The Ultimate Guide to Cash Flow Projections

What Is a Cash Flow Projection?

Cash flow projections are the amount of money you expect to flow into and out of your business within a given timeframe. What makes cash flow projections different from cash flow forecasts is that cash flow projections assume some type of hypothetical scenario, like an increase in prices or hiring a new employee, to determine a best- case and worst-case scenario for what cash flow might look like in the future. Business owners use cash flow projections to better understand how business decisions will impact their future cash flow.

When it comes to managing your small business finances, cash flow is king. Eighty-two percent of business failures can be attributed to poor cash flow.[1] In order to keep in control of your cash, you need accurate cash flow projections. This means using data you already know about your cash flow and extrapolating it forward in time.

There are several different types of cash flow projections, and a lot of great business reasons for keeping accurate cash flow projections. With an accurate cash flow projection, you can see the consequences business decisions you make today will have in the future.

In this guide, we’re going to tell you everything you need to know about cash flow projections. But to start, let’s learn a bit more about what cash flow is, and why it matters.

What Is Cash Flow?

Simply put, cash flow is the net amount of cash moving into and out of a business at any given time. Understanding your cash flow provides you with a better idea of your business’s liquidity, flexibility, and overall financial performance. Businesses can either be cash flow positive, or cash flow negative.

Being cash flow positive means you have more money going into your business at any given time than you have going out. The operative word here is “time.” If you’re not cash flow positive at a specific time, it could have dire consequences for your business.

For example, imagine that over the course of a month, your company has a sales volume of $50,000. At the beginning of the month, you estimate your costs in rent, payroll, and raw materials at about $46,000. That leaves you with $4,000 in profit, right? Well, let’s say about $5000 of that $50,000 in sales volume is still outstanding—meaning clients haven’t paid you yet. Therefore, at the end of the month, you actually only have$45,000 in cash inflow, and $46,000 in cash outflow—you’re $1,000 in the hole.

This might not be a big deal, but if it happens repeatedly over the course of several months, you might be unable to afford rent, or pay your staff. Then you’ve got big problems. Therefore, it’s extremely important to stay cash flow positive.

If you need to figure out your cash flow, start with our free cash flow template to help with your cash flow analysis.

Cash Flow vs. Profit

When talking about cash flow and cash flow projections, it’s also important to mention profit. The main goal of operating a business is profit, but as the example above shows, being cash flow positive can sometimes be more important than turning a profit. In fact, you can be cash flow positive without being profitable, and vice versa.

Profit is a measurement of what you have left over after your expenses are paid. In the above example, the business truly does have $4,000 in profit at the end of the month, but because they also had $5,000 in accounts receivable, their cash flow was negative. If a business is waiting on a large invoice to be paid over the course of several months, their cash flow may run negative, even if that payment helps the business turn a profit.

Ideally, you want to be cash flow positive and profitable at the same time. But the reality is that many businesses turn a profit while facing scary bouts of negative cash flow at various times throughout the year.

What Is a Cash Flow Projection?

Now that we know what cash flow is (and what it isn’t), we’re equipped to talk about cash flow projections. A cash flow projection is an estimate of the money you expect to flow in and out of your business over a given period of time based on some sort of additional factor. With a cash flow projection, you can factor in a future hypothetical situation—such as an increase in prices—and work it into your assumption on future cash flow.

Running cash flow projections is a useful technique when evaluating new ideas, strategies, and financing opportunities because they give you a best-case and worst-case scenario from a cash flow perspective. You can estimate the effects of a business change (such as hiring a new employee), show lenders you can pay back a loan on time, and compare expenses for different income periods. Using cash flow projections is key if you hope to manage cash flow responsibly.

Cash Flow Projection vs. Cash Flow Forecast

At this point, you might be thinking that a cash flow projection sounds awfully similar to a cash flow forecast. You’re not wrong.

A cash flow forecast is an estimate of how much money will flow in and out of your business at any given time. It is used to evaluate your future financial position from a cash flow perspective. When you make a cash flow forecast, you’re judging what your future cash flow will be based on anticipated payments, receivables, as well as capital investment and debt financing. Put another way, cash flow forecasting is a way to ensure that the business will have enough cash on hand to continue operating and avoid funding issues.

The cash flow forecast is different from the cash flow projection in one key way: A forecast is a prediction of the most likely future cash flow income, whereas a projection will factor in an alternative scenario to determine what future cash flow might look like. Both a cash flow forecast and a cash flow projection are based on key historical data, but the cash flow projection includes the added wrinkle of a hypothetical assumption.

Using both a cash flow forecast and cash flow projection gives you the clearest picture of your future cash flow position. Start by running a cash flow forecast to determine the most likely future cash flow scenario, then factor in cash flow projections to see how different business events will change your forecasted cash flow.

How to Create a Cash Flow Projection

To accurately project cash flow, you must start by creating a cash flow forecast. That’s because your cash flow projections are directly tied to the results of your cash flow forecast.

To get started with your cash flow forecast, you’ll first want to create forecasts for sales and profit and loss. This will help you build a better understanding of your cash flow forecast. Let’s break this down into a step-by-step process.

- Create a sales forecast: A sales forecast is a projection of how much you expect to sell in the future, typically broken down month by month. Your sales forecast should factor in your previous year’s sales figures, any new products you might sell, your ideal sales mix, and any new business you’re hoping to win.

