How to Calculate Cash Flow for Your Business

How to Calculate Cash Flow: 4 Formulas to Use

- Cash flow = Cash from operating activities +(-) Cash from investing activities + Cash from financing activities

- Cash flow forecast = Beginning cash + Projected inflows – Projected outflows

- Operating cash flow = Net income + Non-cash expenses – Increases in working capital

- Discounted cash flow (DCF) = Sum of cash flow in period ÷ (1 + Discount rate) ^ Period number

When it comes to your business accounting, there are a number of different formulas and statements you can use to evaluate your financial health. Luckily, if you use an automated accounting or bookkeeping software, pulling reports and making financial calculations are relatively simple. However, even if you do use a software platform, it’s still important to understand how to calculate some of the most significant metrics that serve as a measure of your business’s health—like cash flow.

Knowing how to calculate cash flow can be useful if you’re managing your finances through a spreadsheet program, like Excel, or simply to give you a better sense of what goes into the automation of your accounting software—especially since calculating your cash flow can show where your business stands financially and give insight into what it needs to do to grow.

In this guide, we’ll explain four formulas that can be used to calculate cash flow, how they work, and how you can use each result to inform your business’s financial decisions.

Overview

It’s easiest to think of cash flow as the net amount of cash moving into and out of a business at any given time. In this way, performing a cash flow analysis can give you a better idea of your business’s liquidity, flexibility, and overall financial performance.

This being said, however, there are actually multiple ways to calculate cash flow—depending on what type of analysis you’re looking to perform and the specific cash flow formula you use. Below, we’ll explain how to calculate cash flow in four different ways:

How to Calculate Cash Flow With a Cash Flow Statement

First, let’s discuss how to calculate cash flow in the most common way—through a cash flow statement, also called a statement of cash flows. The cash flow statement shows the flow of cash into and out of your business during a specific period of time and is one of the three core financial statements within business accounting.

This being said, to calculate cash flow in this way, you’ll use the following formula:

Cash from operating activities +(-) Cash from investing activities +(-) Cash from financing activities + Beginning cash balance = Ending cash balance

To start, it’s important to know that this cash flow formula uses information from both your profit and loss statement and your balance sheet to show the sources of cash inflows and outflows during a specific period.

From these statements, therefore, you’ll be able to pull the following and plug the data into the formula above:

- Operating activities: Cash generated or used to run the day-to-day operations of your business.

- Investing activities: Cash used for investing in assets like securities, bonds, equipment, or other fixed assets and cash generated from the sale of these types of assets.

- Financing activities: Cash generated from loan or capital contributions by owners and payments made to reduce loan balances or pay distributions or dividends to the shareholders or owners.

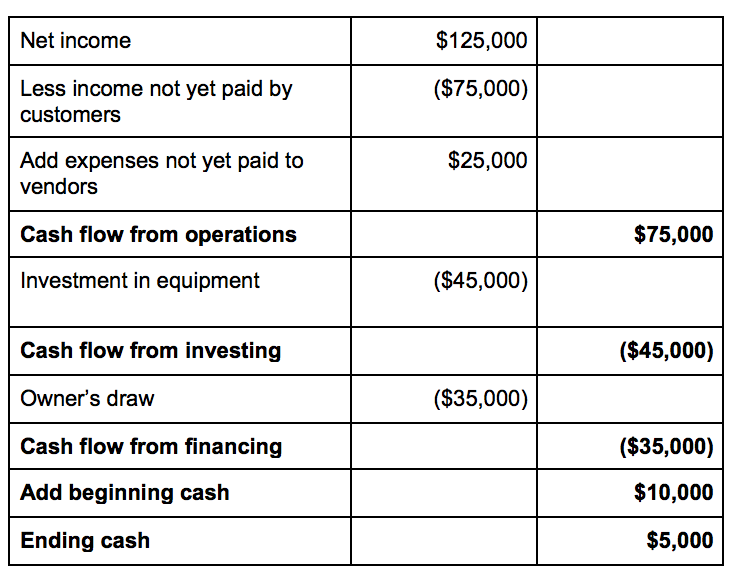

Let’s look at an example: Company A has $125,000 of annual profit but only $5,000 in the bank at the end of the year. We can use the cash flow formula to get a better sense of why this is the case and illustrate the difference between cash flow vs. profit. As you’ll see in the chart below:

