Self-Employment Taxes and SECA: Tax Obligations for the Self-Employed

This article has been reviewed by tax expert Erica Gellerman, CPA.

What Are Self-Employment Taxes?

Self-employment taxes are social security and medicare taxes for freelancers, consultants, and other self-employed business owners. Under the Self-Employed Contributions Act (SECA), individuals who don’t have taxes withheld from their wages must pay self-employment taxes. The current self-employment tax rate is 15.3% of net self-employment income.

Many consultants, freelancers, and other self-employed workers mistakenly believe their tax obligations won’t change much once they leave their 9-to-5 jobs and are responsible for their own business accounting. However, once you become self-employed, you often end up with greater responsibility for small business taxes. Since you’re not an employee, you don’t have an employer to deduct taxes from every paycheck. As a result, you’re responsible for calculating taxes, making the required payments to the Internal Revenue Service (IRS), and filing the necessary tax forms yourself.

As a self-employed business owner, you must pay self-employment taxes on net business income over $400 per year. We’ll cover how self-employment taxes are calculated, how and when to pay the taxes, and the accompanying tax forms that you have to submit to the IRS. Self-employed individuals have more tax responsibilities, but understanding the rules can put you ahead of the game and save you money.

Who Has to Pay Self-Employment Taxes?

Virtually everyone who earns income in the United States must pay social security and medicare taxes. If you’re an employee, then your employer will withhold these taxes as payroll taxes from every paycheck. Your employer will also pay a portion of Social Security and medicare taxes, sharing the tax liability with you. For employers and employees, these taxes are called FICA taxes after the Federal Insurance Contribution Act.

For self-employed individuals, these are called SECA taxes after the Self-Employed Contributions Act (SECA). There’s no employer-employee share of SECA taxes—the self-employed individual pays the entire share out of their net earnings. Anyone who earns over $400 in self-employment net income in a year must pay self-employment taxes.

Independent contractors, freelancers, consultants, sole proprietors, partners in a partnership, and members of limited liability companies that are taxed as disregarded entities must pay self-employment taxes. Partners in a partnership and members of a multi-member LLC must pay self-employment taxes on their respective share of the business’s income. In most cases, corporate shareholders who actively work for the corporation are considered employees subject to FICA tax withholding.

How Much Are Self-Employment Taxes?

The current self-employment tax rate is 15.3% of net self-employment income. This comes from adding up Social Security taxes (12.4%) and Medicare taxes (2.9%). There’s also a 0.9% Medicare surtax on certain high-income earners, which goes to fund healthcare under the Affordable Care Act.

You must pay 12.4% Social Security taxes on net annual self-employment income up to $137,700. For example, say you make $220,000 this year in net self-employment earnings. You would pay $17,074.80 in Social Security taxes. Your earnings above $137,700 aren’t subject to Social Security taxes.

The medicare tax of 2.9% is required on all net self-employment income. In the same example, you would pay $6,380 in Medicare taxes.

There is an additional 0.9% Medicare surtax on annual self-employment earnings applies over $200,000 for single tax filers ($250,000 for married filing jointly, and $125,000 for married filing separately). Assuming you’re single filing jointly in the example above, the $20,000 above the $200,000 threshold would be subject to the Medicare surtax. That brings the medicare surtax to $180. Add everything up, and your total self-employment tax bill would be $23,674.80. That’s a lot of money, but thankfully, as we’ll explain more below, half of your tax responsibility can be deducted as a business expense.