- Create a profit and loss forecast: You can use your sales forecast to create your profit and loss forecast. This forecast will combine your business’s income with the day-to-day expenses of running the business. Costs that should be factored into the P&L forecast include raw materials or inventory, staff wages, third-party services like payroll software or freelancer contracts, and general operating expenses like rent and electricity. Also be sure to record the costs in your P&L forecast in the month you incur them for accuracy.

- Create a cash flow forecast: With these two documents in hand, you can create your cash flow forecast. Start by using your sales forecast to estimate how much money you expect to come in and when the money will be available. Next, subtract the costs from your profit and loss statement, making sure to include the costs in the months you plan to pay them. Add up all the money spent each month, and subtract it from the money coming in to get your net cash flow. Use that number as if it were your bank balance at the end of the previous month. Then look at your bank balance at the end of the current month. If your bank balance is decreasing, you might need to take out a business loan to remain cash flow positive. If it’s rising, perhaps it’s time to reinvest some of that money into your business.

So that’s the cash flow forecast. Now, how do we turn that into a cash flow projection? Well, let’s say you run a business called ABC Marketing. You’re considering hiring a new director of sales, and you want to know how the added payroll overhead will affect your cash flow over the next year.

To start, you’d add the cost of this new role to your P&L forecast, making note of the costs associated with employing this position. You’d then use historical data to determine how having a new director of sales will impact your sales forecast. In what ways can this person increase revenue? How will they make other members of the organization perform better? Can they help you win any new business?

Once you have an idea of these numbers, you’d use the data in your sales and P&L forecasts to create a cash flow projection. If carrying this position increases your cash flow month-over-month, you should probably move forward with the hire. If not, maybe hold off on hiring a director of sales for now. It’s also important to note that hiring for this position may negatively impact cash flow to start, but increase it in the long run as the individual ramps up.

Obviously, cash flow projections aren’t perfect, and depend on a lot of variables. But they are a tool that can provide valuable piece of mind for business owners trying to make smart decisions.

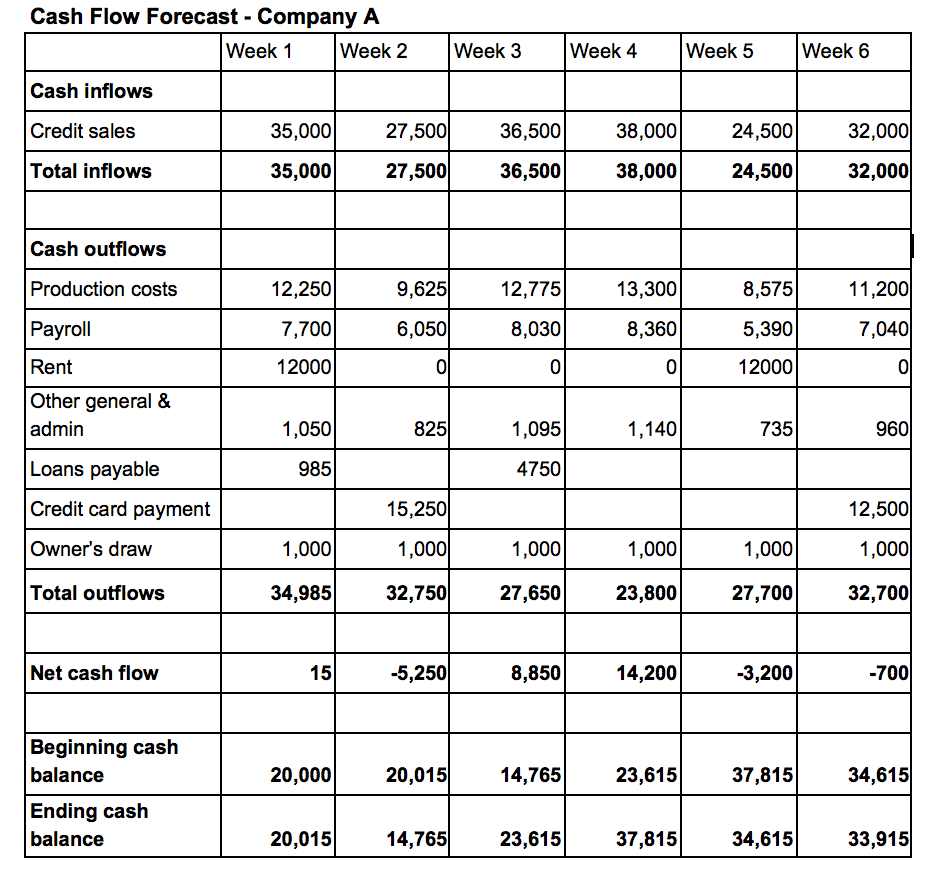

To get started with your cash flow projection, use this cash flow projection template.

The Final Word

As you can see, cash flow projections are a useful technique to employ when trying to determine the financial impact of business maneuvers. If you’re planning any future changes to your business, be sure to perform a cash flow projection to ensure the move doesn’t put you in an untenable financial position. When deployed correctly, cash flow projections can tell you what’s worth your while, and help grow your business.

Article Sources:

- PreferredCFO.com. “Cash Flow: The Reason 82% of Small Businesses Fail“

Seth David

Seth David is the chief nerd and president of Nerd Enterprises, Inc. which provides consulting and training services in accounting and productivity based software. Consulting services range from basic bookkeeping to CFO-level services such as financial modeling.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.

- Using Assets, Liabilities, and Equity to Check Your Business’s Financial Health

- Cash Flow vs. Profit: Everything You Need to Know

- Current Assets Formula: What It Is, Calculation, and Example

- Divestiture Definition: What Is Divestiture in Business?

- Certified Business Appraisal: What It Is and Why It Matters