How to Build Business Credit Fast: The 10 Best Ways

10 Ways to Build Business Credit Fast

- Register your business entity.

- Get an employer identification number (EIN)

- Open a business banking account.

- Establish a business address and phone number.

- Apply for a business DUNS number.

- Open trade lines with your suppliers.

- Get a business credit card or business line of credit.

- Borrow from lenders who report to business credit bureaus.

- Keep business information current with the bureaus.

- Pay all of your business’s bills and loans back on time.

If you’ve ever been on the market for a consumer loan, such as a home loan, you probably have a handle on your personal finances. You know where your personal credit score stands month-to-month and how personal credit impacts your ability to qualify for financial products. But as a business owner, you might not know anything about your company’s business credit rating—why this is important, what your rating is, or how to establish and build business credit.

If you’ll ever need credit for your business in the future—with a small business loan or business credit card, for example—then your business can’t just get by with a strong personal credit score. Your personal credit will definitely help, but you’ll also need to build a positive business credit history. This being said, however, before you can start building business credit, it’s important to understand the answers to the following questions:

- What is business credit?

- Why is business credit important?

- What are the benefits of business credit?

- How does business credit work?

In this guide, therefore, we’ll explain everything you need to know about business credit—including how it works, how you can check your current credit file (for free), and how to build credit fast for your company.

What Is Business Credit?

Before we dive into how to build business credit, let’s start with the basics: What is business credit?

Essentially, in the same way that you build personal credit based on your personal financial history, you establish business credit based on your business’s financial history—meaning how you handle any credit that’s been extended to your business, including credit cards, loans, lines of credit, trade lines from suppliers, and more. Whereas personal credit is tied to your social security number, however, business credit is tied to your employer identification number or EIN.

Ultimately, though, just as your personal credit illustrates your reliability as a borrower, your business credit conveys whether your business is a trustworthy borrower.

How Does Business Credit Work?

With this basic definition in mind, let’s explain business credit in more detail and answer the question, how does business credit work?

As we mentioned, one of the core differences between business credit and personal credit is that business credit is tied to your EIN. Therefore, as you go through various financial activities through your business—opening a bank account, getting a credit card, paying suppliers—this information becomes part of your credit history and is reported to credit bureaus that deal specifically with businesses.

The three main business credit reporting agencies are Dun & Bradstreet (D&B), Experian, and Equifax. Each company collects information from the vendors and creditors you do business with, as well as from legal filings and public records. Then, using a credit reporting algorithm, they establish your business credit in the form of a numerical value: your business credit score. Unlike a personal credit score, however, which is determined based on a standard evaluation method, your business credit score will vary based on the credit bureau as each agency has their own method for calculating your score.

This being said, however, your business credit score will typically range from 1 to 100 with a higher score indicating that your business is creditworthy, meaning you’re likely to pay a bill or loan back on time. Additionally, although each credit bureau has their own evaluation process, generally your business credit score will be influenced by factors such as:

- Credit: Length of credit history, credit utilization, credit mix, payment history, balances, and trends

- Demographic details: Business size, years in business, and industry risk

- Public records: Amounts and frequency associated with bankruptcies, judgments, and liens

As you’re trying to build business credit—especially when you’ve just started your company and are trying to build new credit—actions like paying on time, mixing the types of credit you use, and not maximizing your credit limit, will all benefit your business credit history and therefore, business credit score. On the other hand, actions such as missed payments, balances outstanding, and current judgments can all lower your credit score.

The 10 Best Ways to Build Business Credit Fast

At this point, you should have a clear idea of how business credit works. Early in the life of your company, you’ll want to focus your time and attention on building business credit.

Although it takes time to get business credit, by taking control over your business’s credit history, you’ll start to understand it more and see how, over time, different actions affect your credit rating.

Therefore, if you’re wondering how to build business credit—and fast—there are some tried-and true-methods you can use. All of the following 10 steps can impact your business credit history, and hopefully, for the better.

1. Register Your Business Entity

As we’ve explained, your business credit history is separate from your personal credit history. Therefore, the first step to start building business credit is to actually keep your business and personal finances and separate. In order to separate these finances, then, you’ll need to set up a registered business entity.

