Bench vs. QuickBooks—Which Is Right for Your Business?

Bench vs. QuickBooks: The Ultimate Comparison

Finding the right business accounting software can significantly streamline your financial processes, especially if you’ve been managing your books by hand. Luckily, between the tried-and-true solutions, like QuickBooks Online, to the newer players, like Bench, there are a number of competitive options for you to choose from. If you’re wondering specifically how Bench and QuickBooks compare to one another, we’re here to help.

In this Bench vs. QuickBooks comparison, we’ll break down these platforms in terms of features, pricing, and more so that you have all of the information you need to determine which (if either) is the better option for your small business.

Bench vs. QuickBooks: The Basics

To start, although Bench and QuickBooks Online both serve the same overarching purpose—to help you manage your basic bookkeeping and accounting processes—there are a few inherent differences between these two solutions that are important to understand.

First, whereas QuickBooks Online is generally a standalone accounting software, Bench Accounting is an online bookkeeping service—including their proprietary software as well as access to a professional bookkeeping team in all of their plans. Although QuickBooks Online has a companion service, QuickBooks Live, which gives you access to actual bookkeeping assistance (for additional costs), on the whole, you can purchase and use any of the QuickBooks plans on your own.

Therefore, and as we’ll discuss in greater detail below, the way QuickBooks and Bench structure and price their services is directly related to this crucial distinction.

This being said, you can see our Bench Accounting vs. QuickBooks Online comparison summarized in the chart below:

| Bench | QuickBooks Online | |

|---|---|---|

Plans |

3 different plans with distinct features |

4 plan levels with increasing features |

Cost |

Pricing starts at $249 a month for Core plan (if billed annually). |

Pricing starts at $25 per month for Simple Start plan |

Notable Features |

– Outsourced monthly bookkeeping and access to proprietary software included in all plans – Tax prep and financial reports are offered as part of bookkeeping service – Option to certain payment processors based on your plan |

– Feature-rich software across four different plans – Higher-level plans include advanced tools for inventory, time, and project tracking, and more – Option to add QuickBooks Live Bookkeeping to outsource bookkeeping processes |

Users |

Offers the ability to grant access to an accountant or business partner |

Varies based on the plan level |

Mobile App |

Bench app available for iOS users |

QuickBooks accounting app available for iOS and Android |

Integrations |

Can connect to financial accounts, but does not actually integrate with any third-party platforms |

Hundreds of integrations available, including Intuit products and third-party tools |

Customer Support |

Can contact your bookkeeping team by booking a call or messaging in-app, receive answers in one business day |

Customer support available via phone and live chat, priority support available for Advanced users |

Best For |

Businesses that are looking to outsource their bookkeeping |

Businesses that are looking for a fully functional and scalable accounting software |

Bench vs. QuickBooks: Features

With this overview in mind, let’s see what the Bench vs. QuickBooks comparison looks like in terms of features.

Bench Features

As we mentioned briefly above, Bench is both an accounting software and an online bookkeeping service—meaning with any of their plans, you have access to their proprietary, web-based software platform, as well as your team of professional bookkeepers. Thus, instead of managing your own books, Bench takes care of them for you, allowing you to monitor all correspondence and processes easily online.

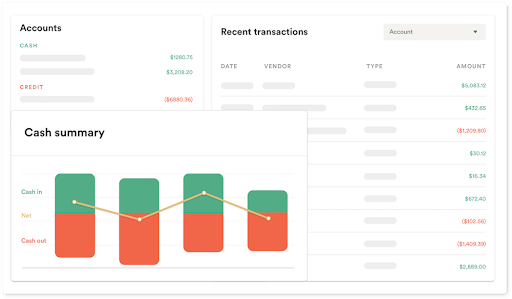

Example of the Bench software dashboard. Image source: Bench

Overall, you can expect the following with the Bench Accounting service:

- Access to a dedicated bookkeeper who will help you set up your account and show you how the Bench software works

- Receive monthly bookkeeping service (including peer review) in which your bookkeeper imports and categorizes your business transactions and performs reconciliation

- Ability to connect financial accounts—including bank accounts, credit cards, loans, and merchant processors

- Track your business’s financial health with real-time and monthly reporting; generate financial reports like income statements, balance sheets, and more

- Receive tax-specific support—including federal and state income tax filings

- Access catch-up bookkeeping services if you’re behind on your finances and need your books up-to-date (may require additional fees)

