Profit and Loss Statement: A Guide for Small Business Owners

A profit and loss statement—also called an income statement or P&L statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. It’s usually assessed quarterly and at the end of a business’s accounting year.

While business accounting software makes it simple to produce a P&L statement, we recommend that you familiarize yourself with the terminology and process. This guide will teach you how to analyze and prepare a profit and loss statement—plus, download our free profit and loss statement template to use for your business.

In this guide:

What’s Included in a Profit and Loss Statement?

Before you can create and analyze your own profit and loss statement, it’s important to understand what’s included in this report and how it works.

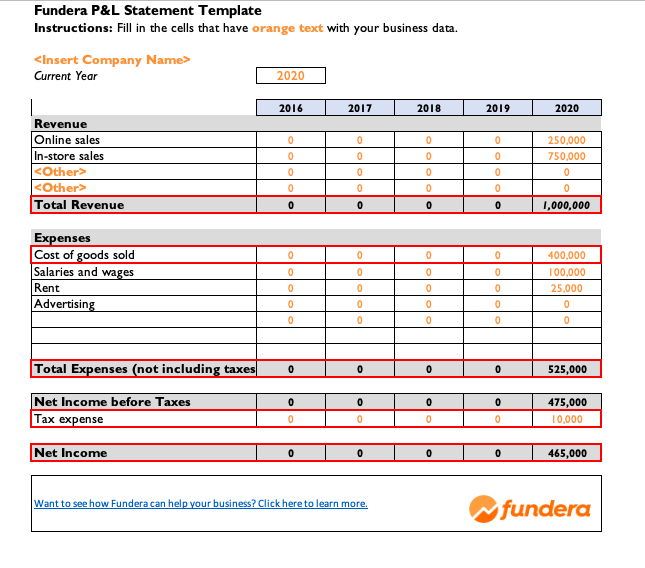

Overall, a profit and loss statement can be broken into five parts (highlighted in red in the image below):

- Revenue (or income)

- Costs of goods sold (COGS)

- General expenses

- Other expenses—including taxes, interest, etc.

- Net income

With this overview in mind, let’s walk through the most common terms included in a profit and loss statement—and their definitions:

- Revenue: Revenue includes the total sales that you make, but it also includes money you receive from things like selling property and equipment or receiving a refund on your taxes.

- Expenditures: It’s not difficult to figure out what information is contained in the total expenditure line, but there may be specific types of expenditures you may not be familiar with.

- Cost of goods sold (COGS): Even though you might sell a cup of coffee for $3, you don’t actually make $3 from the sale. You have to account for the cost of the materials and the time it takes to produce it, which is the cost of goods sold (COGS).

- Gross profit: This is the number you get when you subtract the cost of goods sold from your revenue.

- Operating expenses (OPEX): Operating expenses include any costs associated with running your business that are not included in the cost of goods sold. P&L statements usually divide these expenses into descriptive categories like payroll, travel, training, building leases, utilities, equipment purchase, hardware and software, advertising, cell phone, and internet service. The list can get quite extensive, depending on the size and type of small business you operate.

- Depreciation: You probably already know that if you drive a new car off the lot, it immediately loses some of its value. This is depreciation, and it doesn’t just apply to cars. Equipment, machinery, and other business goods lose value over time as well, and this can be counted as a loss at tax time.

- EBIT: This acronym stands for earnings before interest and tax. It’s calculated by subtracting operating expenses from gross profit. Another term for EBIT is operating profit.

- EBT: This stands for earnings before tax, and this number comes from subtracting both COGS, OPEX, interest, and depreciation/amortization from your total revenue. EBT is a great indicator of business performance and makes it easier to compare your business to others if you need to.

- Earnings available for common shareholders: If your company has investors or if you take a salary from the company, this line is important because it shows a net after-tax profit, minus any dividends for preferred shareholders.

- Owner’s draw: This is any salary for the business owner which comes out of company revenues.

- Net Income: Net income, or profit, is the proverbial “bottom line” on a profit and loss statement for small businesses. It’s what’s left after you subtract all your expenses from your total revenue. Hopefully, you’ll see a profit, but there is a chance you’ll show a loss, especially if you’re just starting out in business. This is obviously the most important line on the income statement.

How to Read a P&L Statement

If your profit and loss statement seems intimidating, don’t worry. It’s easier to understand if you break it down into three overarching categories:

- Revenue: Sales/revenue/income—all the money your business has made is normally listed first

- Expenses: Costs/expenses—how much it costs your business to make money is listed next

- Net income: Your bottom line at the conclusion of the statement

These categories are then broken down into sub-categories. For example, revenue could include your various revenue sources (e.g. in-store sales and online sales). Similarly, you can break down your expenses into sub-categories, like the cost of delivering your product or service (COGS), and the general operating costs of the business (OPEX).

