What Is Stop-Loss Insurance?

Stop-loss insurance is a type of commercial insurance that protects self-insured businesses in case of catastrophic or large claims. This coverage is utilized by businesses that have opted to pay their employees health benefits out-of-pocket instead of using traditional group health insurance. With stop-loss insurance, businesses can receive reimbursement for claims that exceed a pre-determined level.

Due to the rising costs of small business insurance, many business owners have opted to self-insure. Instead of contracting with a health insurance carrier, self-insured businesses set aside money to pay employees’ health claims out of pocket.

As you might imagine, there are a number of benefits to self-insurance, but also risks. Therefore, if you have or are considering self-insurance, you’ll also want to look into stop-loss insurance coverage—as this type of policy can help minimize your potential liabilities.

Stop-Loss Insurance Definition

Stop-loss insurance, also referred to as excess insurance, is a type of coverage purchased by businesses who are self-insured to limit their liability in the event of large, unpredictable, or catastrophic health claims.

This coverage limits a self-insured business’s liability by placing a cap on the amount the employer has to pay on an individual employee’s claims, as well as aggregate claims across the company.

In other words, your stop-loss insurance coverage might state that the maximum amount you can pay on a claim is $100,000. If the costs of the claim exceed $100,000, therefore, the additional costs are covered by your policy.

To this point, it’s important to note that stop-loss insurance coverage functions as a reimbursement—meaning if you have a claim of $150,000, (e.g. one that exceeds your limit by $50,000) you’ll still be responsible for the initial payment of that total amount. The insurance company you work with will later reimburse you for that overage amount, in this example, the $50,000.

All of this being said, unlike other types of business insurance, stop-loss insurance coverage is typically purchased from a third-party administrator (TPA)[1] or business health insurance provider.

Types of Stop-Loss Insurance

Now that you have a better understanding of the basics of stop-loss insurance, let’s break down the two main types of coverage:

1. Specific Stop-Loss Insurance

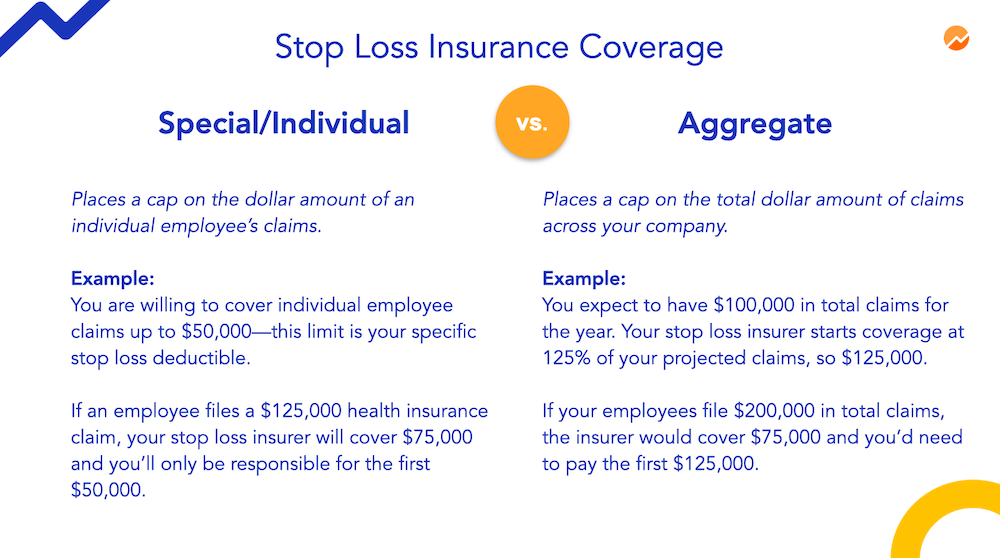

Specific stop-loss insurance, also called individual stop-loss insurance, places a cap on the dollar amount of an individual employee’s claims.

Let’s say one of your employees is suddenly diagnosed with a chronic illness, or becomes pregnant. In these situations, the employee’s health costs could quickly increase. If you purchase this type of stop-loss insurance, the coverage will kick in once the employee’s claims exceed a specific dollar limit.

For example, suppose you are willing to cover individual employee claims up to $50,000. This $50,000 limit is called your specific stop-loss deductible. If an employee files a $125,000 health insurance claim, the stop-loss insurer will cover $75,000. You’ll only be responsible for the first $50,000.

2. Aggregate Stop-Loss Insurance

Aggregate stop-loss insurance, on the other hand, places a cap on the total dollar amount of claims across your company, after which the coverage will kick in. This insurance isn’t based on the health insurance claims of any one employee, but rather your the claims exposure across your entire team.

This type of stop-loss insurance can be important for something as simple as an especially tough flu season that results in multiple employees getting sick and filing claims. You also might face demographic changes, such as several employees becoming pregnant in the same year.

With this in mind, aggregate stop-loss insurance coverage is usually tied to your business’s expected claims exposure for the year. As an example, let’s say you expect to have $100,000 in total claims. Stop-loss insurers often start coverage at 125% of your projected claims for the year—$125,000 in our example.

If your employees filed $200,000 in total claims, therefore, the insurer would cover $75,000. Again, you’d need to pay the first $125,000, which is called your aggregate stop-loss deductible or aggregate attachment point.