- View real-time cash flow tracking via the Bench Pulse dashboard

- Track your expenses by tagging transactions with labels such as products, clients, location, or sales channel

- Upload receipts or statements to Bench and access them at any time

- Access Bench online or using the mobile app for iOS devices

- Access unlimited one-on-one support; book a call or send an in-app message to your bookkeeper whenever you need

- View the status of your books through the Bench platform

- Grant account access to a business accountant or partner

As you can see, as an online bookkeeping service, the features of Bench are focused on basic bookkeeping and financial reports—taking on these monthly responsibilities on behalf of your business. If you think Bench is the right option for your business, you can get 30% off your first three months.

QuickBooks Online Features

With QuickBooks Online, the features are set up a little differently. On the whole, QuickBooks is a web-based accounting software that gives you all of the tools you need to manage your bookkeeping, accounting, and other related financial processes through their system. Unless you subscribe to QuickBooks Live (which we’ll discuss more below), QuickBooks Online will not give you access to professional bookkeepers or perform bookkeeping as part of your plan.

Example of the QuickBooks Online dashboard. Image source: QuickBooks

Example of the QuickBooks Online dashboard. Image source: QuickBooks

Thus, the specific functionality you receive with QuickBooks Online will largely depend on which of the four plans you choose—Simple Start, Essentials, Plus, or Advanced.

Simple Start

Simple Start is the most basic version of QuickBooks Online. With this plan, you’ll be able to:

- Connect your bank and other financial accounts and automatically import transactions

- Automatically sort transactions into tax categories

- Capture and upload digital receipts and match them to expenses

- Create and send customized invoices, track invoice statuses, automatically calculate taxes on invoices, and send payment reminders

- Create and send estimates, accept mobile signatures, track estimate status, and convert estimates to invoices

- Accept credit cards and bank transfers from your invoices; automatically match payments to invoices

- Grant account access to your accountant or export documents to share with them

- Track and categorize mileage using the QuickBooks app on your smartphone

- Run general reports for profit and loss statements, expenses, balance sheets, etc.; create customized reports

- Track cash flow and reporting through your dashboard

- Manage 1099 contractor payments

- Download and use the QuickBooks app for iOS or Android devices

- Connect to other Intuit products (Payroll, QuickBooks Live, etc.) as well as hundreds of third-party tools in the QuickBooks app store

- Access customer support via phone or chat

Essentials

The next level plan, Essentials, includes all of the features of the Simple Start plan, as well as:

- Enhanced reporting like sales, accounts receivable, and accounts payable reports

- Bill management tools to track bill statuses, record payments, and create recurring payments

- Time tracking to track billable hours by client or employee and automatically add them to invoices, as well as manual time entry for you or employees

- Option to integrate with TSheets for time tracking (additional costs required)

- Access for up to three users with controlled user-access levels

Plus

On top of all of the functionality of Simple Start and Essentials, the QuickBooks Plus plan also offers:

- More in-depth reporting options, including inventory reports, enhanced sales reports, profitability reports, and specific budgeting, expense, and class reports

- Access for up to five users

- Project profitability tracking through job costing for labor, payroll, and expenses

- Inventory tracking to monitor products, cost of goods, and receive notifications when inventory is low

- Purchase order creation and vendor management

Advanced

Finally, the last QuickBooks Online plan, Advanced, provides the greatest capabilities—offering all of the features of the previous three plans, plus:

- Bill pay for multiple vendors and contractors, synced payments, and ability to create checks from anywhere

- Access for up to 25 users, with customize access by role

- Advanced business analytics and insights with smart reporting by Fathom

- Batch invoices and expenses

- Receive a dedicated account manager from QuickBooks and access Priority Circle premium customer service

- Use automatic online back-up to restore a specific version of your company; view a log of version histories with account of all changes made

- Automated workflow creation

QuickBooks Live Bookkeeping

Compared to the Bench software, QuickBooks Online (regardless of plan) includes a much wider variety of features—beyond your basic bookkeeping tools. However, on their own, none of the QuickBooks plans offer outsourced bookkeeping; instead, you must manage your own processes through the platform.

To accommodate business owners who are looking for outsourced bookkeeping, however, QuickBooks does provide an add-on service, QuickBooks Live Bookkeeping, which includes many of the same features as Bench Accounting. QuickBooks Live Bookkeeping can be added to any of the four QuickBooks plans, but will require an additional monthly cost based on your expenses.