On your P&L statement, you’ll also find your gross profit or gross margin (calculated by revenue minus COGS). This number indicates how much capital is left over for other expenses. Next, your operating profit (EBIT) is the result of gross margin minus operating expenses. Finally, after accounting for interest, depreciation, amortization, and taxes, you’ll get your bottom line—also known as net profit, net income, or net earnings.

Your bottom line reflects your business’s profit or loss. If you show a loss, you spent more than you earned. If you show a profit, you made more than you spent. Your bottom line signals whether you need to increase revenues, cut costs, or both. Over time, your profit and loss statement can also show your business’s growth, as well as patterns in income and expenses.

All of this being said, you should also generate a balance sheet and a cash flow statement for your business. These three financial statements combined offer a more comprehensive overview of your business’s financial health.

P&L Statement Example

To help you better understand this financial statement, we’ve created this profit and loss statement example that shows you all of the terms we’ve covered so far:

| Item | Value |

|---|---|

|

Online Sales |

$250,000

|

|

In-Store Sales |

$750,000

|

|

Total Sales |

$1 million

|

|

Cost of Goods Sold |

($400,000)

|

|

Gross Profit |

$600,000

|

|

Operating Expenses |

|

|

Payroll |

$100,000

|

|

Rent |

$25,000

|

|

Utilities |

$10,000

|

|

Depreciation and Amortization |

$5,000

|

|

Total Operating Expenses |

($140,000)

|

|

EBIT / Operating Profit |

$460,000

|

|

Interest Expense |

($20,000)

|

|

EBT / Earnings Before Taxes |

$440,000

|

|

Taxes (assuming a 20% tax rate) |

($88,000)

|

|

Earnings Available for Common Shareholders |

$352,000

|

|

Owner’s Draw |

$100,000

|

|

Net Income |

$252,000

|

In this profit and loss statement example, our company is operating at a healthy surplus of $252,000 for the year. Most of the business’s revenue comes from in-store sales, and the company’s main expense is payroll.

The company can try to increase profits by further developing its online store and by conserving on payroll costs. Depending on the type of business you have, your operating expenses section might have far more expense categories.

Just keep in mind that a profit and loss statement example like this one only shows you the finished product. As we mentioned above, one of the tougher parts is going to be ensuring that your figures are correct on the P&L statement. This is why having accounting software and a great business bookkeeper or accountant is essential—they’ll make sure that’s the case.

P&L Statement Template

If you’re not using accounting software to generate a P&L statement you might find it easier to utilize a profit and loss statement template. This will help ensure you’re following the right steps as you prepare your form.

Fundera’s profit and loss statement template (shown above) can help you create a P&L statement in Microsoft Excel or Google Sheets. Microsoft Office, QuickBooks, and other sites also have Excel templates you can use as well.

This being said, if you’re not using accounting software, you’ll want to be preparing your profit and loss report in Excel or a similar program. Using the formulas and tools in Excel, you can quickly calculate numbers and see patterns.

In the next section, we’ll show you how to prepare your own profit and loss. Feel free to download our template below and follow along.

How to Prepare a Profit and Loss Statement

Now that you know how to analyze a profit and loss statement, you’ll find it’s fairly easy to figure out how to prepare one.

We highly recommend that you use a top business accounting software like QuickBooks or Xero to manage your books. Software like this will make it easy to automatically prepare financial statements. Accounting software also makes it easy to collaborate with a bookkeeper or an accountant, who can ensure your numbers are correct.

If you’re not quite ready to take on accounting software, on the other hand, you can follow these steps to prepare your own P&L statement:

- Prepare your business’s revenue for each quarter of the year. What were your sales generated for each quarter of that year?

- Itemize your business’s expenses for each of those quarters. What money did your business spend? Do those expenses count as the cost of goods sold or operating expenses?

- Subtract your overall expenses from gross profit to get your EBIT per quarter and for the year.

- Now, account for any interest and taxes and subtract these from your EBIT. Interest charges are one of the most complicated parts of the P&L statement, so if you’re unsure of how to handle these, you’ll want definitely want to consult a business accountant.

- Determine if your company has operated at a profit or a loss.

As you can see, a simple P&L statement is all about answering the question: has my company operated at a profit or a loss over a specific period of time? As you prepare one, you can see how each source you reference brings you closer to an answer.

The Bottom Line

At the end of the day, profit and loss statements are important for all small businesses. In fact, public corporations are required by law to complete them. Aside from following regulations, however, profit and loss statements give you the opportunity to review your net income, which is essential for making sound business decisions.

Therefore, you’ll want to review your profit and loss statement regularly to evaluate your income, expenses, and determine what (if any) changes you need to make to increase the profits of your business.

Moreover, you’ll want to compare and contrast your most recent statements with past statements for a better picture of your current standings and to help make informed decisions in the future.

Meredith Wood

Meredith Wood is the founding editor of the Fundera Ledger and a GM at NerdWallet.

Meredith launched the Fundera Ledger in 2014. She has specialized in financial advice for small business owners for almost a decade. Meredith is frequently sought out for her expertise in small business lending and financial management.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.