FreshBooks vs. QuickBooks

- FreshBooks: With three plan options and a focus on time tracking and invoicing, FreshBooks is an accounting solution best suited for self-employed professionals like independent contractors and freelancers.

- QuickBooks Online: One of the most popular small business accounting platforms, QuickBooks Online is well-suited for a variety of business owners, especially those who need more advanced accounting tools for reconciliation, taxes, reporting, and inventory management.

If you’re searching for the right business accounting software, there’s no doubt that you’ve come across both FreshBooks and QuickBooks. As two web-based accounting solutions designed particularly for small business owners, FreshBooks and QuickBooks each offer robust feature sets, a variety of plans to choose from, and overall, user-friendly and effective platforms. With these overarching similarities in mind, however, you might be wondering: What’s the difference between FreshBooks vs. QuickBooks—and which option is best for my business?

We’re here to help. In this FreshBooks vs. QuickBooks Online comparison, we’ll break down both of these accounting software systems—discussing features, pricing, and more—so that you’ll have all of the information you need to determine which solution is right for you.

FreshBooks vs. QuickBooks: The Basics

Before we dive into the details comparing FreshBooks vs. QuickBooks, let’s begin with a basic overview of these two accounting solutions. On the whole, both FreshBooks and QuickBooks Online are web-based accounting solutions, meaning you can use either platform anywhere you have access to the internet. Additionally, FreshBooks and QuickBooks each offer multiple plan options, priced on a monthly subscription basis, with the included features increasing as the plan levels increase.

Moreover, both FreshBooks and QuickBooks have a mobile accounting app available for iOS and Android devices so that you can manage your finances on the go, as well as provide you with the opportunity to integrate with a number of third-party solutions to expand the functionality of your platform.

As we mentioned briefly above, on the surface, FreshBooks and QuickBooks look relatively similar. However, when you start exploring these two accounting software systems more thoroughly, you’ll see that they do, in fact, have a number of significant differences.

FreshBooks vs. QuickBooks: Features and Pricing

Keeping this overview in mind, let’s break down the differences between FreshBooks vs. QuickBooks—starting with the features and plan options that FreshBooks has to offer.

FreshBooks Features

As a web-based accounting software with three core plan options, FreshBooks is designed to serve the needs of small business owners. In particular, FreshBooks caters to service-based businesses, self-employed professionals, and overall, small business owners who are looking for substantial invoicing capabilities within their accounting solution. FreshBooks prices their software on a monthly basis, with each plan offering more features and fewer limitations. Overall, FreshBooks differentiates their plans not only based on features but also, most notably, on the number of billable clients you can accommodate.

Regardless of which plan you choose, though, you can expect FreshBooks software to include:

- Invoicing software to customize, create, and send invoices to clients

- Connection to your business bank account with automated import

- Expense entry and tracking with tax categories and multi-currency capabilities

- Ability to create and send customizable estimates, allow clients to accept estimates online, and easily convert them into invoices

- Time tracking based on client or project; bill clients based on your tracked hours

- Project management with budgets, due dates, and file sharing

- Accept credit cards and other payments using FreshBooks Payments or Stripe; accept ACH transfers; automatically record both payments and expenses

- Bank reconciliation capabilities and essential accounting reports like general ledger, profit and loss statement, chart of accounts, balance sheet, and more

- Ability to add client information with internal notes and manage client communication with relationship feed

- Customizable workflows and over 200 third-party integration options

- Access for your business accountant

- Secure data storage with SSL encryption

- Mobile app for iOS and Android devices

- Customer service from FreshBooks team via phone and email

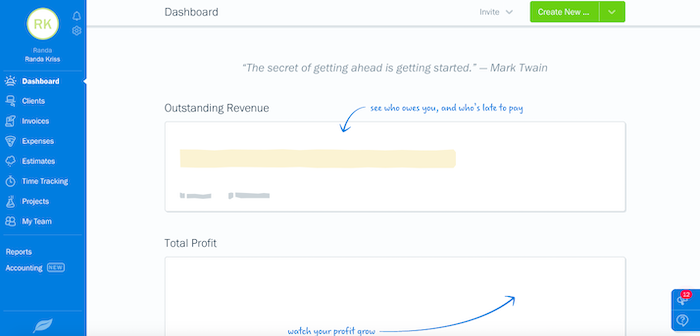

Example of a FreshBooks dashboard. Photo credit: FreshBooks

FreshBooks Pricing

As you can see, FreshBooks offers an impressive feature set—giving business owners the ability to complete their essential bookkeeping and accounting tasks, as well as manage time, clients, and projects. With all of this in mind, let’s continue our FreshBooks vs. QuickBooks comparison by discussing the pricing of the three FreshBooks plans.