On the whole, QuickBooks Live Bookkeeping includes access to a team of bookkeepers who will:

- Set up your books, review and categorize transactions, and reconcile your accounts

- Run and review monthly financial reports

- Perform a customized year-end review with tax information for you to give to your accountant

- Provide ongoing support via on-demand chat and scheduled video conferences

Therefore, although these bookkeeping features are not included as part of QuickBooks Online (as they are with Bench) it’s important to note that QuickBooks does offer these services, they just do so in a different way.

Bench vs. QuickBooks: Pricing

Now that we have a better sense of the QuickBooks vs. Bench comparison in terms of features, let’s break down how they compare in terms of pricing.

Overall, both QuickBooks and Bench price their services on a subscription basis. With Bench, you’ll be able to choose between three plan options with monthly subscription prices. Bench also gives you the option to opt for an annual subscription and receive a discounted rate. With QuickBooks Online, your monthly subscription price will also be based on which of the four plans you choose (based on the features you need). Plus, if you want to add QuickBooks Live Bookkeeping, you’ll need to pay an additional monthly fee.

Bench Pricing

The Bench plan options are as follows:

- Core plan: $249 per month, billed annually ($299 per month).

- Includes a free business bank account from Lending Club

- Real-time accounting

- Run payroll exclusively with Gusto

- Connect with select payment processors

- Flex plan: $349 per month, billed annually ($399 per month).

- Allows you to link your existing bank accounts and debit cards

- Customized accounting with one add-on for free

- Connect with most major payroll platforms

- Connect with most major payment processors

- Pro plan: $449 per month, billed annually ($599 per month).

- Allows you to link your existing bank accounts and debit cards

- Specialized accounting

- Connect with most major payroll platforms

- Connect with most major payment processors

With Bench, you can cancel your subscription at any time; plus, you can first sign up for a free trial and work with the Bench team to ensure you have the right plan for your needs.

QuickBooks Online Pricing

The price of QuickBooks will depend on which of the four plans you choose. It’s also important to note that, unlike Bench, QuickBooks does not offer a pricing discount for opting for an annual subscription.

QuickBooks breaks down their pricing as follows:

- Simple Start: $25 per month

- Essentials: $50 per month

- Plus: $80 per month

- Advanced: $180 per month

There are instances in which you may incur additional costs with your QuickBooks Online plan. First, if you want to process online payments in QuickBooks, you’ll pay the transaction fees associated with those payments. Additionally, if you choose to use TSheets, QuickBooks Payroll, or another Intuit product, you’ll need to pay the costs associated with that service as well.

Plus, if you want to add bookkeeping services to your QuickBooks plan by opting for QuickBooks Live, you’ll need to pay an additional monthly cost based on your expenses. For QuickBooks Live, you’ll pay:

- $200 per month for $0 to $25,000 in monthly expenses

- $400 per month for $25,001 to $150,000 in monthly expenses

- $600 per month for monthly expenses $150,001 and over

Moreover, if you only want a bookkeeping setup, you can pay $50 for a one-time session with a QuickBooks Live bookkeeper.

QuickBooks does not require a contract and you can cancel your subscription at any time. You also have the option to sign up for a 30-day free trial of any QuickBooks Online plan or receive your first three months of the software at a discounted rate.

Bench vs. QuickBooks: How They Compare

Based on all of this information, you should have a better sense of what QuickBooks and Bench can offer to meet your business bookkeeping and accounting needs. So, how do these two products stand out against one another?

Ultimately, when it comes to Bench Accounting vs. QuickBooks Online, both platforms have their merits; however, much of their benefits will depend on what exactly you’re looking for in an accounting software and whether or not you’re trying to outsource your monthly bookkeeping.

Benefits of Bench

If you’re looking to completely outsource your business bookkeeping, there’s no doubt Bench is going to be a top solution for you. With Bench, you can rely on your team of bookkeepers to take care of your essential bookkeeping processes, as well as related financial tasks like tax preparation and reporting.

Additionally, as a web-based platform, Bench is user-friendly, easy to learn, and highly accessible, allowing you to access your financial data and work with your bookkeeping team regardless of location.

Plus, unlike many other online bookkeeping services that require you to pay for a separate software in addition to their service, Bench’s bookkeeping software and services are bundled into one monthly or annual subscription cost.