Unincorporated business entities—a general partnership or sole proprietorship—are the easiest to work with in terms of starting up and managing paperwork. But with these structures, there’s no legal or financial separation between the owner and the business. In this case, when you choose to work with a vendor or apply for a loan, you’ll have to provide your personal social security number. As a result, your activity on your business accounts will be reflected on your personal credit report.

If you want to establish business credit, then you’ll want to choose one of the following structures:

- C-corporation – A C-corporation gives you and your business legal and financial separation. Corporations are considered separate legal cities, and a C-corporation is ideal for a business that’s planning to issue stock or go public in the future.

- S-corporation – S-corps are pass-through entities in which business’s profits are only taxed at the individual level. S-corps are also considered separate legal entities.

- Limited liability company (LLC) – An LLC is another type of incorporated business entity with liability protection and financial separation between you and your business. An LLC is easier to manage than a corporation and offers more tax flexibility.

- Limited liability partnership (LLP) – An LLP is a registered business entity that’s popular among professional industries, such as lawyers and doctors.

Although it’s important to keep your ability to build business credit in mind while making your decision on how to structure your business, it’s not the only factor you should consider.

If you’re unsure exactly how to choose the right entity type for your business, you can consult a business attorney or accountant for help.

2. Get an Employer Identification Number (EIN)

The next step to establish and build business credit is to get an EIN. The IRS uses an employer identification number (EIN) to track businesses for tax purposes. Just like your social security number serves as your identification number for personal taxes, your EIN serves the same purpose for your business.

Generally, sole proprietorships, partnerships, and single-owner LLCs can just use the owner’s social security number for tax purposes (as long as they don’t have any employees). Most other types of businesses, though, need an EIN.

This being said, even if you’re not required to, it’s a good idea to get an EIN anyway. One of the biggest benefits of an EIN is that it can help you establish business credit. Plus, an EIN is free and easy to apply for on the IRS’s website.

When you eventually apply for a loan or a credit card for your business, you’ll usually be asked to either provide your Social Security number or EIN on the application. If you only have your social security number to offer, then you can rely only on your personal credit to help you qualify and get a good rate.

As we mentioned earlier, if you have an EIN, then your business credit will be tied to this number and you can use this history to qualify for credit products and business financing.

Source: IRS

3. Open a Business Bank Account

As we stated above, it’s essential for the purpose of building business credit, and in general, to separate your business and personal finances. In addition to choosing your business entity, opening a business bank account is a crucial step to drawing a line between business and personal expenses. By opening this account, business credit bureaus will easily be able to see what money you’re taking out of and putting into your business, and will report that information on your business credit report.

Therefore, once you have an EIN, you’ll want to explore your options and open the business checking account that’s best for your company. After you open your account, of course, it’s important to actually use it. You should only use this bank account to pay for business expenses—everything from utilities and rent to your business cell phone. These purchases, as long as you pay them in full and on time, every time, can also contribute to building business credit.

All in all, opening a business bank account will not only provide a bank reference for the three credit reporting agencies,

but it will also open doors for better credit accounts in the future—the best small business lenders look for borrowers with business bank accounts that have been established for at least a couple years.

4. Establish a Dedicated Business Address and Phone Number

Although this next tip might seem like a simple step, getting a dedicated business address and phone number will solidify your business’s separate existence. Having this is a small, but important step towards building business credit because it will allow you to register with business directories.

To explain, directories like the Better Business Bureau, YP.com, and Angie’s List require businesses to have an address and phone number to sign up. Business credit reporting agencies collect information from these directories, so it’s important to have correct and consistent contact information listed on all of the popular directories.

Additionally, when you set up a dedicated phone line for your business, you’re establishing your first, simple trade credit relationship with the phone company. This history gets reported to credit agencies and will help you establish business credit.

5. Apply for a Business DUNS Number

Of the three business credit bureaus we mentioned above, Dun & Bradstreet is probably the most well-known. In fact, their Paydex score is the business credit score commonly used by suppliers and creditors. Therefore, if you want to build business credit, it’s a good idea to open a credit file with this agency.