Like we mentioned earlier, it’s important to remember that FreshBooks differentiates their plans not only based on the features that are included, but also on the number of clients you can accommodate within your account. Additionally, FreshBooks requires that you pay an additional fee per user account—regardless of which of their three plans you choose—whereas QuickBooks Online offers a certain number of users based on the plan level. For a limited time, FreshBooks is offering 60% off for six months on Lite, Plus, and Premium plans when new users skip the 30-day free trial period and opt to buy now.

FreshBooks Lite Plan

The first plan FreshBooks offers is the Lite plan. This plan costs $15 per month if you purchase the software on a month-to-month basis and $13.50 per month if you purchase an annual plan. With the Lite plan, you’ll only be able to manage five billable clients in your account. However, you’ll also receive the following capabilities:

- Unlimited customized invoices

- Unlimited expense entries

- Accept credit card and ACH payments online

- Automated bank import

- Unlimited time tracking

- Unlimited estimates

- Tax time reports

- Custom functionality and workflows with over 200 integrations

If you want to add team members to your FreshBooks account—no matter which of the three plans you choose—you’ll need to pay an additional $10 per month, per team member.

FreshBooks Plus Plan

The next FreshBooks plan, the Plus plan, can accommodate 50 billable clients. This plan will cost $25 per month for a monthly plan and $22.50 per month for an annual plan. With FreshBooks Plus, you’ll have access to all of the Lite features as well as:

- Unlimited proposals

- Automated recurring invoices

- Double-entry accounting reports

- Scheduled late fees

- Automated late payment reminders

- Client retainers

Once again, if you want to add team members, you’ll have to pay $10 per month per team member. Moreover, the Plus plan gives you the option to utilize an advanced version of FreshBooks payments for an additional $20 per month.

FreshBooks Premium Plan

Finally, the FreshBooks Premium plan offers the greatest amount of functionality at the highest cost. The Premium plan costs $50 per month for a monthly plan or $45 per month for the annual plan. With the Premium plan, however, you’ll be able to accommodate 500 billable clients, as well as access all of the features of the previous two plans.

Furthermore, like the Plus plan, FreshBooks Premium gives you the option to use FreshBooks Payments Advanced for an additional $20 per month. Once again, it will cost $10 per month per team member for you to add users to your FreshBooks Premium account.

This being said, although these are the main FreshBooks plan options, it’s worth noting that FreshBooks also offers a Select plan, which accommodates over 500 clients and is available on a quote-basis by working directly with the FreshBooks sales team.

QuickBooks Online Features

Now that we’ve explored FreshBooks in terms of features and pricing, let’s break down QuickBooks Online. Perhaps one of the most crucial differences between FreshBooks vs. QuickBooks Online is that whereas FreshBooks caters specifically toward service-based businesses and self-employed professionals, QuickBooks Online is designed for a greater variety of small business owners, especially those with product-based operations.

This being said, QuickBooks Online offers four core plan options, compared to FreshBooks’ three options. On the whole, however, you can expect QuickBooks to include the following capabilities, regardless of which of the plans you choose:

- Income and expense tracking

- Ability to capture and organize receipts

- Tax categories for organizing income and expenses

- Customizable invoicing and estimates; convert estimates into invoices

- Ability to accept payments online, including credit cards and bank transfers using QuickBooks Payments or a third-party processor

- Mileage tracking

- Business bank account and credit card connection and automatic transaction import

- Basic accounting reports including profit and loss statements, balance sheets, and expenses

