Servicing

Servicing refers to how a loan is managed. Payment disbursement, record maintaining, collections and following up on delinquencies all fall under loan servicing.

Tips for reviewing a business loan agreement

As you prepare to review your business loan agreement and sign on the dotted line, here are some tips to keep in mind:

Read the fine print and ask questions

At this stage of the application process, it might be tempting to skim over the loan agreement in order to access your funds as soon as possible. However, it's extremely important to read through your loan contract completely and make sure you understand every section and what it means for you, as the borrower.

You should review the fine print and take note of anything that seems unclear or incorrect, as well as write down any questions you may have. Then, you’ll want to reach out to your lender to ask for clarification and/or answers to your questions.

Your lender should be able to provide upfront, adequate responses. If you find that it is hesitant to do so, you might want to consider looking for a different lender.

Note that just because a lender has offered you a business loan agreement does not mean you’re required to sign it.

Look out for red flags

You’ll also want to keep an eye out for other red flags that might suggest an untrustworthy or predatory lender. Some of these may include lenders who:

Request money upfront.

Guarantee your approval.

Rush you through the application process.

Pressure you to pursue and sign the loan.

Offer terms that are “too good to be true.”

Work with a business attorney

An attorney can be an invaluable resource when reviewing a business loan agreement.

These professionals can help you understand all of the terms and conditions laid out in the contract and protect your rights as a borrower. If you need to negotiate any parts of the document with your lender, an experienced business attorney can assist with this process as well.

And if you’re concerned about the costs of an attorney, you can turn to an organization like SCORE or your local Small Business Development Center, which offers access to legal professionals at low or no costs.

A version of this article originally appeared on Fundera, a subsidiary of NerdWallet.

On a similar note...