Form 1040X Instructions: How to File Form 1040X Amended Tax Return

This article has been reviewed by tax expert Erica Gellerman, CPA.

Form 1040X Amended Tax Return

The 1040X is an IRS tax form used to make adjustments to a personal tax return that’s already been filed with the IRS for the year, most typically Form 1040. IRS Form 1040X is not, however, used to correct simple mathematical errors, but rather to make changes for additional income, filing status updates, and dependent or exemption amendments.

When it comes to taxes, any business owner knows that the responsibility is two-fold. Not only do you have taxes to pay and file specifically for your business, but you also have to file your own personal tax return as well. Plus, with all of the possible tax liability from your business, you have more to grapple with when it comes to your personal return, especially if you’re self-employed. This being said, taxes (and the accounting behind them) are complicated—and if you file your Form 1040 individual income tax return and later realize there’s an error, you might worry about the repercussions you could face from the IRS.

Luckily, even the IRS knows that mistakes happen and they give you the opportunity to correct mistakes on your annual income tax return with an amended tax form: IRS Form 1040X. With Form 1040X, you can correct errors to a tax return you’ve already filed and submit the new form to the IRS. To help make the process easier, we’ve created this Form 1040X guide—we’ll discuss everything you need to know about the 1040X tax form—including where to find and file it, as well as provide a step-by-step break down of Form 1040X instructions.

What Is IRS Form 1040X?

IRS Form 1040X, also called the Amended U.S. Individual Income Tax Return, is a tax form used to correct errors from an individual’s personal income tax return that has already been filed with the IRS. Form 1040X can be used to make corrections on Form 1040, 1040A, 1040EZ, 1040XNR, or 1040NR EZ. If, therefore, you completed any of the aforementioned 1040 forms and filed them with the IRS, only to later discover a mistake, you can use 1040X to remedy those errors.

It should be noted, however, that in this case “errors” refers to correcting information that changes tax calculations. Any mathematical errors will be corrected by the IRS. If, for example, you claimed a dependent on your original Form 1040 that you shouldn’t have actually claimed, you would use Form 1040X to adjust this claim and recalculate your deductions. Likewise, if you made adjustments to your Schedule C that would affect your 1040 tax calculations, you would also file IRS Form 1040X to make the necessary corrections.

Who Needs to File Form 1040X

Since IRS Form 1040X is an amendment form, no one is required to complete it. However, if you do find an error that needs correcting, you should file this form to ensure that you’re meeting your personal tax obligations and to avoid fines or penalties from the IRS. This being said, the IRS defines four qualifications for why you would need to file a 1040X tax form: [1]

- As we mentioned earlier, to correct Form 1040, 1040A, 1040EZ, 1040NR, or 1040NR EZ.

- Make certain elections after the prescribed deadline.

- Change amounts previously adjusted by the IRS.

- Make a claim for a carryback due to a loss or unused credit.

Once again, you do not need to file the 1040X tax form for simple mathematical errors as the IRS will fix those on their own. Additionally, you do not need to file Form 1040X if you forgot to include a required form or schedule. The IRS will mail a request to you for you to complete these documents, as necessary.

When to File Form 1040X

Unlike other required tax forms, like the W-2 or 1099, for example, IRS Form 1040X does not have a specific date by which you must file. Instead, the IRS has some general filing guidelines for this tax form. First, you should only file Form 1040X after you’ve filed your original return and received any related refund. In addition, to receive a credit or a refund, you must file this amendment form within three years after the date you filed your original return or within two years after the date you paid the tax, whichever is later. For these purposes then, even if you filed your original return early, the IRS considers the form filed on the due date, April 15, for example. You would then have three years from that date to submit a 1040X amended tax return. Furthermore, the IRS Form 1040X instructions document details special case scenarios in which your timeline for submitting the amended tax form would differ—including in the cases of federally declared disasters, foreign tax credit or deduction, and bad debt or worthless security.