Therefore, while Bench may seem to be an expensive option, in reality, it’s competitively priced considering the level of service that’s included. Comparing the pricing to QuickBooks Live Bookkeeping, for example, the cheapest cost of QuickBooks is $25 per month for the Simple Start plan, plus $200 per month for the live bookkeeping, for a total of $225.

With Bench, however, your monthly price will be $249 per month with the Core plan (annual subscription price). Although this is slightly higher than the cost of QuickBooks, this plan also includes your business tax filings (which is not offered with QuickBooks Live Bookkeeping), as well as a free business bank account.

All of this being said, Bench is an ideal solution for business owners who have fairly straightforward bookkeeping needs and prefer to outsource these processes instead of managing them on their own or hiring an in-house professional.

Benefits of QuickBooks Online

Although Bench can handle bookkeeping on your behalf, QuickBooks allows you to manage more of your accounting tasks in one place. Even with the Simple Start plan, QuickBooks offers a range of features that Bench does not—from mileage tracking to invoicing to accepting payments. In this way, QuickBooks gives you the ability to streamline your financial processes beyond simple income and expense tracking and reconciliation—making it much more of an accounting software, as opposed to a bookkeeping software, like Bench.

Additionally, with four different plan levels, QuickBooks is highly scalable, allowing you to grow with your accounting software and upgrade your plan when your needs change. With the higher level plans, QuickBooks Online includes advanced capabilities like inventory tracking, job costing, bill pay, and more.

Plus, if there are any functionalities that you want that are not included in your QuickBooks Online plan, you have the option to integrate with hundreds of third-party tools to add those functionalities to your software. Of course, perhaps the most notable of these options is QuickBooks Live Bookkeeping, which grants you access to the same outsourced bookkeeping features as Bench, on top of the variety of capabilities included within the QuickBooks Online software.

In contrast, although Bench allows you to connect merchant processing accounts and recommends a partner network for financial tools, they do not offer any direct integration options. Therefore, QuickBooks is a much more functional software, even though you’ll need to pay for QuickBooks Live Bookkeeping on top of your monthly QuickBooks Online subscription to access the same personalized service as Bench.

Whether you’re planning to manage your own bookkeeping or work with a separate bookkeeper or other accounting professional, QuickBooks Online is better-suited for business owners looking to get the most out of their accounting software—as well as those who aren’t looking for outsourced bookkeeping above all else.

Choosing Between Bench Accounting vs. QuickBooks for Your Business

At the end of the day, it’s up to you to look at the QuickBooks vs. Bench comparison to decide which of these solutions is right for your business’s needs. However, as we’ve suggested throughout this guide, much of this decision will depend on what exactly you need from your bookkeeping and accounting platform.

If you’re looking for access to a straightforward software system with a team of professionals to handle your monthly bookkeeping, Bench is probably better-suited for your business. On the other hand, if you aren’t necessarily looking to outsource your financial processes and instead would prefer a well-rounded, scalable software solution, QuickBooks Online will likely be the better choice. Plus, when it comes to QuickBooks, it’s important to note that you always have the option to opt into QuickBooks Live Bookkeeping at a later time if you decide that you’d like that type of service.

Due to the inherent differences between Bench vs. QuickBooks, if you’re leaning toward one or the other, it might also be worth looking into top alternatives in their respective spaces to ensure you’re truly finding the best solution for your business. For example, if you are looking for outsourced virtual bookkeeping, you might also look into Wave accounting and their Wave Advisors service. On the other hand, if you’d prefer a self-service accounting platform with greater functionality, you might compare Xero or FreshBooks to QuickBooks Online.

Ultimately, one of the best approaches you can take to find the right bookkeeping or accounting software for you is to make a list of everything you’re looking for in a solution and compare all your options to these qualifications—this way, you can narrow down the platforms that will most closely meet your needs. Moreover, it’s always worth taking advantage of a free trial or demo, if offered, so that you can get a firsthand sense of how the system functions and whether it will actually work for your business.

Randa Kriss

Randa Kriss is a senior staff writer at Fundera.

At Fundera, Randa specializes in reviewing small business products, software, and services. Randa has written hundreds of reviews across a wide swath of business topics including ecommerce, merchant services, accounting, credit cards, bank accounts, loan products, and payroll and human resources solutions.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.