Best Restaurant Accounting Software

- Restaurant365: Best all-in-one accounting solution.

- QuickBooks Online: Best integrated solution.

- FreshBooks: Best budget option.

- TouchBistro: Best point of sale system with accounting functions.

- ZipBooks: Best free option.

Running a restaurant is hard work. There are the long days and nights, staffing issues, and tons of requirements to make sure you’re in compliance with all applicable state and local laws and health codes.

However, starting a restaurant can also yield huge rewards. There’s nothing better than having customers leave you rave reviews, celebrating milestones like birthdays and anniversaries with long-time patrons, and watching all your hard work translate into profits in your bank account.

Behind every well-run restaurant is good restaurant accounting software. This is a key component in making sure that you’re properly tracking your restaurant’s costs, revenues, profits, and financial potential. The restaurant industry has some specific business needs, and choosing the right software will let you spend less time on recordkeeping and more time on what you love—running your business.

Best Restaurant Accounting Software

Now that we’ve looked at the specific requirements your industry faces, let’s look at the best accounting software for your restaurant. Whether you want an all-in-one solution, something you can use to easily outsource your bookkeeping, or free accounting software for your restaurant business, there is something on this list for every restaurateur.

Here is the best restaurant accounting software:

Restaurant365: Best All-in-One Accounting Solution

If you’re looking for cloud-based, all-in-one restaurant accounting software, you can’t go wrong with Restaurant365 (R365). This software handles your inventory, catering, accounting, budgeting, forecasting, and scheduling, all within one cloud-based platform. This means you don’t have to switch back and forth between multiple software programs to get the information you need to make effective business decisions. You can even use R365 to budget and track data on different franchise locations or branches of your restaurant.

Because this software specific to the restaurant industry, R365’s reports feature already includes many of the reports that matter most to you. You won’t have to spend hours customizing reports designed to work with any industry. With an attractive dashboard and auto-scheduled reports, you can make sure anyone on your team has the information they need right at their fingertips. Since R365 is specifically designed for restaurants, it can pull even more granular data than QuickBooks or other general industry software.

Restaurant365 is an all-in-one solution for your accounting needs, but you’ll need to hook up your point of sale and payroll systems with it. Fortunately, R365 integrates with dozens of POS systems and payroll services. Even more exciting, many of your major food vendors integrate with R365, meaning you can automatically update food costs and import your invoices, saving hours of data-entry time.

If you don’t want to do your own accounting or hire an in-house bookkeeper to do it for you, R365 can connect you with an accountant who specializes in restaurant accounting and supports your software. This partnership program with accountants who specialize in the restaurant industry makes R365 more powerful than competitors in the all-in-one solution space. Since R365 is cloud-based, you don’t have to worry about trading files or being locked out of your software while your accountant is working, either.

Restaurant365 Pricing

With prices starting at $159/month per location, R365 is not the least expensive option available. For inventory management and scheduling functionality, you’ll have to upgrade to a costlier plan or pay a per location fee. Although R365 is costly, what you gain in terms of business insight could make the investment well worth the price.

The restaurant business is tough. Having a specialized, all-in-one accounting software geared toward your specific needs and working with an accountant who understands your industry can be the difference between profitability and barely scraping by. This makes R365 a very attractive option for your restaurant business.

QuickBooks Online: Best Integrated Solution

If you’re already working with an accountant or bookkeeper and don’t want to switch to a different provider, then an all-in-one, specialty accounting software like Restaurant365 might not be the best solution for you. Most accountants and bookkeepers don’t want to work with more than a couple of software solutions, and you will benefit most from using a provider that knows your software well.

If this is your situation, your best bet for an accounting software for your restaurant is QuickBooks Online. Not only is QuickBooks Online (QBO) supported by hundreds of accountants and bookkeepers—meaning there is a very good possibility your accountant or bookkeeper supports it—but there is also tons of training available if you decide you want to do your own bookkeeping or hire an in-house bookkeeper.

Although QuickBooks Online won’t be able to handle your entire back-end operations like R365 can, QuickBooks does integrate with dozens of restaurant-specific tools and POS apps that specialize in restaurant operations. This gives restaurateurs flexibility to design the perfect technology stack for their needs. And, as with an all-in-one solution, you won’t have to switch back and forth between multiple programs to get the information you need to run your restaurant.

Much like R365, QBO boasts a dashboard and auto-scheduled reports, meaning you can access the information you need in seconds. And, since QBO is cloud-based, everyone on your management or financial team can access your software simultaneously. Resources abound on using QBO for every industry, and so you can easily find guidance online to create the exact reports you need to run your restaurant business profitably. QBO also offers built-in time tracking and payroll solutions, so you track staff time and spot inefficiencies.