To do that, you’ll need to register for a DUNS—a Data Universal Number System. The DUNS system is a numerical identification process for business entities. When you apply for one, you’ll receive a unique nine-digit code. The process is completely free and can be completed on the Dun & Bradstreet website, but it takes up to 30 days to receive your DUNS number.

Having a DUNS isn’t a requirement for businesses, unless you’re applying for a federal government contract, grant, or SBA loan, and it’s not a system that’s managed by the government. Nevertheless, everyone from national to international suppliers and lenders uses D&B business credit scores, so if you’re trying to build new business credit for your startup, applying for a DUNS is a good idea.

6. Establish Trade Lines With Your Suppliers

If you’ve followed steps one through five, then you have already laid a solid foundation upon which to establish business credit. To keep building business credit, then, there are some additional best practices you can follow.

One best practice is to maintain and establish good relationships with vendors and suppliers. Just as with your personal credit, you’ll build business credit as you bring on a variety of different suppliers, vendors, and lenders—given that you maintain a good relationship with them.

As you buy more supplies, inventory, or other materials from third-party vendors, those purchases can become relationships—and will, therefore, help you build business credit. As we mentioned above, it will be particularly beneficial if your suppliers and vendors extend trade credit, which, to reiterate, means they allow you to pay several days or weeks after you receive the items you ordered (e.g., NET 30).

Although this credit isn’t coming from a traditional lender, it is similar to a loan. Paying your vendor or supplier on time and in full (maybe even early), then, will help you get good business credit—just like paying consumer credit cards on time helps you build your personal credit.

As an example, Lucas Horton, a gemologist and owner of Valeria Fine Jewelry, said trade lines helped his business credit:

“I opened four memo accounts with diamond sellers who reported to business credit bureaus. According to Experian, my business now has a B-rating (up from a D) due to lack to information. I am not large enough to engage in things that would build my credit [even further] like taking out a loan, so that is probably as high as I will ever get. However, for my needs, it is high enough to get me the credit I require.

A memo account is when they send you diamonds and you have a certain amount of time to pay for it rather than paying for it upfront. Most of the larger companies I have accounts with at least report to Dun & Bradstreet or Experian.”

This being said, the key is to choose suppliers, like Horton did, who will report your payments to business credit bureaus. Not all vendors do this, and if your supplier doesn’t report to the business credit agencies, then your on-time (or early) payments won’t actually help you build business credit. It’s worth noting, therefore, that the popular suppliers Uline, Quill, and Grainger all report to business credit bureaus.[1]

As long as you pay on time and in full with these suppliers, you’ll be able to boost your business credit score.

7. Get a Business Credit Card or Line of Credit

Many startups and small businesses use loans and credit lines to finance the operation and growth of their business.

Not only is this type of credit crucial for keeping a business running smoothly, but using it will also help with establishing and building business credit.

As a first step, you might consider applying for a business credit card to cover day-to-day purchases for your business. Using a business credit card will also help solidify the separation between your personal and business finances, further building business credit.

For example, Nate Masterson, CEO of beauty company Maple Holistics, said he relied on business credit cards to improve his company’s business credit standing:

“We decided to use business credit cards because… they play an essential role in building your company credit profile. This is particularly useful for small businesses who rely on loans and grants. Furthermore, because there are several major card issuers which report your business activity to your personal credit report, this can be a great way to boost your personal credit, if you are responsible.

Pay your bills early, or at the very least on time. This is the number one, most important rule that will get your business a perfect credit score with business credit bureau. We made sure to only use our business card on purchases we were confident we could pay off in full by the end of each month.”

Additionally, a business line of credit works in much the same way as a credit card, minus the physical card. Instead, the funds live in your business bank account and you can withdraw money on an as-needed basis. You then pay back what you borrow to reset your balance.

Ultimately, the act of borrowing and repaying funds on a business credit card or line of credit will help build business credit—given that you’re paying on time (or early, if possible) and in full.