Where to Find Form 1040X

You can find the 1040X tax form on the IRS website. This form can either be completed online and printed, or printed and filled out by hand and mailed to the IRS. It’s important to note that even if you used a tax preparation software or the IRS E-file system to file your original 1040 electronically, you must mail the 1040X and file it physically. Once you’ve filed Form 1040X, it can take the IRS eight to 12 weeks to process it and may take as long as 16 weeks. After three weeks, however, you can track the status of your return using the IRS Amended Return tracking system.

Form 1040X Instructions

Now that we’ve explored the basics about the 1040X tax form, let’s break down the steps that you’ll need to take to complete the three parts and file the form with the IRS.

Step 1: Prepare the information you’ll need to complete Form 1040X, including your original return.

Before you start filling out a 1040X amended tax return, you’ll need to gather a handful of tax documents that you’ll need to complete it. The exact forms you need will ultimately depend on the specific error that you’re correcting. Regardless of the specific error, however, you will definitely need your original income tax return, that being whichever version of the 1040 you filed. You will need to consult the original form to make adjustments on Form 1040.

At this point, it’s important to note that the IRS made significant changes to Form 1040 in 2018—discontinuing the use of 1040A and 1040EZ and combining them into a new version of the Form 1040. [2] If, therefore, you are amending either of these discontinued forms with Form 1040X, you might find it helpful to fill out a new 1040 form first. You would not file this form with your 1040X, but you can use it to more easily complete the amendment form.

This being said, in addition to your original 1040, you should gather any other forms relevant to your amendment filing: W-2s, 1099s, schedules, or worksheets. You might also find it helpful, as the IRS in fact suggests, to make your calculation adjustments in the margins of your original Form 1040 and then transfer those numbers to Form 1040X.

Step 2: Fill in the first section of Form 1040X with your basic information and amended return filing status.

With all of your information gathered, you’ll want to start to complete Form 1040X by filling in the first section of the form on page one. As you’ll see in the photo below, you’ll need to indicate which calendar year this return is amending, as well as provide your:

- Name and SSN

- Spouse’s name and SSN (if applicable)

- Home address and phone number

You’ll also have to indicate your filing status (single, married, etc). If you’re completing the 1040X tax form to amend your filing status, you’ll check the box of the correct status here. Even if you’re not changing your status, you still must complete this box with your corresponding filing status. For amended tax returns in 2018 or earlier, in the “full-year health care coverage” box, you’ll check to affirm that you had qualifying health care coverage or a coverage exemption that covered all of the relevant tax year. If you can’t check this box, you may owe a shared responsibility payment.[3] Beginning in 2019 you will leave this box blank.

Photo credit: IRS

Step 3: Determine which lines (1-30) you need to complete.