- Sales tax tracking

- 1099 contractor management

- Data backup and security

- Account access for two accountants

- Access to QuickBooks app for iOS and Android

- Integration options for other QuickBooks products and third-party tools

- Customer service via phone

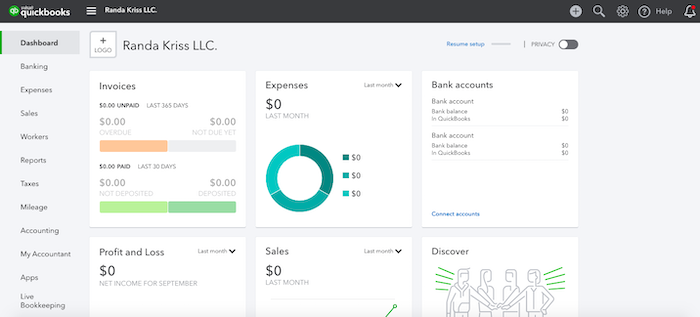

Sample of a QuickBooks Online Dashboard. Photo credit: QuickBooks

QuickBooks Online Pricing

As you may have noticed, FreshBooks and QuickBooks Online have many of the same general features. However, another important difference to note between FreshBooks vs. QuickBooks is that when it comes to pricing—QuickBooks differentiates their plans based on functionality and users, whereas FreshBooks, as we discussed, also breaks down their plans based on the number of billable clients. With QuickBooks Online, you’ll be able to add an unlimited number of clients to your account—regardless of which of the four plans you have.

Additionally, whereas FreshBooks requires you to pay an additional $10 per month per user for multi-user access, QuickBooks Online bakes multi-user access into their plan options (as we’ll explain below). Finally, it’s also important to point out that unlike FreshBooks, QuickBooks does not offer discounted pricing for purchasing an annual software plan.

With these initial differences in mind, then, let’s discuss the four QuickBooks Online plan options.

QuickBooks Online Simple Start Plan

The first plan QuickBooks offers is the Simple Start plan. This is the most basic and most affordable of the four plans, priced at $25 per month. If you purchase a QuickBooks Online subscription right now, however, you can take advantage of QuickBooks’ limited time discount. This being said, the Simple Start plan includes the following features:

- Track income and expenses

- Capture and organize receipts

- Maximize tax deductions

- Invoice and accept payments

- Track miles

- Send estimates

- Track sales and sales tax

- Manage 1099 contractors

Moreover, with the Simple Start plan, as well as with any of the QuickBooks Online plans, you have the option to integrate with QuickBooks Self Service or Full Service Payroll. The Self Service Payroll add-on will cost $35 per month, plus $4 per employee per month. The Full-Service Payroll add-on, on the other hand, will cost $80 per month, plus the same per employee per month fee.

QuickBooks Online Essentials Plan

The next QuickBooks Online plan, Essentials, costs $50 per month, with the limited time option to receive 50% off your first three months. As we mentioned earlier, QuickBooks includes multi-user access in the cost of their different plans, so the Essentials plan gives you access for up to three users without requiring an additional per-user, per-month fee.

In addition to all of the functionality of the Simple Start plan, the Essentials plan also includes:

- Bill management

- Time tracking by client or employee

- Integration option with TSheets by QuickBooks

- Up to three users with customizable access levels

QuickBooks Online Plus Plan

The third plan, QuickBooks Online Plus, will cost $80 per month. If you take advantage of the limited time discount, you’ll receive 50% off your first three months.

With QuickBooks Online Plus, you’ll have access to all of the features of the previous plans, as well as:

- Up to five users

- Project profitability tracking

- Inventory tracking

Of these additional capabilities, perhaps the most notable is inventory management—which FreshBooks does not offer in any of their plan options.

QuickBooks Online Advanced Plan

Finally, QuickBooks Online Advanced is the last plan option. This plan, just like FreshBooks Premium, is the most expensive with the most functionality. This being said, QuickBooks Online Advanced costs $180 per month and $90 for the first three months with the current limited-time discount.

In addition to all of the capabilities of the lower level plans, the Advanced plan will also include:

- Bill pay

- Up to 25 users

- Smart reporting powered by Fathom

- Accelerated invoicing

- Custom user permissions

- Premium customer support and training with Priority Circle membership

- Enhanced custom fields

FreshBooks vs. QuickBooks Online: Which Accounting Software Is Right For You?

Now that we’ve reviewed both FreshBooks and QuickBooks Online in detail, let’s explore the most significant ways in which these accounting solutions differ from one another. Ultimately, as we briefly mentioned above, the heart of the comparison between FreshBooks vs. QuickBooks lies in what kind of small business owner you are and, correspondingly, what kind of accounting needs you have.