QuickBooks Online Pricing

QBO for small business pricing starts at $25/month, though you might need to go with the middle-tier $50/month option to get all the features you want your restaurant accounting software to have. Only the more expensive plans come with time tracking and bill pay. Although this is considerably less than R365’s monthly investment, don’t forget to factor in the costs for all your integrated software subscriptions before making a decision based on price.

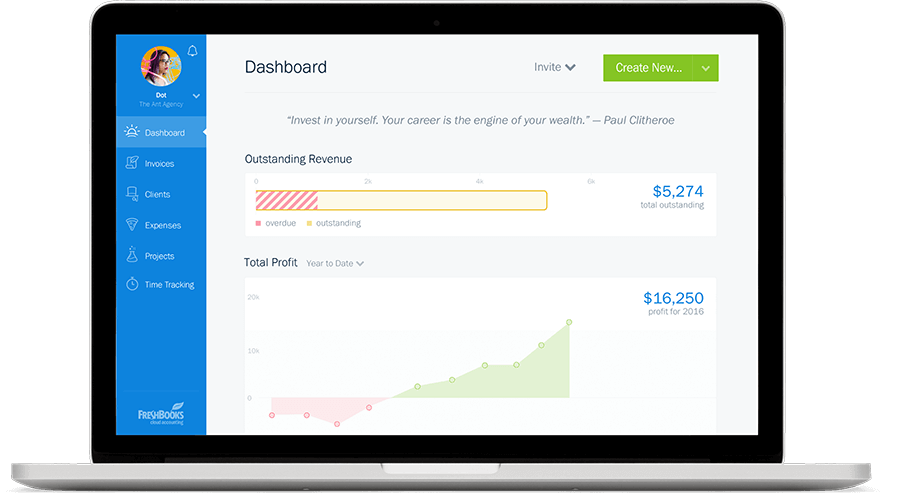

FreshBooks: Best Budget Option

FreshBooks is another accounting software that, like QuickBooks Online, is designed to work with all industries. However, the functionality that you get for the cost makes it an especially great choice for restaurant owners who want to run a lean operation. Although not as comprehensive as R365, FreshBooks is loaded with helpful features that can help you run your restaurant more efficiently.

It’s easy to categorize and track expenses and revenue on FreshBooks, and you can store receipts in the app simply by taking a picture. Since FreshBooks categorizes the expenses, it is easy to see your restaurant’s smallest and largest areas of spending. If you connect your bank account or credit card to FreshBooks, your account will always have an up-to-date picture of your expenses in real-time.

Financial analysis and tax filing is easy with FreshBooks because the software has already categorized your expenses and revenues. Using the stored financials, you can create a balance sheet, income statement, and profit and loss statement, and run dozens of reports. You can view various revenue streams to see which menu items are most popular with your clientele.

When FreshBooks launched in 2004, their initial goal was to help businesses manage their invoices more easily. Even today, that remains a core part of their cloud-based software. You can create and send custom invoices by email, a helpful feature if you provide wholesale ingredients to other restaurants.

You don’t get shift scheduling with FreshBooks, as you do with R365, but you can track your staff’s hours worked and see how they’re spending their time.

FreshBooks Pricing

FreshBooks pricing starts at $15/month for up to five billable clients. This is less expensive than QuickBooks and significantly less expensive than R365. FreshBook’s entry-level plan should work for most restaurants since most restaurants are on the buying end, purchasing raw goods from suppliers. You can get a 10% discount off this price if you pay annually. Plus, for a limited time, FreshBooks is offering 60% off for 6 months on Lite, Plus, and Premium plans when new users skip the 30-day free trial period and opt to buy now.

ZipBooks: Best Free Solution

We usually discourage business owners from using free accounting and bookkeeping software. Typically, the support and functionality you get from a paid solution makes the relatively minimal investment in the software worthwhile. Although this also holds true with accounting software for restaurants, the high startup costs associated with restaurants might make investing in a bookkeeping or accounting solution right from the beginning unfeasible.[1]

ZipBooks can help you bridge the gap between no accounting software at all and a subscription-based cloud accounting solution. You can start with the free version of ZipBooks and then upgrade to a paid version for as little as $15/month as your restaurant grows. And, if you don’t want to do your own bookkeeping, you can hire ZipBooks to do it all for you.

The benefit you lose with a free or low-cost solution like ZipBooks is the ease of integration. If you’re doing your own bookkeeping, you will have to either do some data entry or switch between multiple programs to get the reporting you need. If you hire a ZipBooks professional to do your bookkeeping, the monthly cost will increase based on the complexity of your business.

