What Is a Business Contingency Plan and How to Create One

Business Contingency Plan Definition

A business contingency plan identifies potential risks to your business and outlines the steps or course of action your management team and employees would need to take to combat them. Risks can include a global pandemic, natural disaster, loss of a key employee, supply chain breakdown, a new competitor, and more. You can think of a business contingency plan as a Plan B or disaster recovery plan. It gives your business something to fall back on in case things don’t go as planned.

In a perfect world, your business would be immune from disaster. Unfortunately, this is not the case. A disaster such as COVID-19 can strike when you least expect it and leave you in a difficult situation. Unexpected events are virtually a guarantee in business.

That’s where a business contingency plan comes in. Just as your business plan helped you launch your business, a business contingency plan can ensure your organization is well-prepared when times get tough. Let’s dive deeper into what a business contingency plan is and how you can create one.

What Is a Business Contingency Plan?

A business contingency plan is essentially a strategy that outlines the steps or course of action your management team and employees would need to take in the event of a disaster. You can think of it as a Plan B or disaster recovery plan. It gives you something to fall back on in case things don’t go as planned.

Without a business contingency plan, you put your business at risk for a great deal of damage and lost productivity. It may be the difference between continuing operations and completely shutting down. Unfortunately, many organizations forgo business contingency plans because they’d rather put all their time and energy into Plan A. They don’t realize that a Plan B will help them achieve success, rather than hinder it.

The importance of a contingency plan should not be overlooked. After all, if your competitor has a strong business contingency plan in place and you do not, who is likely to survive when a disaster hits? Your competitor.

By putting time and thought into your plan, you can overcome obstacles and keep business stable in the midst of a crisis. Not only does a disaster recovery plan minimize the impact of unforeseen events, but it also creates a plan for running your business after the disaster comes to an end.

When Should You Develop a Business Contingency Plan?

Most organizations focus on contingency planning during their annual planning meeting. At this time, they discuss their strategies for success for the upcoming year and identify what risks they need to prepare for. Some organizations, however, prefer to plan for the unexpected throughout the year as they believe it’s an effective way to cope with various issues.

For example, if you notice a new competitor stealing a great deal of your market share in the middle of the year, you may come up with a contingency plan for that particular situation right then. It wouldn’t make sense to wait until the next annual meeting to tackle a problem happening now.

How to Create a Business Contingency Plan

The keys to a strong contingency plan are thoughtful brainstorming sessions and strong research. If you’d like to create a business contingency plan for your business, here are some steps to follow.

Step 1: Consider Major Risks

Think about the nature of your business, the types of products and services you provide, and the customers you serve. What types of events would negatively impact your organization as well as your employees, equipment, and other resources?

During this step, it’s a good idea to hold multiple meetings with your management team and key employees. If you have the funds, investing in a business consultant who can steer you toward the right direction may be worthwhile. Your risks will likely fall into these categories.

Staffing

People are the lifeblood of your business. Without them, you’d have a tough time earning money and meeting your goals. Consider the management team and employees at your organization. Are there specific people that are essential to your business? What would you do if they unexpectedly quit, sustain an injury, or pass away? Is there one person that knows how to do a certain task that nobody else knows how to do?

Technology

These days, technology plays a vital role in any organization. If you’re a sales-oriented business, what would you do if your customer relationship management (CRM) system breaks down? If you offer software development services, how would you operate if a specific program stopped working? Jot down a list of all the technologies and equipment you need to function optimally.

Inventory

Chances are you have inventory you’d like to safeguard in the event of a disaster. If you sell women’s clothing, for example, this may be the merchandise in your warehouse. If you offer a service like home health care, your inventory may consist of stethoscopes, alcohol wipes, and other tools your nurses take on client visits.

Legalities

There are federal and local laws that your business must follow. Consider what they are as well as any potential lawsuits that you may be susceptible to. You may want to consult an attorney to make sure you have all the legalities of your business covered.

Some of the most common examples of risks include:

- Your top sales representative quits

- A fire strikes

- A less expensive competitor enters the market

- Your computer system breaks down

- A hacker steals your client’s personal information

Step 2: Prioritize Risks

Once you’ve compiled your list of risks, it’ll be time to prioritize them. So how do you do that? Go through each risk on your list and figure out how likely it is to happen. Then, determine how much it will impact your business if it were to arise. The risks that have a greater probability of occurring and have the potential to cause the most damage should be at the top of your priority list.

Step 3: Develop a Contingency Plan for Each Risk

After your risks have been prioritized, you’ll need to develop a separate plan of action for each one. Begin with the top priority risks and make your way down to the ones that are lower priority. Each contingency plan you create should outline what you’ll do to prepare for that risk and the steps you’ll take to keep damage to a minimum.

Here’s a business contingency plan example: Let’s say your business involves a call center and one of your risks is that many employees are likely to call out at the same time. You need these employees on the phones or your business will slow down and lose money. In this scenario, you may prepare by creating a “backup list” of employees who can fill in on short notice.

Your “backup list” employees are people that will gladly pick up an extra shift at a moment’s notice. You’ll have them to call and cover for any employees that don’t show up. By creating a contingency plan for each risk, you can achieve some much-needed peace of mind and alleviate stress when you don’t have all the resources you need to succeed.

Step 4: Share and Modify the Plan

Your business contingency plan is no good if you’re the only one who knows about it. As soon as you’ve finalized it, store in a place that your management team and employees can easily access. Also, host a meeting to present it to everyone and address any questions or concerns they may have. You’ll likely find that sharing your business contingency plan with others opens your eyes to new ideas and insights that can improve it.

