Business Property Tax: The Ultimate Guide

What Is Business Property Tax?

Business property tax is a tax that you pay on the assessed value of real property, like land or real estate, that your business owns. Your tax rate will be based on the assessed value of your business’s land or real estate, as opposed to the fair market value. Business property tax is regulated at the state and local level, and your local tax authority will notify you of the amount of annual taxes you’re responsible for paying.

Calculating and paying small business taxes is one of the more complicated and tedious parts of business ownership. Depending on your individual business, your tax responsibilities may be slightly different, but at the end of the day, you’ll still be held to federal, state, and local obligations. One of these more local tax obligations is business property tax, which can refer to physical land or a business location you own, as well as the personal property, or any goods or products, you use to operate your business.

Business property tax is generally handled at the local level, making your obligations greatly dependent on where your business is located. However, there is some overarching information business owners should know, which we’ll cover in this guide. We’ll break down what business property tax is, how to pay business property taxes, and offer guidance for business property tax deductions.

What Is Business Property Tax?

Business property tax is the tax you are responsible for paying on property, like land or real estate, that your business owns. Business property taxes are assessed at the local level, typically by the city or county where your business property is located. These taxes are a significant source of revenue for municipalities and are used for funding local schools, roads, public safety, government administrators, and more.

Similar to personal property taxes, your tax rate will be based on the assessed value of your business’s land or real estate, as opposed to the fair market value. Your local tax authority will determine the assessed value of your property and notify you of the amount of annual taxes you’re responsible for paying. However, in addition to the business property tax you’ll need to pay on your land or buildings, you may also be obligated to pay another type of business property tax, referred to as business personal property tax.

What Is Business Personal Property Tax?

In addition to your business’s real estate or land that can be subject to business property tax, you may be responsible for paying taxes on your business’s personal property as well. Business personal property, also referred to as tangible personal property, encompasses any goods or products that your business owns and uses for business purposes. Common examples of business personal property include:

- Furniture such as desks, cabinets, chairs, and machinery

- Fixtures

- Computers, telephones, and printers

- Business equipment like cash registers and fax machines

- General business tools and supplies

Like the taxes that are imposed on businesses for their land and real estate, your local tax authority may require that you pay taxes on these items as well. Typically, you’ll first pay sales tax on this business personal property when you buy it; however, you may also need to pay an annual value tax on this property, just as you would for land or real estate.

How Is Business Property Tax Calculated?

Unfortunately, one of the reasons that business property taxes are so complicated is because they’re variable. Unlike FICA taxes, for example, which are designated by the federal government and regulated by the IRS, business property tax is specific to states, cities, and counties. Therefore, your business property tax will be determined at the local level, based on your business’s location—and taxes will inevitably vary from municipality to municipality.

Generally, business property taxes are calculated by your local tax authority based on your property’s assessed value. While the method for determining your property’s assessed value can vary based on location, your assessed value is then used to calculate the business property tax you owe. Similarly, if you’re required to pay property taxes on your business’s personal property, you’ll also pay based on the assessed value of the property. The specific types of business personal property covered under the tax and the tax rate, however, will vary from one locale to another.

As an example, let’s explore more specifically how New York City calculates property taxes for businesses. According to the NYC Department of Finance, there are four steps involved:[1]

- Determining market value

- Determining assessed value

- Determining transitional assessed value, if applicable

- Applying exemptions, if applicable

Each of these steps involves multiple considerations throughout the process, depending on your specific situation. To start, NYC divides your property into one of four classes—business property, like an office building or store, is going to fall into class four.

Then, to determine the market value of your business property, the city will use your property’s income earning potential and expenses. Next, your assessed value is based on a percentage of your market value. The assessment ratio used for this calculation depends on your class. For tax class four, the assessment ratio is 45%. With this assessed value, the amount of property tax you owe is calculated by multiplying the taxable value (aka assessed value) of your property by the current tax rate for your property’s tax class.