If you’re just starting out or have poor personal credit and are having a hard time qualifying for regular business credit cards, you can try to apply for and use secured business credit cards. A secured business credit card is “secured” by a funds deposit that you make against your card.

Moreover, if you require equipment but don’t have access to the necessary cash or qualify for a loan, you might consider the benefits of leasing. Not only does this allow you to obtain the equipment you need to grow your business, but it also helps to establish business credit.

8. Borrow From Lenders That Report to the Business Credit Bureaus

If you’re repaying your credit cards and loans on time and in full, you can be proud of your stellar payment history. However, you’ll want to be sure that you’re actually getting recognized for this good behavior and building business credit from your success.

Therefore, you’ll want to make sure that you try to work with lenders who report to the credit bureaus. Ideally, lenders should report to one or more of the three major business credit bureaus—D&B, Experian, or Equifax. Luckily, this is less of a concern with other financial entities as most banks and traditional financing institutions will routinely report borrowers’ repayment histories to business credit reporting bureaus. Some online lenders, however, don’t file reports to business credit bureaus.

To ensure that you build business credit from a loan, then, you’ll want to check into a lender’s policy before you apply.

9. Keep Business Information Current With the Bureaus

Each business credit bureau collects different information and has different scoring models. On top of this, different suppliers and different lenders report different kinds of data. This being said, because a lender or supplier could pull your business credit report from any or all of the three main bureaus, it’s important that you keep an eye on each of your reports—maintaining all three of them.

These bureaus allow you to update basic information about your business (like the number of employees or years in business) and upload financial documents. The more complete your profile is at each of the business credit reporting bureaus, the better.

Additionally, and as we mentioned above, it’s important to review your credit reports from each of the different bureaus, not only to see your current status, but also to ensure that there aren’t any errors affecting your business credit score. Even the smallest error can impact your business credit in a huge way.

If you’re not using a continuous credit reporting service or monitoring tool, a good rule of thumb is to check your business credit report every six months. In doing so, if you find an error, you’ll want to verify that the information is truly inaccurate, contact the appropriate bureau(s) to explain what is incorrect, and request that the necessary change be made.

10. Borrow Responsibly

When you’re thinking about how to build business credit, your mantra should be exactly the same as it is with building personal credit: borrow responsibly. With steady, responsible borrowing habits—drawing from a mix of business credit accounts, and paying those accounts on time and in full—you’ll see your business credit score improve.

Additionally, another factor you’ll want to keep in mind with regard to your credit is your credit utilization ratio. Your credit utilization ratio is determined based on how much credit you have compared to how much you’re using. For example, you may have a $10,000 balance on $20,000 available credit—in this case, your credit utilization ratio is 50 percent.

Your credit utilization ratio is often a major contributor to your business credit score. If you have a high credit utilization ratio, you are seen as a greater risk—therefore, you should attempt to keep your credit utilization ratio as low as possible to effectively build your credit. Generally, you should aim for 30% or below. Therefore, in our example above, the 50% credit utilization ratio is less than ideal.

Along the same lines, another method you can use within your borrowing to improve your credit utilization ratio, and thus build credit, is to increase your credit limit and not actually use it. In the case of a credit card or line of credit, once you’ve proved to the lender that you’re creditworthy (usually after six to 12 months) you can request a limit increase, which will decrease your credit utilization ratio. For example, if you had a balance of $10,000, but your available credit had increased from $20,000 to $30,000, your credit utilization ratio would decrease from 50% to 30%, bringing you within the ideal ratio and improving your business credit score.

On the other hand, although all of these tips will help you build business credit when things are going well, you also don’t want to overextend what you’re capable of. For example, as with a personal credit rating, your business credit rating will suffer if you apply for too many credit accounts over a short period of time. You’ll want to make sure to space out your business credit card or business loan applications.

In addition, your business credit can also suffer if you have too much debt, so you don’t want to take on more than you can handle. After all, you never want to make a late payment as this is a huge factor in calculating your business credit score. Therefore, if you’re struggling with cash flow or having trouble paying your bills as a result of too much debt, you’ll want to consider options like refinancing or debt consolidation to make payments more manageable.