Overall, FreshBooks is designed for self-employed professionals and service-based businesses, whereas QuickBooks Online more wholly caters toward general and product-based small business owners—and their respective feature sets and pricing plans reflect this distinction.

Keeping this essential difference in mind, let’s break down the individual areas where FreshBooks and QuickBooks stand out in this comparison:

FreshBooks Benefits

On the whole, when comparing FreshBooks vs. QuickBooks, FreshBooks stands out in terms of their time tracking and invoicing tools, pricing, and simplicity.

Let’s explain:

Time Tracking and Invoicing

As a solution that’s first and foremost designed to be self-employed accounting software, one of FreshBooks greatest strengths is their time tracking capabilities. Regardless of which of the FreshBooks plans you opt for, you have unlimited time tracking tools that allow you to track time wherever you are, record time based on specific clients, and automatically bill for tracked hours. You can also manage time tracking for your entire team, add detailed time entry notes, see tracked time on a monthly and weekly basis, and track time based on individual projects.

Additionally, FreshBooks offers a built-in timer for both desktop and mobile so you can easily track your time while you’re working. Moreover, FreshBooks’ time tracking tools are directly connected to their intuitive, comprehensive, and easy-to-use invoicing software—making the entire process of working, billing, and receiving payment seamless within the platform.

Although QuickBooks Online does offer time tracking and invoicing, these features aren’t nearly as prevalent within their accounting software as they are in FreshBooks. First, there are no time tracking tools in the Simple Start plan—and to truly utilize the full extent of QuickBooks’ time-tracking capabilities, you have to integrate with TSheets—which comes at an additional cost. Plus, whereas FreshBooks’ time tracking is client- and project-focused, QuickBooks time tracking tools largely revolve around tracking employee time.

Pricing

Another way in which FreshBooks stands out compared to QuickBooks Online is in pricing.

Although the various FreshBooks and QuickBooks plans are priced fairly similarly, overall, FreshBooks is available at a lower price point—with their most expensive plan, Premium, capping at $50 per month, compared to $180 per month for QuickBooks Online Advanced.

Additionally, FreshBooks offers a discount for those who opt for an annual subscription, where QuickBooks does not offer any equitable deal.

With plans at a lower price point that largely differ based on the number of billable clients, you can see how FreshBooks caters more to independent contractors and freelancers compared to QuickBooks Online.

Simplicity

Finally, comparing FreshBooks vs. QuickBooks Online, one of the most notable benefits of FreshBooks is the platform’s simplicity. By all accounts, the FreshBooks system is user-friendly, easy to set up, and approachable for even the smallest of businesses, including those without prior accounting experience.

With their three different plans, FreshBooks offers the core bookkeeping and accounting features that small business owners—particularly those that are self-employed—need to manage and streamline their finances, without an overwhelming amount of options and advanced functions they might not need.

Moreover, the FreshBooks mobile accounting app adds another layer of approachability and accessibility for on-the-go business owners and is highly rated in the Apple App Store. Plus, whereas QuickBooks only provides customer support via phone (unless you opt for the Advanced plan), FreshBooks provides both email and phone support regardless of which plan you choose.

All of this being said, with these benefits, you can see how FreshBooks succeeds in offering a well-rounded solution for their target market: self-employed professionals.

QuickBooks Online Benefits

Where does QuickBooks Online stand out in this FreshBooks vs. QuickBooks comparison? Ultimately, the most notable benefits of QuickBooks in this discussion are the platform’s automation and bank feed functionality, advanced features, and plan options.

Automation and Bank Feeds

As we explained with regard to FreshBooks’ appeal to self-employed professionals, QuickBooks stands out with their features designed to accommodate a variety of small business owners. In this way, the QuickBooks accounting software offers automation and bank feed capabilities that FreshBooks does not. For example, when you connect your accounts to QuickBooks Online, your transactions are automatically imported and sorted into categories which you can approve or edit. With FreshBooks, on the other hand, all transactions are imported as “uncategorized” and you have to manually go into the system and add the appropriate category.

Additionally, when tracking expenses, only QuickBooks Online allows you to distinguish between the type of expense, whereas FreshBooks only allows you to add categories or subcategories. Therefore, if you’re looking for a specific transaction—and you have multiple bank accounts and credit cards—this is going to be much more difficult in FreshBooks. Moreover, FreshBooks does not have a chart of accounts unless you opt for their Plus plan.