Therefore, if the assessed value of your business property is $10,000, you would then multiply this value by the tax rate for class four, which for the 2018-2019 tax year is 10.514%. Your annual business property taxes, then, would be $1,051.40.[2]

In New York State, all property taxes are based on real property, meaning land or real estate. New York does not implement a personal property tax, meaning your business is only taxed based on the buildings or land you own, and not on any of your equipment, supplies, etc.

How to Pay Business Property Tax

As you can see, calculating business property tax is a lengthy process and the specifics depend wholly on where your property is located. How and when you pay your business property tax is also going to be determined by your city or county.

Your local tax authority will complete the assessment of your property and then send you this information, along with a bill for the taxes you owe, on a yearly (and sometimes more frequently) basis. Once you’ve received your business property tax bill, you’ll need to pay your owed amount by the date indicated. If you feel your assessment or tax amount is incorrect, you’ll be able to appeal to your town or city. This process will be dictated by the specific locale.

Returning to our example of business property taxes in NYC, the city sends out bills either semi-annually or quarterly depending on the value of your property. You have the option to pay your property tax bill electronically or by mail, but the Department of Finance recommends that you do it electronically.

If you live in a location where business personal property is incorporated into your business property tax, you might have to complete an annual listing form to provide your local tax office with the relevant information on these items. Your tax office would then use this list to determine the business personal property taxes you owe and would inform you as necessary, along with your assessment and bill for real business property taxes.

Business Property Tax for Buying or Selling

In addition to the business property taxes you’ll be responsible for paying on an annual basis as an owner of real estate or business personal property, you may also need to pay property taxes for the buying or selling of business property—like if, for example, you’re buying an existing business. The specifics of these taxes, once again, are dictated by your local authority. Some locales split the property tax burden between the buyer and the seller, based on how long each individual owned the property during the year. In New York City, you must pay a Real Property Transfer Tax on any sales or transfers of real property of over $25,000.

Business Property Tax Deductions

Although you’re responsible for paying the business property tax as specified by your local tax authority, you may have the opportunity to deduct these taxes as business expenses with the IRS. The IRS lays out their restrictions for these kinds of business tax deductions in Publication 535—saying that you can generally deduct real business property taxes if they’re based on the assessed value of the real estate. However, the IRS also states that you typically cannot deduct property taxes that are charged for local benefits and improvements and that increase the value of your property.

In terms of business personal property tax, on the other hand, the IRS allows you to deduct any state or local tax on these items, as a business expense, as long as the item is used for your business. You’ll be able to indicate any applicable deductions from business property tax on your Schedule C form when you’re filing your taxes.

Business Property Tax: Tips for Small Business Owners

Now that we’ve gone through the essential information you need to know with regard to business property tax, let’s explore a few tips worth considering, as a business owner, related to this particular tax obligation.

Consider Taxes When Choosing a Business Location

Business property taxes can be a significant factor in determining where your business should be located. As business property tax is extremely variable depending on state and city, you’ll certainly want to consider how the taxes in any particular location would affect your business. Some locales, as we’ve mentioned, charge property taxes on business personal property, as well as real property, and of course, some states and cities generally have higher property tax rates than others.