If funds are tight and restaurant bookkeeping software isn’t in your budget, using ZipBooks can help you keep your records in order.

ZipBooks Pricing

The entry-level ZipBooks plan provides free accounting software for restaurants, but is limited in terms of functionality. If you want to sync up more than one business bank account, allow multiple users, track employee schedules, or run reports, you’ll need to upgrade to the $15/month plan. That’s similarly priced to QuickBooks Online.

TouchBistro: Best Point of Sale System With Accounting Functions

For some restaurateurs, a point-of-sale solution could provide the ideal restaurant accounting solution. Particularly if you operate a restaurant with multiple locations, a high-volume restaurant, or a restaurant with a separate cafe or bar, a full-featured POS system could be the best option for you. TouchBistro is an iPad POS solution for fast food chains, fine dining restaurants, cafes, food trucks, breweries, and bars. It also handles basic accounting functions.

As a POS terminal, TouchBistro is your central cash register. As a result, TouchBistro keeps tabs on all of your incoming and outgoing cash flow. This allows you to run over 50 accounting reports and end-of-day summaries. You can examine specific details, such as which menu items have the highest profit margin, or do bigger picture stuff, like making financial statements.

Built-in to TouchBistro is a customer relationship manager, inventory management, menu management, and staff scheduling. Send orders to the kitchen with just a few clicks, track inventory, and automatically place orders when you’re running low on ingredients or supplies. The all-in-one solution of TouchBistro is similar to R365, but with an added bonus—you also get the hardware needed to process all of your restaurant’s transactions.

If you’d rather use TouchBistro only as your POS, the good news is that it integrates with QuickBooks Online, FreshBooks, Xero, and other popular accounting software.

TouchBistro Pricing

The pricing for TouchBistro begins at $69/month for one POS terminal. If you have multiple registers, you’ll need to upgrade to the $129/month (two registers) plan or $249/month plan (up to five registers). If you need the hardware, that is sold separately. Each of the plans comes with full reporting and analytics.

Features to Look for in Restaurant Accounting Software

Because of the nature of the restaurant business, restaurateurs have several unique challenges they must consider when choosing the best bookkeeping software for their needs.

You’ll want to make sure that the restaurant bookkeeping software you choose can tackle all of these:

- Inventory management – Careful inventory management ensures your profits aren’t lost to waste and spoilage. A good inventory management software for your restaurant will include reporting that can help you determine what you need to order, as well as when you should order it. Not only will this reduce loss due to spoilage, but it’ll also help you make sure you don’t run out of the ingredients for your most popular menu item on the busiest day of the week.

- Payroll and tip tracking requirements – Managing payroll can be cumbersome for restaurants. Restaurants typically have larger staffs than other small businesses, meaning there are more time records to reconcile before processing payroll. The restaurant industry also has unique requirements for tracking and reporting tips. Accurately tracking and accounting for tips received by your staff can significantly increase your profitability.

- Scheduling needs – Although you might not think of your scheduling system as something to consider when deciding on bookkeeping software for your restaurant, proper scheduling does have a tremendous impact on your profitability. Making sure you can easily pull reports that show how your scheduling impacts your revenue is a must in your restaurant accounting software.

- Point of sale software – The right point of sale software will reassure you patrons are being charged properly, taxes are being collected appropriately, and tips are reported as they should be. The best accounting software for your restaurant will either integrate with your existing POS software, or offer a built-in POS solution (like TouchBistro).

When choosing the best accounting software for your restaurant, keep in mind the systems you already use for point of sale, inventory management, payroll and tip tracking, and scheduling. If you’re just getting started, make sure all your chosen systems will integrate seamlessly with each other before making your final purchases.

Finding the Best Restaurant Accounting Software

As is the case for all businesses, the best restaurant accounting software is the one you’re most comfortable using to help you make sound business decisions.

Whether you go with an all-in-one solution like Restaurant365, an integrated solution like QBO, a free solution like ZipBooks, or another restaurant bookkeeping software, take the time to set up the software correctly and understand how it works. Hire an accounting professional to help you understand your financial reports and what they mean for your industry. And—when you can no longer manage the day-to-day bookkeeping yourself—hire a bookkeeper who knows how to use your software.

Here’s to turning your hard work into huge profits!

Billie Anne Grigg

Billie Anne Grigg is a contributing writer for Fundera.

Billie Anne has been a bookkeeper since before the turn of the century. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Beancounter, and a Mastery Level Certified Profit First Professional. She is also a guide for the Profit First Professionals organization.

Billie Anne started Pocket Protector Bookkeeping in 2012 to provide an excellent virtual bookkeeping and managerial accounting solution for small businesses that cannot yet justify employing a full-time, in-house bookkeeping staff.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.