It’s important to note that your business contingency plan is not set in stone. Unfortunately, it’s not one of those things that you create once and never touch again. As your business evolves and times goes on, you may identify new risks and solutions for your plan. Set up a time every quarter or year to review and modify your business contingency plan as necessary.

Business Contingency Plan Templates and Examples

If you’re new to this concept and need some guidance, this business contingency plan template can be invaluable. You can use it to create a game plan for each risk that you need to strategize for.

Blank Template

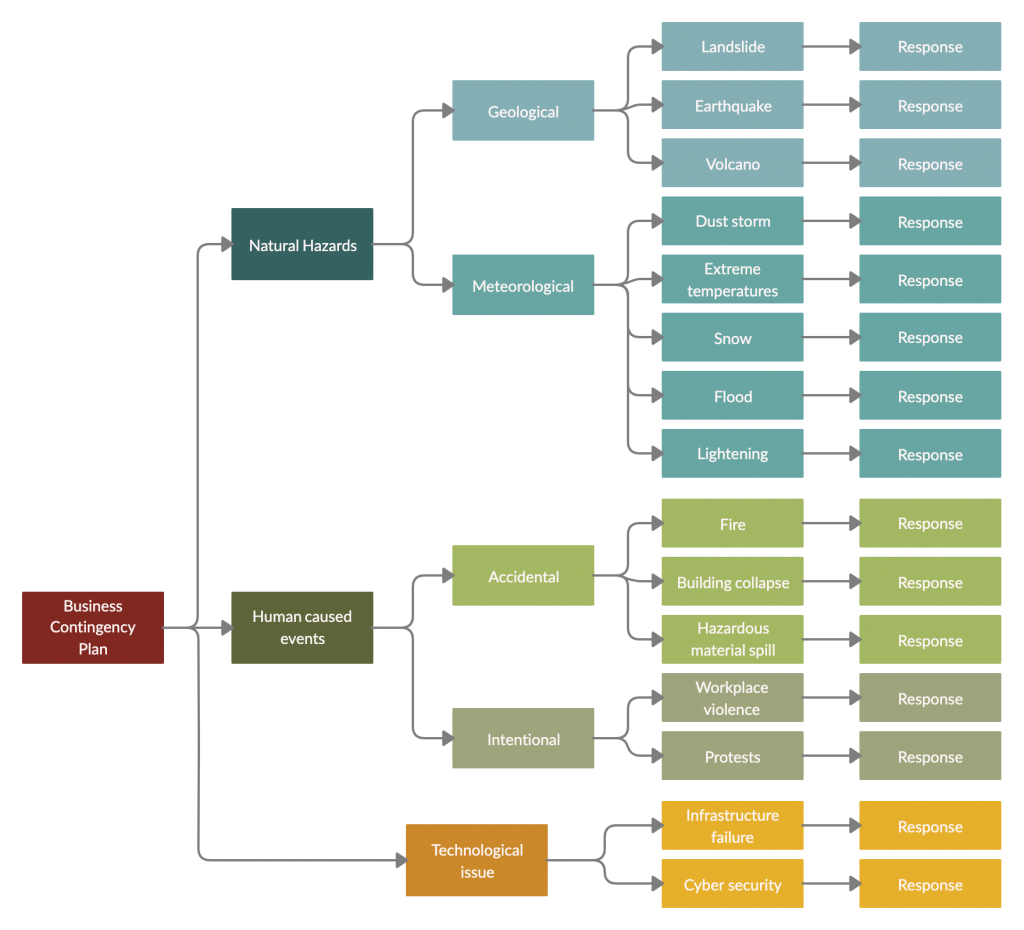

When choosing a business contingency plan template to follow, it can be helpful to pick between a few different visual options. Each template below from Creately offers a completely different visual experience and outlines different examples of business contingency plans. One may work better for you than another based on your business needs and your personal style preferences. Take a look at each template and see which one is easiest for you to follow visually.

Example #1

Example #2

Example #3

Where Does a Business Contingency Fit Into Your Overall Business Plan?

Although a business contingency plan is vital for every business, it’s only one piece of your overall business plan. The other components for your plan should include financial planning, strategic planning, and succession planning. When a business contingency plan is paired with them, you can get a good understanding of where your business is headed.

You’ll find that contingency planning complements your financial and strategic planning. After all, your overall vision may not come to fruition if you don’t have a backup plan. A business contingency plan takes a proactive approach to business management and can allow you to survive just about any crisis.

Business Contingency Plan vs. Business Continuity Plan

A business contingency plan is used to identify any potential business risks and clearly identifies what steps need to be taken by staff if one of those risks ever becomes a reality. A business continuity plan sounds similar in name and like a business contingency plan, aims to mitigate risks to the company. Business continuity plans outline a process that can help a company both prevent and recover from any major threats to the company. Ideally, this type of plan will help protect both staff and company assets in the event of some kind of emergency.

The Bottom Line

While you may not realize the importance of a business contingency plan when things are going well, you’ll be so glad you have one when an unforeseen circumstance arises.

If you’d like to protect the health and safety of your employees and customers, minimize interruptions and financial loss, and be able to resume operations quickly, you need a business contingency plan. In today’s unpredictable economic climate and competitive landscape, having a Plan B is not a luxury. It’s a necessity.

Anna Baluch

Anna Baluch is a freelance writer from Cleveland, Ohio, who enjoys writing about a variety of small business and personal finance topics. Her work can be seen on LendingTree, Credit Karma, Nav, Freedom Debt Relief, and a number of other well-known publications. When she’s not writing, she can be seen volunteering and trying new restaurants.