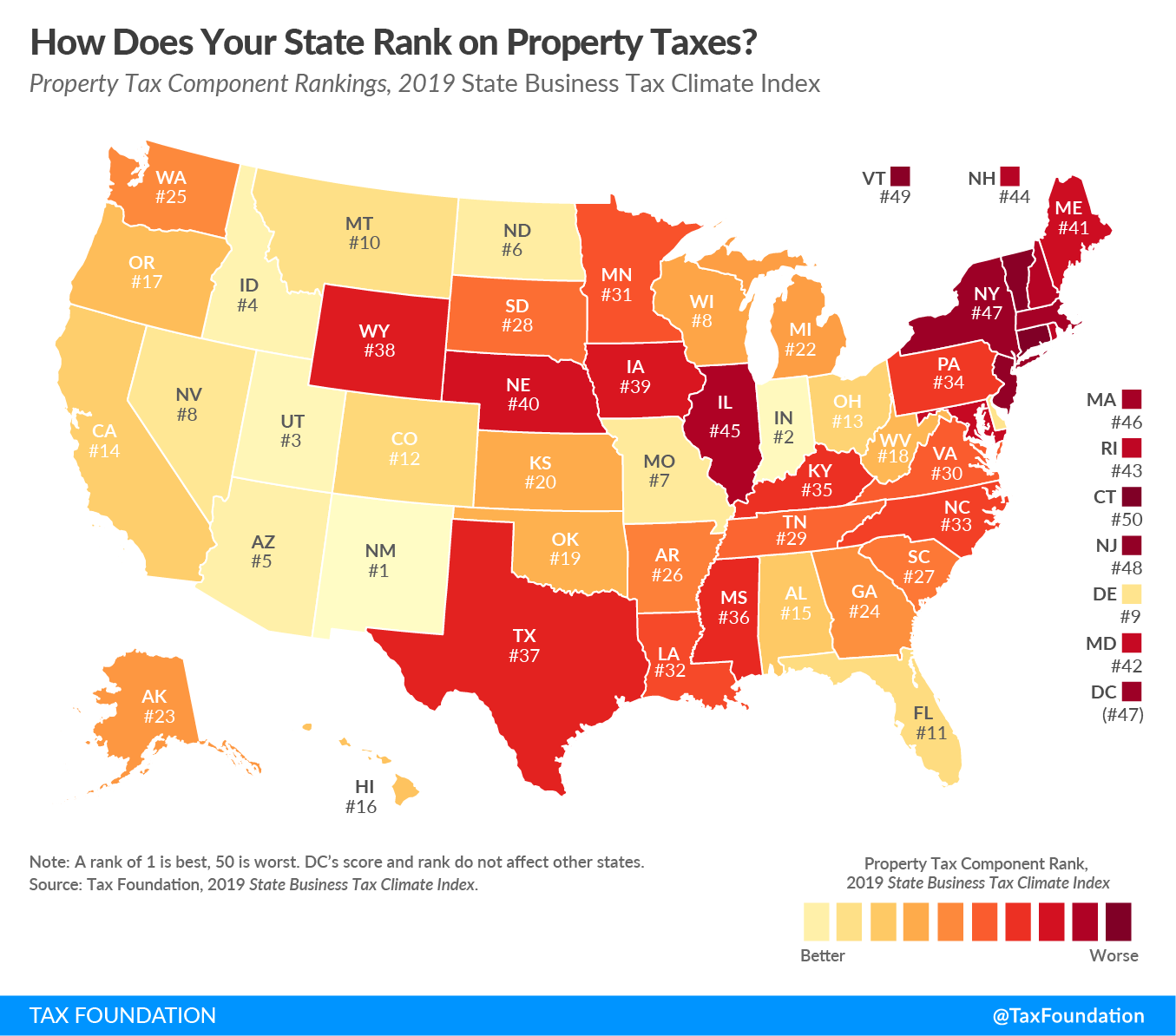

Therefore, since taxes will feature heavily into your business financials, it’s certainly worth considering the possibility of lowering your property tax obligations based on location. This being said, according to the Tax Foundation, New Mexico, Indiana, and Utah are the states with the best property taxes for businesses, while Connecticut, Vermont, and New Jersey are the worst.[3]

Source: Tax Foundation

Before you buy a property for your business, you may want to work with your business team and advisors to determine which location will benefit you best in terms of property taxes—especially if you’re looking to establish your principal place of business.

Familiarize Yourself With Local Laws

As we’ve discussed, business property tax is dictated at the state and local level. Therefore, before you buy business property, or even after you have, you’ll want to talk to your local tax authorities and familiarize yourself with local laws. Although we often consider IRS business forms the biggest tax burden on small businesses, you don’t want to forget about the obligations, like property tax, that you owe to local authorities as well. These obligations, of course, can extend beyond property tax and may have an additional impact on the way you conduct business.