In most cases, self-insured small businesses need both types of stop-loss insurance to ensure maximum protection. This is because both claim size and the number of claims can affect your finances. It might turn out that a single employee submits unusually costly claims, or a high volume of lower-dollar claims can drain your finances.

This being said, it’s important to note that some states, including California and New York, have regulations on stop-loss insurance and the size of individual and aggregate deductibles. For example, New York only allows businesses with more than 100 employees to buy stop-loss coverage[2]. California, on the other hand, prohibits individual stop-loss deductibles below $40,000[3].

Moreover, in addition to these state government regulations, you’ll also find that there are a number of variations on stop-loss coverage based on the provider as well. Therefore, you’ll want to work with an insurance broker or agent that’s experienced in your state and can help find the right policy for your needs.

Stop-Loss Insurance Cost

When it comes down to it, the cost of stop-loss insurance coverage can vary widely among businesses, but usually, premiums range from $15 per month to $100 per month, according to a survey by Aegis Risk[4].

Although there are a variety of factors that can contribute to your ultimate costs, the most impactful factor is the individual stop-loss deductible. The higher that deductible, the less likely it is that the stop-loss insurer will be obligated to pay, and consequently, the lower your premiums will be.

This table shows Aegis Risk’s breakdown of how premiums change in sync with the individual stop-loss deductible that you choose:

Average Monthly Stop-Loss Insurance Coverage Premium by Deductible

| Individual stop loss deductible | Average monthly premium |

|---|---|

|

$100,000

|

$95.30

|

|

$200,000

|

$43.31

|

|

$300,000

|

$27.61

|

|

$400,000

|

$19.96

|

|

$500,000

|

$15.52

|

With this in mind, the aggregate stop-loss deductible will also impact the monthly premium, but to a lesser extent. On average, adding aggregate stop-loss insurance increases your monthly premium by $7.13.[4]

Benefits of Self-Insurance and Stop-Loss Insurance

As you can see, stop-loss insurance can be complicated, so you might be wondering why businesses choose this route instead of sticking with traditional health plans.

In short, self-insurance and consequently, stop-loss insurance coverage, have grown in popularity due to the rising costs of traditional health insurance, as well as the flexibility that these alternative coverage methods provide businesses.

Generally, self-insurance allows businesses to:

- Set their own rules on copays and deductibles

- Collect employee premiums

- Choose their own provider network to suit the needs of employees

- Have more control over their cash flow, paying as claims arise

- Save money on business taxes (self-funded plans are not subject to state taxes on health insurance premiums)

Of course, the biggest drawback of self-insurance is the inherent risk—which is where stop-loss insurance coverage comes into play. As we’ve discussed, stop-loss insurance allows small businesses to self-insure while limiting their risk exposure to large, unexpected, or catastrophic claims.

Tips for Finding and Utilizing Stop-Loss Insurance

Again, as we’ve mentioned, the process of self-insuring and getting stop-loss insurance to mitigate your risk can be complex. Therefore, you’ll want to take the time necessary to understand and compare your options, as well as work with insurance professionals to ask any questions you might have.

This being said, you can follow these guidelines as you start the process:

- Consider a TPA: The main job of TPAs is to process claims and complete other administrative tasks. However, TPAs often offer stop-loss coverage themselves or through a partner business insurance company. If you’re already using a TPA for administrative needs, then purchasing stop-loss coverage through them can be cost-effective.

- Consider a level-funded plan: Level-funded plans are a sort of hybrid between self-insurance and regular group health insurance, making them a good option for small businesses. With a level-funded plan, you contract with an insurer and pay a monthly fee which covers three elements—a TPA, stop-loss premiums, and claims allowance.[5]

- Invest in strategies to minimize costs of self-insurance and stop-loss insurance: To minimize these costs, for example, you might:

- Tailor your individual and aggregate deductibles to your team’s demographics and to the medical trends you’ve noticed among your employees

- Reevaluate your deductible every year based on the claims you received the preceding year

- Choose a stop-loss insurance carrier that offers wellness and prevention resources that you can include in your employee benefits package. This might reduce the number of claims.

- Don’t plan for the “best case scenario.” You should be prepared to keep running your business even if all of your financial reserves are depleted from claims.

- Budget appropriately: When budgeting, you should remember that stop-loss insurance premiums aren’t the only cost for a self-insured employer. Your total costs include the dollar amount of employee claims that you have to pay out of pocket, administrative costs, TPA fees (if using a TPA), and stop-loss insurance premiums.

The Bottom Line

At the end of the day, stop-loss insurance protects your business from high health care expenses without taking coverage away from your employees. Small businesses that self-insure already face higher risks than businesses that purchase health insurance from a traditional insurance carrier.

Therefore, stop-loss insurance coverage helps lower this risk, so you can enjoy the minimized costs and flexibility of self-insurance without having to worry about unexpected large or high-volume claims.

Priyanka Prakash, JD

Priyanka Prakash is a senior contributing writer at Fundera.

Priyanka specializes in small business finance, credit, law, and insurance, helping businesses owners navigate complicated concepts and decisions. Since earning her law degree from the University of Washington, Priyanka has spent half a decade writing on small business financial and legal concerns. Prior to joining Fundera, Priyanka was managing editor at a small business resource site and in-house counsel at a Y Combinator tech startup.