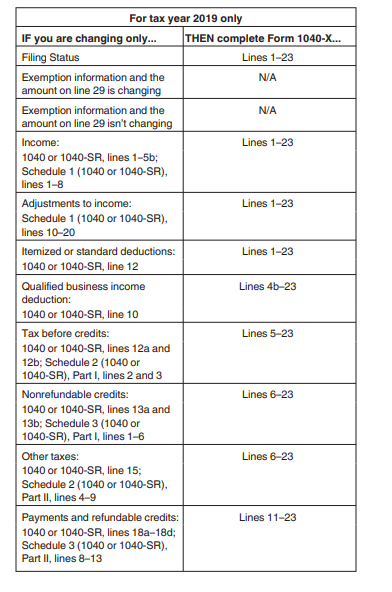

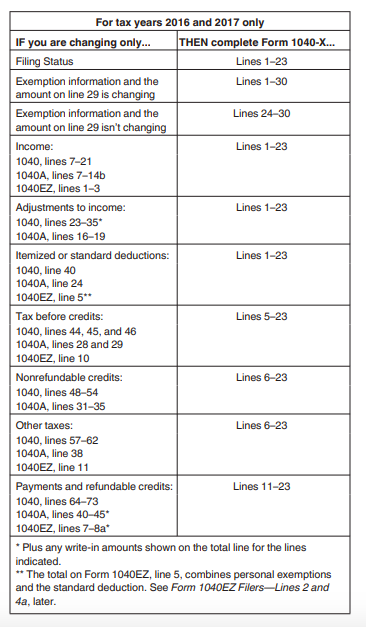

On the remainder of page one, you’ll see lines one through 23, starting with those categorized as income and deductions and ending with refund or amount you owe. On the second page, you’ll find Part 1, which contains lines 24 through 30. One of the most difficult parts of completing Form 1040X is determining which of these you need to complete and ultimately, it will depend on exactly what you’re amending by filling out this form. In the Form 1040X instructions document, however, the IRS provides three charts, one for 2019, one for 2018, and one for 2016 and 2017, (as shown below) to help guide you.

Photo credit: IRS

Photo credit: IRS

Photo credit: IRS

As you can see, these charts break down specific adjustments you might be making, like filing status or income, and list which lines of the 30 you need to complete based on your adjustments. If you’re still unsure of which lines to complete, we’d recommend consulting the “Which Lines to Complete” section of the 1040X instructions, and then the detailed descriptions the IRS provides of the individual lines.

Step 4: Fill in lines one through 23, as applicable.

Based on your specific circumstances as determined by the IRS guidelines, you’ll complete lines one through 23 on page one of the 1040X tax form. The amounts you’ll see on these lines will be very similar to those on your original 1040 return form. To complete these lines then, you’ll fill in column A, with the original amount you reported, column B, with the net changes aka the amount of increase or decrease, and column C, the correct amount. If you’re recording any losses or decreases (negative numbers), you should do so by putting the number in parentheses, i.e. (125).

By completing line items one through 23, therefore, you’ll be reporting your income and deductions, determining your tax liability, indicating the taxes you’ve paid, and finally, calculating whether you owe the IRS more in taxes or if you’ve overpaid. As you’ll see in the photo below, these categories are broken down to include:

- Adjusted gross income (line 1)

- Deductions (line 2)

- Exemptions (line 4)

- Business income deductions (line 4b)

- Taxable income (line 5)

- Tax liability (lines 6-11)

- Federal taxes withheld (line 12)

- Estimated tax payments (line 13)

- Earned income credit (line 14)

- Refundable credits (line 15)

- Total payments (lines 16 and 17)

- Overpayment (line 18)

- Amount you owe (line 20)

- If you overpaid, the amount you want refunded/applied to another tax year (lines 22 and 23)

Photo credit: IRS

As you’re completing this section of IRS Form 1040X, we would recommend following the form line by line, as some of the lines, like number three, require you to calculate based on other line items you’ve already filled out. Additionally, even if you’re consulting the IRS chart as pictured above, it’s helpful to double check each line as you go through and verify that it does or does not apply to your amended return.

Note, if you’re filing a tax return from 2018 or later, you will leave lines 24, 28, and 29 blank.

Step 5: Fill in Part I (lines 24-30), as applicable.

Next, you’ll fill in Part I of 1040X, which is actually on page two of the form. This part, as per its name, only needs to be completed if you’re changing information related to exemptions and dependents. Once again, you’ll see that lines 24 through 29 are broken up into three columns, A, B, and C. In these lines, you’ll record the original number of exemptions you reported (Column A), the net change (Column B), and the correct amount or number (Column C). You’ll follow along each line, reporting for you and your spouse as well as any dependents. Then, in line 28, you’ll record your total number of exemptions. In line 29 you’ll calculate and record your exemption amount by multiplying the total in line 28 by the amount shown in the instructions for line 29 for the year you’re amending.[4] Finally, in line item 30, you’ll record all dependents you’re claiming on this amended tax return.

Photo credit: IRS

Step 6: Fill in Part II.