Review Your Property Listing Forms

When you receive your business property tax bill, or annual property listing form, you’ll want to make sure you review them carefully, especially if your real or personal property has changed. According to Paige Knight from Gurian PLLC, one of the most common business property tax mistakes that their Dallas-based CPA firm sees is business owners forgetting to remove personal property that is no longer in service from the listing form. This omission leads to an inflated tax bill.

Similarly, the second most common mistake Gurian finds is including assets on the property listing form that should not be there—either because they are exempt or because they’re real property (only personal property needs to be included here). This being said, if you’re required to complete a business property listing form to inform your local tax authority of your tax liability, you should take extra care to make sure it’s up to date and reflected accurately on your property tax bill.

Work With a Tax Advisor

Although we’d recommend that you work with a tax advisor for all of your business taxes, this tip might be even more significant when it comes to business property tax. Since business property tax is so specific and localized, you’ll want to make sure that the tax professional you choose—whether a CPA, tax lawyer, or enrolled agent, is familiar with the tax laws in your particular location.

Any of these individuals, however, should be able to walk you through your business property tax and other tax obligations, answer any questions you may have, and help you complete and file any necessary tax forms. At the end of the day, working with a business tax advisor can help ease your tax burden by helping you remain compliant with tax laws and preventing any fees or penalties.

Utilize an Accounting or Tax Software

Similarly, you may consider using business accounting software to keep track of your business financials, expenses, and tax obligations, as another way to help simplify and expedite your business’s tax processes. In fact, some accounting software platforms help you complete tax forms or even file taxes on your behalf.

Nevertheless, utilizing an accounting software will keep you organized and make it easier and quicker to complete your business taxes, even if you’re working with a professional. When it comes to local-specific taxes, like the business property tax, you’ll want to see how your accounting software or other tax platform handles state and local taxes.

Pay Attention to Possible Exemptions or Deductions

If you work with a tax professional, or even if you complete your business taxes on your own, you’ll want to pay close attention to any possible exemptions or deductions, especially when it comes to business property tax. We briefly mentioned exemptions earlier, but generally, as is the case with many types of taxes, your local tax authority may offer tax exemptions for specific kinds of businesses and properties, like nonprofits, historical lands, or agricultural properties.

Since business property tax can be quite expensive, you’ll want to determine if your business can qualify for any exemptions under the law. In addition, you’ll want to see if you can save your business money with property tax deductions. Although the IRS specifications for these kinds of deductions can be confusing, a tax professional should be able to help you identify the most claims and receive the best possible business tax refund.

Business Property Tax: The Bottom Line

Ultimately, business property tax is just another piece in the larger responsibility that is business taxes. While it can feel overwhelming, you’ll want to ensure that you take the necessary time to research your local tax authority and your corresponding obligations to complete your business property taxes accurately.

As business property tax is designated at the local level, you’ll also want to make sure any professional that you hire to help you with accounting or taxes understands the business tax laws that are relevant to your location. In addition, since business property tax may be one of the most expensive taxes your business incurs, you’ll want to consider the local tax rates before buying business property. As with all business taxes, though, patience and attention to detail can help ensure your business property tax responsibilities are met so your business can continue running smoothly.

Article Sources:

- NYC.gov. “Calculating Your Property Taxes“

- NYC.gov. “Tax Bills and Payments“

- Taxfoundation.org. “Ranking Property Taxes on the 2019 State Business Tax Climate Index“

Randa Kriss

Randa Kriss is a senior staff writer at Fundera.

At Fundera, Randa specializes in reviewing small business products, software, and services. Randa has written hundreds of reviews across a wide swath of business topics including ecommerce, merchant services, accounting, credit cards, bank accounts, loan products, and payroll and human resources solutions.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.

- Form 1040X Instructions: How to File Form 1040X Amended Tax Return

- Self-Employment Taxes and SECA: Tax Obligations for the Self-Employed

- Sales Taxes: The Ultimate Guide for Small Business Owners

- What Is a Business Audit, and What Types of Audits Should You Be Ready For?

- IRS Audit: How Business Owners Can Prepare for and Pass an Audit