What Is a Balance Sheet?—Balance Sheet Example and Definition

As a small business owner, managing your accounting processes is a necessary, yet complex piece of your overall operations. Nevertheless, even if you outsource your bookkeeping or business accounting to a certified professional, it’s important to understand a variety of key accounting concepts and reports, especially those that directly relate to analyzing your business’s financial performance and health.

One of the most important statements to understand is your accounting balance sheet. This report is one of the core financial statements used by accountants, creditors, and lenders to analyze your business’s financial performance. Moreover, the balance sheet is used for a number of key accounting concepts and formulas, making it all the more significant that your balance sheet is accurate.

To help you sort through this often overlooked accounting report, we’ve created this balance sheet guide. We’ll answer the question, “what is a balance sheet,” break down a balance sheet example and overall explain everything you need to know about this integral business accounting statement.

What Is a Balance Sheet?

A balance sheet is an accounting report that details a business’s assets, liabilities, and equities at a specific point in time. Therefore, the information on your balance sheet should accurately reflect the following formula:

Assets = Liabilities + Equity

As a summary of your business’s assets and liabilities, the balance sheet shows both what your business owns and what it owes at any given time. Compared to the profit and loss statement, which shows how your business has performed over a specific period of time, your balance sheet shows the financial status of your business on any given day.

Because of this fact, this particular accounting report is used along with the income statement and statement of cash flows to analyze your business finances—and is also used in other accounting calculations, such as the debt-to-equity ratio, accounts receivable turnover ratio, and more.

Balance Sheet Format

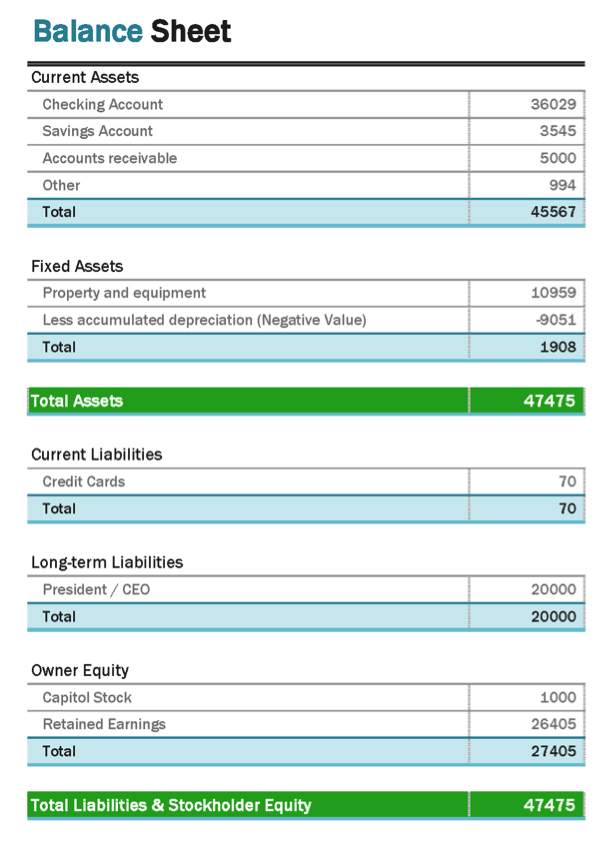

Assets

Assets are what your business owns or has the right to collect—cash, equipment, accounts receivable, employee advances, etc. Assets are listed first on an accounting balance sheet and are broken up into current assets and fixed assets, as you’ll see below.

Current assets are those items that can easily be turned into cash. These are generally listed first, as on the whole, assets are listed on the balance sheet in terms of liquidity, meaning how easily they can be converted into cash. In addition to the cash in your bank account, current assets also include:

- Cash equivalents

- Accounts receivable

- Inventory

- Investments

After current assets, your balance sheet will list fixed assets, which includes tangible items you use in your business, like equipment, land, or buildings to produce income for your company. You may also have intangible assets. This type of assets includes items that are non-physical, but still relevant to your business, like your website domain, copyrights, trademarks, or even goodwill.

If applicable to your company, these assets are included beneath fixed assets. Although not shown in our example, the combination of fixed assets and intangible assets is often referred to by the accounting term non-current assets, also called long-term assets.

Liabilities

Liabilities are what your business owes or has an obligation to pay, such as accounts payable, payroll liabilities, loans payable, and customer deposits. Just like assets, your liabilities will be broken down into two categories on your balance sheet—current liabilities and long-term liabilities.