Cash from operating activities: $75,000 +(-) Cash from investing activities: $45,000 +(-) Cash from financing activities $35,000 + Beginning cash balance: $10,000 = Ending cash balance: $5,000

To explain in greater detail, although Company A was profitable, they still had $75,000 uncollected from their customers and owed vendors $25,000 at the end of the year. These non-cash transactions result in a cash basis income of only $75,000 for the period. They also used $45,000 to purchase new equipment, and the owner took out $35,000 as a draw from the company, which left only $5,000 in the bank at the end of the year.

Therefore, using our cash flow formula to create this statement shows how Company A is managing their money, and more specifically, what types of activities are contributing to the cash inflows and outflows. By evaluating this statement, Company A can determine what they need to do to increase their cash flow and grow their business.

In this way, learning how to calculate cash flow by creating a cash flow statement is an essential part of managing your business finances.

All of this being said, most accounting or bookkeeping software platforms will have a way for you to create this report automatically. However, if you want to calculate your own cash flow statement, you can start with our free cash flow template to help with your analysis.

How to Calculate Cash Flow Using a Cash Flow Forecast

Although creating a cash flow statement using the corresponding formula is perhaps the most common way to calculate cash flow, it’s not the only way. Whereas the cash flow statement shows the cash status of your business at any given time, a cash flow forecast can help your business predict what your cash balance will be in the future.

This report can help you determine whether your business will be able to meet its financial obligations by taking into account the current cash balance and adding or subtracting expected future cash inflows and outflows. A cash flow forecast is a great financial calculator in that it’s forward-leaning and can help you make decisions for the future, like indicating whether it’s a good time to consider making an investment or to seek funding from business loans, cash flow loans, sales of property, or investors.

With this in mind, here’s how to calculate cash flow for the future:

You’ll start with your current cash balance and add the amount of cash you expect to receive during the forecast period. This could be cash from customers, loan proceeds, or cash from investors.

Then, you’ll deduct your expected cash outflows for the period including things such as unpaid bills to vendors, loan payments, payroll, and other fixed expenses that must be paid during the period. A cash flow forecast is typically reported by a specific period such as a week, month, or quarter.

The cash flow formula for the forecast will look like this:

Beginning cash + Projected inflows – Projected outflows = Ending cash

To clarify, let’s look at the example shown in the chart below: Company A wants to buy a new machine for $25,000 in order to increase production to meet customer demands, and they need to decide whether to finance the purchase or pay with cash. Either way, the bank requires that they maintain a balance of $15,000 in their account at all times. The owner knows how to calculate cash flow and has done an analysis of the expected cash inflows and outflows for the next six weeks.

As you can see, by using the formula: Beginning cash: $20,000 + Projected inflows: $35,000 – Projected outflows: $34,985 = Ending cash: $20,015—he can predict the ending cash balance for each week.

Overall, then, this forecast indicates a few things:

Overall, then, this forecast indicates a few things:

- In week two, the cash balance is expected to fall below the $15,000 minimum balance required by the bank, so perhaps the owner can defer his $1,000 draw until the third week when there is a surplus of cash.

- The ending balance at the end of week six is $33,915, which is only $18,915 more than the required minimum balance and therefore, doesn’t leave enough cash to purchase the equipment.

By knowing how to calculate cash flow and preparing the cash flow forecast, Company A determines that in order to purchase the machine during the next six weeks, they need to seek outside financing for at least part of the purchase so they can maintain their minimum required balance and be able to meet their other financial obligations.

As you can see, a cash flow formula like the one used in a cash flow forecast can be essential in helping you make day-to-day decisions for your business finances. It can help you plan when to spend money and be much more deliberate with where and when your money goes.