Overall, QuickBooks Online, regardless of the plan that you choose, provides more automated and comprehensive features for business owners to manage their bank feeds and perform reconciliation, especially if they have multiple accounts connected to the platform.

Advanced Features

Whereas one of the most notable benefits of FreshBooks is simplicity, one of the notable benefits of QuickBooks Online is their advanced features. In addition to the ways in which QuickBooks provides better bank feed management, they also, on the whole, have more in-depth and advanced capabilities to offer business owners. For example, starting with the Essentials plan and up, QuickBooks Online allows you to manage your business’s outstanding bills as well as pay them—with simplified bill pay tools if you opt for the Advanced plan. FreshBooks doesn’t offer bill pay or management in any of their plans.

Additionally, QuickBooks Online gives you the ability to schedule invoices for the future, which FreshBooks does not—unless you put a customer on a payment schedule plan—which isn’t quite the same function. Moreover, QuickBooks provides greater tools for managing and tracking sales tax, reporting, and of course, inventory, which FreshBooks does not offer at all. Finally, QuickBooks also offers more features for businesses with employees like employee-focused time tracking, direct payroll integration with QuickBooks payroll, and 1099 management tools.

Considering all of these different areas in which QuickBooks offers more robust or advanced functionality, you can see how—compared to FreshBooks—QuickBooks Online is designed for a wider variety of small business owners beyond the realm of contractors and freelancers.

Plan Options and Structure

Finally, QuickBooks Online stands out with their four plan options as well as the way they structure their plans. Although FreshBooks operates at a lower monthly price point overall, they also charge a monthly fee per additional user and differentiate their plans based on how many billable clients you can accommodate. With QuickBooks Online, on the other hand, your plans are only priced based on features and users—plus multi-user access is a feature that is included within the monthly price of each increasing plan level.

To explain, if you want to add two team members to your FreshBooks Plus account, you’ll end up paying the $25 monthly fee, plus $20 per month for the two team members, and you’ll be limited to 50 billable clients. With the QuickBooks Online Essentials plan, however, you’ll have account access for up to three users, no client limit, and you’ll pay a flat $40 per month. Moreover, to this same point, with each increasing QuickBooks plan level, you receive notable added accounting tools. If you compare FreshBooks Plus and Premium, on the other hand, you’ll pay twice as much per month for the Premium plan and the only added feature you receive will be an increase in the number of clients you can accommodate.

This being said, considering the way that users, clients, and features are structured within the FreshBooks plans compared to the QuickBooks Online plans, it seems that QuickBooks certainly offers a more appealing plan structure—especially for multi-user access.

FreshBooks vs. QuickBooks: The Bottom Line

At the end of the day, only you can decide which accounting software is right for your small business. Considering everything we’ve discussed in our FreshBooks vs. QuickBooks comparison, there’s no doubt that either of these solutions could serve your business well.

As we’ve mentioned, however, when it comes to FreshBooks vs. QuickBooks Online, the platform that’s better for your business will largely depend on the type of business you run and what kind of accounting needs you have. If, for example, you’re a freelance photographer looking to manage your finances, track your time, and bill clients, FreshBooks may be better suited for your needs. On the other hand, if you need full-service accounting software for a small retail business, you might find that QuickBooks Online is the better fit.

Ultimately, the decision is up to you. And—if you’re still unsure of which platform is right for your business—consider signing up for a 30-day free trial for both solutions, testing out each system, and comparing FreshBooks vs. QuickBooks Online for yourself.

Stacy Kildal

Stacy Kildal is a contributing writer for Fundera.

Stacy Kildal is owner/operator of Kildal Services LLC—an accounting and technology consulting company that specializes in all things QuickBooks. From 2012 to 2017, Stacy has been named one of CPA Practice Advisor’s Most Powerful Women In Accounting.

Stacy is one of the three hosts for the QB Show and has also been featured frequently on Intuit’s Accountant Blog, Community “Ask the Expert” forums, at various Intuit Academy To Go podcasts, as well as hosting a number of Intuit Small Business Online Town Hall sessions.

She is a big fan of working mobile and has been recognized by Intuit as being an expert on QuickBooks Online, having written Intuit’s original courses for the U.S., Singapore and Canadian versions.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.