Current liabilities include accounts payable and other short-term debts like credit card payments, taxes, or rent. Current liabilities are always paid with current assets, so it’s important to have enough assets to take care of liabilities. A small business accounting tip is to have two and a half times more assets than liabilities.

Long-term liabilities, on the other hand, are obligations that will be paid in a term longer than one year. These liabilities can include bonds issued, pension funds, and loans.

Equity

The final piece of this accounting statement will be equity, as you can see in the balance sheet example below. Equity, which is determined by subtracting your liabilities from your assets, is, in essence, the money that is owned by the business’s shareholders. Just like assets and liabilities, equity may be broken down into subcategories, including retained earnings, contributions, or treasury stock.

Ultimately, the way a balance sheet is formatted and the specific line items that are included can vary from business to business and, if you use accounting software, can depend on the manner in which this system tracks your information and produces this particular report. This being said, once again, for a balance sheet to be accurate, your total assets should equal your total liabilities plus your total equity.

Balance Sheet Example

With this balance sheet definition in mind, let’s discuss the different pieces that make up an accurate accounting balance sheet. As we mentioned, your balance sheet consists of assets, liabilities, and equities—and an accurate statement should reflect the formula above: Assets = Liabilities + Equity. You can see this breakdown in our balance sheet example below.

You can also refer to our balance sheet template, should you decide not to start building a balance sheet from scratch.

Why Your Balance Sheet Is Important

Now that we have a better understanding of the different pieces that make up an accounting balance sheet, let’s talk about why this particular report is so important. Essentially, since every transaction your business makes affects this statement, your balance sheet illustrates your business’s overall financial position—meaning it’s an effective tool to be used in conjunction with other financial statements to show a fuller picture of your business’s financial performance.

Plus, because the balance sheet reflects all of the transactions that your business makes on a day-to-day basis, it is used to calculate other financial ratios, like accounts receivable turnover, debt-to-equity, working capital turnover, etc.—each of which can also provide specific insights into different parts of your business’s financial performance. Moreover, since the information on this statement is used in a variety of other accounting calculations, it’s all the more significant that it’s accurate.

All of this being said, at the same time, it’s also important to remember that this accounting report shows a snapshot of a specific period of time—and therefore, should be used as a comparison tool, with balance sheets from other time frames, or as we’ve just mentioned, in conjunction with other accounting reports, to more fully understand the state of your business’s financial health.

Analyzing Your Balance Sheet

Keeping in mind the possible limitations of your accounting balance sheet, it’s worth considering the different questions you can ask and comparisons you can make to glean particular insights about your business finances.

For example, using the break down of assets, liabilities, and equities, on your balance sheet you may ask:

- Does your business have enough liquid assets to cover operating expenses?

- Do you have flexibility with your assets to allow for business changes, such as an unexpected expense?

- Are your numbers trending in a certain direction—up or down—and what action can you take to correct the situation if needed?

- Can your current path be sustained to promote the growth of your business?

A great way to answer some of these questions is to compare your current balance sheet with one from a previous period. Therefore, if you wanted to compare this month’s finances to last month, your report might look like the balance sheet example below.

You can note three important changes, designated by the red numbers in this example:

- Your liquid assets (business checking account) have increased, because

- You were able to collect on many of your receivables, and

- You paid down your credit card debt.

By performing this kind of comparison, you can see how the unique parts of your business finances are functioning, and thereby determine, what, if anything, needs to be changed or adjusted in order to reach your business goals.

The Bottom Line

Although sometimes overlooked, your balance sheet is a core statement within your business’s accounting. As we’ve discussed, this report is particularly significant because it shows the financial status of your business at any given point in time. Plus, by breaking down the specific line items that make up your assets, liabilities, and equities, you can see how your business is performing and identify areas that may need to be improved.

Moreover, since every transaction you make influences this report, it’s an essential tool used by lenders and creditors to determine whether they should lend credit to your business. Therefore, it’s all the more important that you keep your bookkeeping up-to-date and accurate and ensure that any balance sheet report you create is correct.

If you use an accounting software solution, you should be able to create this report within that system. Similarly, your business bookkeeper or accountant should also be able to help you generate a balance sheet, as well as discuss its financial insights with you. When in doubt, however, you can reference and download our balance sheet template.

Seth David

Seth David is the chief nerd and president of Nerd Enterprises, Inc. which provides consulting and training services in accounting and productivity based software. Consulting services range from basic bookkeeping to CFO-level services such as financial modeling.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.