In Part II of this form, you’ll be asked whether or not you or your spouse would like to have $3 go to the Presidential Election Campaign Fund. If you do, you’ll check the first box. If you’re filing jointly and your spouse wants to do this, you’ll check the second box. If you neither of these applies to you, you’ll leave Part II blank. It’s important to note that if you already indicated in your original return that you wanted $3 to go to this fund, you cannot change that decision on this form.

Photo credit: IRS

Step 7: Complete Part III by describing why you’re filing Form 1040X.

The last part of the 1040X tax form, Part III, asks you to explain the changes you’re making. This is perhaps the most important part of this form, as it gives you the opportunity to explain to the IRS why you’re filing this amended return. In this section, therefore, you’ll want to be specific about your reasoning. We’d suggest starting with an overall statement: “I’m filing IRS Form 1040X because I forgot to claim the child tax credit…” and continuing by briefly explaining each line throughout the form where you made changes.

Once you’ve completed Part III, you’ll be able to sign and date the form to complete it. If you’re filing jointly with your spouse, they must also sign and date the form. Finally, if you used a paid preparer, like a certified public accountant, you’ll have this person fill in the paid preparer section with their corresponding information.

Photo credit: IRS

Step 8: File Form 1040X With the IRS.

Once you’ve completed and reviewed Form 1040X, you can file it with the IRS. When you prepare to file the return, you’ll want to make sure to include any relevant schedules, forms, and supporting statements. Even if you used your original Form 1040 to fill out your amended return, you do not need to include a copy when you file 1040X unless the IRS has stated that you do so.

If after completing IRS Form 1040X, you owe additional taxes, you’ll want to pay those immediately to avoid a penalty. You have the option to pay electronically using one of the specified IRS payment methods—including credit card, IRS direct pay, electronic funds withdrawal, etc. On the other hand, if you’d prefer to pay with a check or money order, you can include either of these payments in the envelope with your 1040X return. After you’ve gathered all the components you need to include with your completed form, you can mail the return to the IRS. Once again, even if you filed your original 1040 return electronically, you can only file Form 1040X by mail. This being said, the IRS has different filing locations depending on your filing situation and state. You’ll want to double check the Form 1040X instructions document on the IRS website to confirm you’re mailing your return to the right address.

Form 1040X Amended Tax Return: Points to Remember

For a small business owner who has numerous forms to complete for your business taxes, you may face adjustments that make it necessary to file a personal 1040X amended tax return. Here are some important points you’ll want to keep in mind regarding this tax form:

- Form 1040X can only be filed by mail and you should only do so after receiving your original 1040 return and any related refund.

- Once you file Form 1040X, this then replaces your original 1040 form and becomes your new return for the year.

- You need to file any schedules, worksheets, or statements related to your personal tax return with your 1040X when you file.

- If you need to amend your federal 1040, you’ll want to determine if you need to amend your state tax return as well.

- You’ll want to pay any additional taxes you owe after amending your return to avoid penalties from the IRS.

- Amended returns often take a while to process, but after three weeks you can track the status of your 1040X on the IRS website.

If you do need to complete Form 1040X, you’ll want to be diligent in filing, and doing so correctly. As with your business tax forms, therefore, we’d recommend consulting a tax advisor or other professional who can help you with your personal tax returns as well. Tax professionals can answer any questions you have when completing the form and even fill it out on your behalf if you so choose. This being said, many business accountants can perform personal tax services in addition to the services they offer for your business taxes.

Article Sources:

Randa Kriss

Randa Kriss is a senior staff writer at Fundera.

At Fundera, Randa specializes in reviewing small business products, software, and services. Randa has written hundreds of reviews across a wide swath of business topics including ecommerce, merchant services, accounting, credit cards, bank accounts, loan products, and payroll and human resources solutions.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.

- Self-Employment Taxes and SECA: Tax Obligations for the Self-Employed

- Sales Taxes: The Ultimate Guide for Small Business Owners

- What Is a Business Audit, and What Types of Audits Should You Be Ready For?

- IRS Audit: How Business Owners Can Prepare for and Pass an Audit

- 1099 vs. W2 Employee: Which Is Better for Your Business?