How to Calculate Operating Cash Flow

Next, in addition to calculating cash flow and creating a cash flow forecast, it’s also worth understanding how to calculate operating cash flow. Operating cash flow is the amount of cash generated by the regular operating activities of a business within a given period of time. It is used to determine exactly how much money a business will have on hand within a given period of time to cover operating expenses.

The formula for calculating operating cash flow is as follows:

Operating cash flow = Net income + Non-cash expenses – Increases in working capital

Therefore, (and as shown in the chart below) to calculate operating cash flow, you’d start with the net income from the bottom of your income statement. All non-cash items are added to your net income, such as depreciation, stock-based compensation, and deferred taxes. Once you have this number, you’d subtract changes in working capital. This includes changes in inventory, increases in accounts receivable, and increases in accounts payable.

As you can see, Net income: $100,000 + Non-cash expenses: $85,000 – Increases in working capital: $135,000 = Operating cash flow: $50,000.

With this calculation, you can get a better sense of what your cash flow typically looks like on a day-to-day basis. This can be used to help you plan for the future and also can be helpful information to show investors or lenders when you’re trying to acquire financing.

How to Calculate Discounted Cash Flow

Finally, the last cash flow calculation that’s important to understand is discounted cash flow or DCF.

DCF is a metric used to determine the value of a business, based on its cash flow. On the whole, DCF is a bit more complex to understand than other cash flow formulas. This being said, however, there are three components to discounted cash flow:

- Cash flow in period: This number represents the free cash payments an investor receives in a given period for owning a share.

- Discount rate: The discount rate is a business’s weighted average cost of capital. It represents the required rate of return investors expect from investing in a company.

- Period number: Since cash flow is associated with a specific time period, the period number represents a year, quarter, or month that you’re trying to determine the discounted cash flow for.

With these components in mind, the discounted cash flow formula is as follows:

DCF = Sum of cash flow in period ÷ (1 + Discount rate) ^ Period number

In other words, the DCF is the sum of cash flow in each period divided by one, plus the discount rate raised to the power of the period number.

Due to the complexity of calculating discounted cash flow and its use for business valuation, it’s typically helpful to work with a CPA or appraisal professional to perform this kind of analysis. Generally, this type of cash flow calculation is used to determine the value of a business, which is important if you’re trying to sell your company, gain investors, or establish ownership percentages.

The Bottom Line

At the end of the day, by using these different formulas, anyone can learn how to calculate cash flow. Depending on what you’re trying to learn or evaluate, you may want to use the formula for calculating operating cash flow, or you may want to create a cash flow forecast.

Ultimately, however, although it’s important to have a basic understanding of how to calculate cash flow, managing cash flow can be complicated. Therefore, it’s extremely useful to utilize the resources that are available to you. First, organizing your finances through a bookkeeping or accounting software platform can not only help you manage your finances, but it also can help you create a statement of cash flows or a cash flow forecast.

In addition, you can also find many articles, calculators, and templates to help you create a cash flow statement or a cash flow forecast on the U.S. Small Business Administration’s website, and you can also visit the SCORE website to read informational articles and find a mentor to help you with your cash flow analysis.

Finally, you always can seek out the advice and services of a professional—like a business accountant or bookkeeper. These professionals will be able to help you calculate your cash flow, maintain your books, and answer any questions you have with regard to your business finances.

Heather D. Satterley

Heather Satterley is a contributing writer at Fundera.

Heather is founder of Satterley Training & Consulting, LLC, a firm dedicated to helping accounting professionals learn and implement QuickBooks and related applications. She works with sole practitioners and teams to streamline internal processes as well as consulting on a variety of client engagements.

With over 20 years experience as a bookkeeper, accountant and enrolled agent, Heather has helped thousands of small business owners and accounting professionals sharpen their skills and increase their confidence with accounting technology.

As a member of the Intuit Trainer/Writer network, Heather teaches QuickBooks to accounting professionals all over the country via live training events, webinars, and conferences.

Featured

QuickBooks Online

Smarter features made for your business. Buy today and save 50% off for the first 3 months.