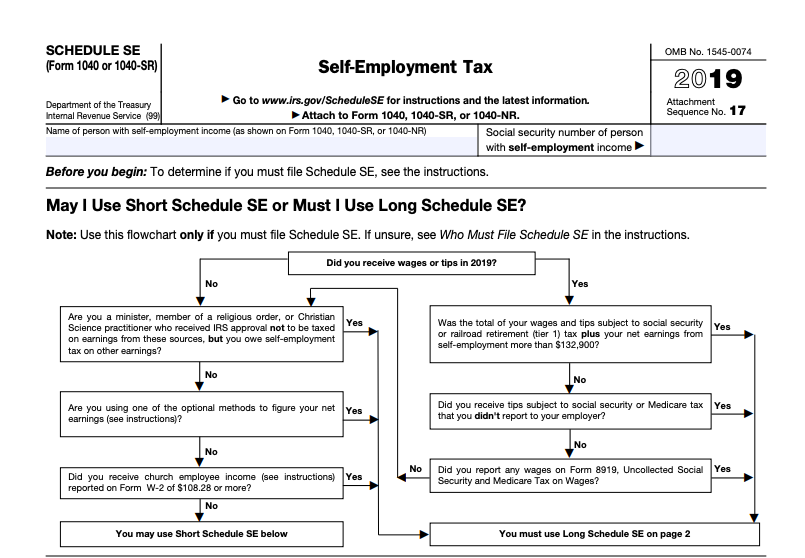

Photo credit: IRS.gov

How to Report and Pay Self-Employment Taxes

Remember, self-employment taxes are calculated on net self-employment income. You’ll calculate your net self-employment income by starting with Schedule C. On Schedule C, you will report your total business revenue for the year, and then make any allowable business tax deductions. That will give you your taxable self-employment income that you report on form 1040.

At that point, you must fill out Schedule SE, which is a self-employment tax form that will help you figure out how much you owe in self-employment taxes. Add the result of Schedule SE to line 58 of form 1040. Although the 15.3% tax rate might seem pretty hefty, there’s some good news. You get a deduction for half of your self-employment taxes (7.65%). The IRS treats the “employer side” of self-employment taxes as a deductible expense to make taxes more equitable for self-employed individuals. The deduction gets reported on line 27 of form 1040. Don’t forget to attach a copy of Schedule SE to your Form 1040.

Employers must deposit FICA taxes on a periodic basis throughout the year. Since there’s no employer for self-employed individuals, the self-employed must pay estimated taxes on a quarterly basis. Form 1040-ES will help you calculate your estimated taxes, and you can send payment through the Electronic Federal Tax Payment System (EFTPS).

Here are the quarterly due dates for self-employment taxes:

- April 15: First quarter (covering Jan. 1 to March 31)

- June 15: Second quarter (covering April 1 to May 31)

- September 15: Third quarter (covering June 1 to Aug. 31)

- January 15: Fourth quarter (covering Sept. 1 to Dec. 31)

Make sure you put these due dates in your business calendar, to avoid paying penalties and back taxes.

Avoid Penalties on Your Self-Employment Taxes

You should always do your best to meet your self-employed tax obligations. Some of the consequences of not meeting your tax obligations are pretty severe:

- Penalties and interest. As mentioned above, failure to make estimated tax payments as required can lead to underpayment penalties and interest. The interest continues to accrue until the balance is paid in full, even if you set up a payment plan with the IRS.

- Backup withholding. In some cases, the IRS or your state tax agency may determine you should be subject to backup withholding. When this happens, the tax agency sends a letter to anyone you have done business with in the past, instructing them to withhold a sizable percentage of any future payments due to you. This backup withholding amount must then be remitted by the business to the tax agency.

- Seizure of assets. Even though the IRS and your state tax agency prefer to avoid this step, they will enforce this consequence if the amount due is large enough or if you ignore their attempts to collect taxes due. The most common form of asset seizure is a tax lien on your bank account. If you owe a large amount of money for taxes and fail to make—and keep—arrangements to pay those taxes, the IRS and other tax agencies may instruct your bank to forward most or even all of the money in your bank accounts to them.

What’s the best way to avoid potential tax pitfalls? Work with a tax professional or certified public accountant (CPA). A tax professional who is privy to your entire financial situation, not just your business tax situation, can advise you on how to best fulfill your tax obligations.

The Bottom Line

As a self-employed individual, more of the tax obligations fall on you to do yourself. But self-employment taxes don’t have to get in the way of your small business. Understanding your obligations and proactively planning to fulfill them can move your tax obligations as a self-employed individual from complicated to manageable. It just takes a bit of guidance and planning. If you find yourself needing extra help, don’t hesitate to work with an accountant or tax professional.

Billie Anne Grigg

Billie Anne Grigg is a contributing writer for Fundera.

Billie Anne has been a bookkeeper since before the turn of the century. She is a QuickBooks Online ProAdvisor, LivePlan Expert Advisor, FreshBooks Certified Beancounter, and a Mastery Level Certified Profit First Professional. She is also a guide for the Profit First Professionals organization.

Billie Anne started Pocket Protector Bookkeeping in 2012 to provide an excellent virtual bookkeeping and managerial accounting solution for small businesses that cannot yet justify employing a full-time, in-house bookkeeping staff.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.