Why Building Business Credit Is Important

So, now that we’ve explained a little bit more about how to build business credit and how it works, let’s discuss why business credit is so important. After all, if you run a very small business, you might be wondering if it’s worth investing in business credit at all—can’t you get by based on your personal credit?

Although you technically could get by with just your personal credit, it’s really not the best practice for small business owners. Plus, as we’ll discuss below, there are certain benefits of business credit, especially good business credit. Let’s break down the main reasons why building business credit is important:

1. Getting Small Business Financing

One of the main reasons why it’s so important to build business credit is because your business credit score is a key factor in a lender’s decision to work with you. Lenders are likely to extend a loan or line of credit to your company only if they see that your business has a good track record of paying your accounts on time and in full. Additionally, if you want to work with the best lenders, it’s even more significant to have established good credit.

Moreover, when you apply for financing, not only will a lender use your business credit history to determine whether or not to work with you, but they’ll also use it to determine how much money you qualify for—in fact, according to the SBA, “businesses have 10 to 100 times greater credit capacity compared to personal credit.”[2] Plus, your business credit score will also factor into what kind of interest rates you receive on your financing. For example, if you’re applying to the SBA’s 7(a) loan program (and SBA loans arguably offer the best interest rates on the market), the SBA will look at one of your business credit scores—your FICO SBSS score—to prequalify you for the loan. If your score is 140 or below, you won’t pass their prescreen process.

Therefore, building business credit is crucial for you to be able to get business financing—and the best possible financing. Even if you’re not looking for financing in the immediate future, it’s nevertheless important to establish business credit. If you neglect your credit, a low score can limit your lending options if you ever do need funding.

2. Supporting Relationships With Suppliers and Vendors

It’s very likely that you’ll need to work with various suppliers and vendors to run your business. Generally, suppliers will offer trade credit, the ability to buy now and pay later, to businesses when they’re purchasing inventory, material, equipment, etc. However, in the same way that lenders prefer to work with businesses who have good credit, suppliers are more likely to offer you trade credit if you have a track record of paying bills on time.

One of the benefits of business credit, therefore, is the ability to receive trade credit and get agreeable repayment terms. This being said, not only can trade credit help your business with cash flow, but it can actually help you build and maintain business credit as well. If the companies you work with report trade information to the major credit bureaus, regularly paying them on-time or early will help improve your score.

3. Protecting Your Personal Credit

Finally, knowing how to build business credit, and of course, actually taking the steps to do so, is important because it will help you protect your personal credit. If you have poor business credit, you’ll likely need to use your personal credit to secure financing. Although this might be a necessary means to an end during the early stages of your business, it’s never the ideal approach.

After all, one of the first things any business owner should do is separate their business and personal finances and therefore, credit. Maxing out your personal credit cards to fund your business can irreparably damage your personal credit scores—meaning if your business fails, you’re left with poor personal credit, making recovery difficult.

Ultimately, building business credit—and when you’re just starting your business, building new credit—is essential for the progression, growth, and stability of your company. Plus, although the thought of selling your company may be the furthest thing from your mind, your credit history will influence this process too. The credit score of your business is fully transferable and therefore, if you sell the company, the new owner(s) will benefit from the work you put in.

What’s in Your Business Credit File?

Many business owners are surprised to know that they may already have a business credit report in their company’s name. Some credit bureaus, including Experian and Equifax, pull public record information, such as collection data and court records, to create your file and generate your score. So, even if you haven’t actively created an account with a credit agency, they might already have enough information about you to compile a credit report.

To view your business credit file, therefore, you can apply online to receive a report from any of the three major reporting bureaus. This being said, however, each of these agencies will charge you a fee to access your report. Luckily, there are several places online that you can use to check your business’s credit history for free. At Fundera, we offer credit monitoring, which includes a free summary of your business and personal credit scores and will alert you to changes in your credit reports.

