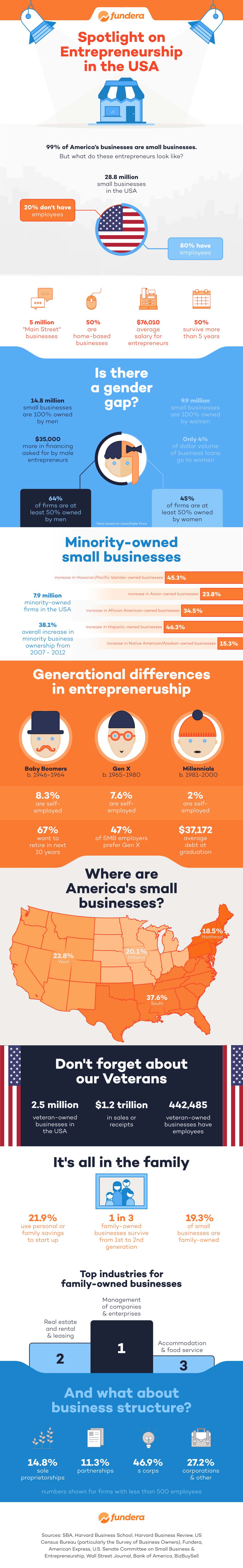

Infographic: Spotlight on Entrepreneurship in the USA

There’s never been a more exciting time to be a small business owner in America. There are more than 28 million small businesses, entrepreneurship is seen as a viable career path, and individuals looking to start up a company have access to a ton of resources.

At Fundera, we see statistics about small businesses and business growth on a daily basis, and we’re always trying to find the most interesting and helpful numbers for our readers.

Recently, we realized that there’s so much information on the web about entrepreneurship but no centralized hub with all of our favorite statistics. We know how busy you are as a small business owner, so we made a nifty infographic to collect this information in one spot.

Keep reading to see our major takeaways and check out the full infographic below!

American small business owners share certain common qualities.

Of the 28.8 million small businesses in the US: 80% have employees, 50% are home-based, and 50% survive more than 5 years. Additionally, the average American entrepreneur pulls in a comfortable salary of $76,010.

That’s higher than the average household salary in the United States—$73,298!

American entrepreneurs are located across the country—but the highest percentage is concentrated in the South and the West.

S corps and corporations are the most popular business structures, with 74.1% of small businesses using these two structures.

There is a clear gender gap in small business.

The numbers don’t lie. There are 14.8 million small businesses owned completely by male entrepreneurs, but only 9.9 million of small businesses are owned by female entrepreneurs.

That’s a difference of nearly 5 million businesses! To put it in perspective, the population of Colorado is 5.4 million.

To increase the gap, the landscape is heavily in the favor of male entrepreneurs. From our data, we know that men ask for $35,000 more in financing when applying for a loan on Fundera. This affects the amount of financing received by male-owned businesses.

Additionally, only 4% of the volume of business loans across the board goes to women entrepreneurs. These are statistics that can’t be ignored and need to be addressed.

Minority-owned business ownership is on the rise.

From 2008 to 2012, there was a 38.1% increase in minority business ownership. And that increase represents positive growth across the board—in Hawaiian/Pacific-Islander-owned businesses, Asian-owned businesses, African-American-owned businesses, Hispanic-owned businesses, and Native-American/Alaskan-owned businesses.

Business ownership increases with age.

When we looked at business ownership by generation, baby boomers beat out both Gen X and millennials in the rate of self-employment. Nearly 1 in 10 baby boomers are self-employed, while the rate for Gen X is 7.6% and the rate for millennials is 2%.

We were not largely surprised by these generational differences—there’s a correlation with self-employment and experience level.

Veterans account for roughly 1 in 10 business owners.

As for businesses run by veterans, 2.5 million of American companies fall under this category—nearly 10% of small businesses are owned by veterans.

And the businesses are successful as they add $1.2 trillion in sales and receipts to the US economy. That’s a statistic that can’t be ignored as it’s about equal to the GDP of Mexico!

It’s all in the family.

While only 19.3% of small businesses are family-owned, family involvement helps start up small businesses across the board. 21.9% of entrepreneurs cited using personal or family savings to get their companies going.

We hope you find these statistics helpful in learning about entrepreneurship and small business trends in the United States!

Want to use this infographic on your site? Go ahead! Just make sure to give a link back to Fundera.

Meredith Wood

Meredith Wood is the founding editor of the Fundera Ledger and a GM at NerdWallet.

Meredith launched the Fundera Ledger in 2014. She has specialized in financial advice for small business owners for almost a decade. Meredith is frequently sought out for her expertise in small business lending and financial management.

Related Posts

- Gender Bias in Small Business: How People Unknowingly Judge Businesses Owned by Women

- New Study: The Best States for Women Entrepreneurs in 2017

- How Many Jobs Do Small Businesses Really Create?

- How to Start a Business in the Top Cities for Growth Entrepreneurship

- The Ultimate Countdown: New Jersey’s 5 Best Cities for Entrepreneurs