Additionally, there are other services, like Nav or CreditSignal, which also will give you options to view your credit file for free. Ultimately, it’s important to see what your business credit looks like before taking any action so that you know where you stand and what the best next steps will be to build or improve your credit rating. In the same vein, by checking your credit file, you can see if there are any mistakes in your existing credit history. Just like errors on a personal credit report, mistakes in a credit report can bring down your score. Therefore, if you find any errors, you’ll want to follow the process for each individual bureau to dispute the error and ensure a correction is made.

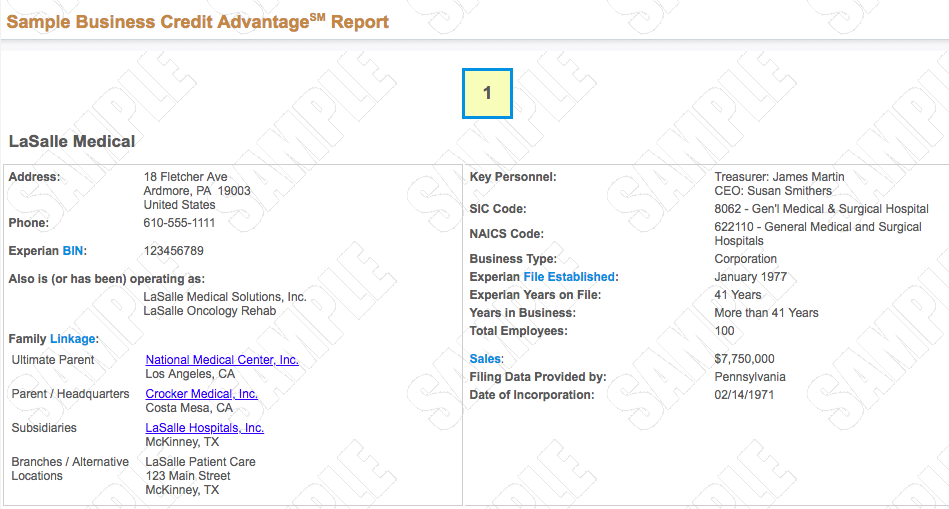

Business credit report example. Source: Experian

Top Tips to Remember

If you’ve followed the 10 steps we discussed previously, you’ve learned how to build business credit—and hopefully, have succeeded in actually doing so. At this point, you’re in the right place to manage your finances, grow your business, and, of course, keep your eye on your credit along the way. With this in mind, here are a few tips to remember with regard to building credit as you continue in the lifecycle of your company:

- Don’t rely on your personal credit. Using your personal credit for your business longer than absolutely necessary can damage your personal credit score and make it more difficult for you to qualify for any financing in the future.

- Always pay your bills on time. Any late payment, even by one day, can damage your credit. Set up a system to ensure that you pay your bills on time. If possible, pay them early.

- Check your score regularly. You’ll want to know where your credit stands and checking your score regularly can help you see how certain actions affect your credit history.

- Review your credit reports for errors, both informational and financial. A Wall Street Journal survey showed that 25% of small business owners who looked found credit-damaging errors on their reports.[3] Make sure to check your reports for errors and go through the process with the respective credit bureau to correct them.

The Bottom Line

As an individual consumer, your personal credit comes into play frequently. For example, your personal credit is a major factor when applying for a car loan, mortgage, or credit card. A good credit score will work in your favor, increasing your chance of immediate approval. Conversely, a low score could hold you back from being approved.

You should consider your business credit to be every bit as important. Although building business credit may not have an impact on your personal life, it can certainly make or break your company.

This being said, by reviewing our 10 credit-building methods, as well as learning the basics of what business credit is, how it works, and why it’s important, you’ll find it easier to make informed and confident decisions.

Although it takes time to establish and build credit, it’s worth the effort. When you have a strong credit history, it will work in your favor time and time again.

Article Sources:

- Nav.com. “5 Vendors That Will Help You Build Business Credit“

- SBA.gov. “Starting“

- WSJ.com. “Credit Reports: What Small Businesses Don’t Know Can Hurt Them“

Georgia McIntyre

Georgia McIntyre is the director of content marketing at Fundera.

Georgia has written extensively about small business finance, specializing in business lending, credit cards, and accounting solutions.